Ripple’s (XRP) price could be on the verge of witnessing another bout of corrections as the broader market cues turn bearish.

XRP holders, too, are pining for a price fall, which is evident in their bets against the altcoin.

Ripple Finds Difficulty Among Investors

XRP price is projected to decline in the coming days as altcoin loses the support of its investors. Institutional investors have been skeptical about the Ripple token since the beginning of the year.

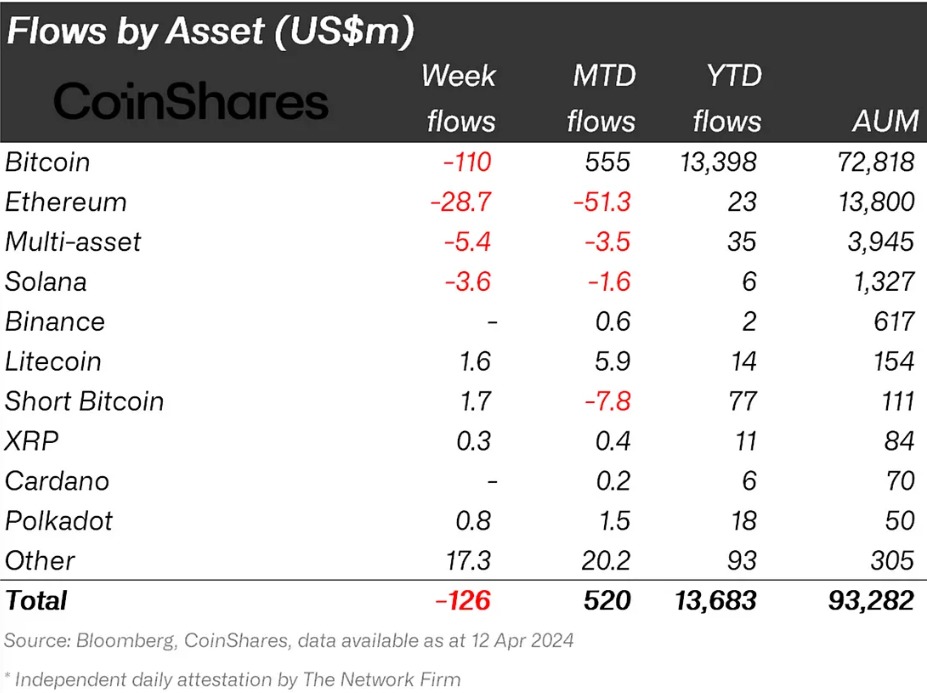

The CoinShares’ institutional flows show that for the week ending April 12, XRP witnessed inflows of just $0.3 million. This is the lowest figure of all the assets, including Polkadot and Litecoin.

Solana and Ethereum were the only other altcoins that performed worse, both of which noted outflows.

Read More: Everything You Need To Know About Ripple vs SEC

But it’s not just the big wallet investors that are bearish about XRP; retail investors are acting similarly. Traders have been making bearish bets against the altcoin in the futures market, as is evident in the funding rate.

The funding rate is a periodic fee paid by one side of the market to the other, ensuring that the contract’s price remains close to the spot price by incentivizing traders to take positions that reflect market sentiment.

While positive rates suggest the dominance of long contracts, negative rates hint at short contracts gaining precedence. The altcoin is witnessing negative funding rates only for the second time this year, suggesting investors are betting on a price decline.

XRP Price Prediction: Another Multi-Month Low on the Cards

XRP price is currently trading at $0.50, holding on above the local support level of $0.47. Falling through this support line will decrease the altcoin to $0.42. This would mark the lowest the Ripple token has been at since August 2023, registering an eight-month low.

Read More: Ripple (XRP) Price Prediction 2024/2025/2030

However, if the altcoin bounces back from $0.47, the XRP price could reclaim the $0.51 resistance level as support. This would enable a rise to $0.55, effectively invalidating the bearish thesis.