The NEM (XEM) price has increased by 27% so far today but has not yet closed above an important horizontal resistance area. Doing so would indicate that a trend reversal has begun.

In any case, the price action and wave count support the upward movement, indicating that XEM has begun a bullish trend reversal.

27% XEM Price Increase Causes Crucial Reclaim

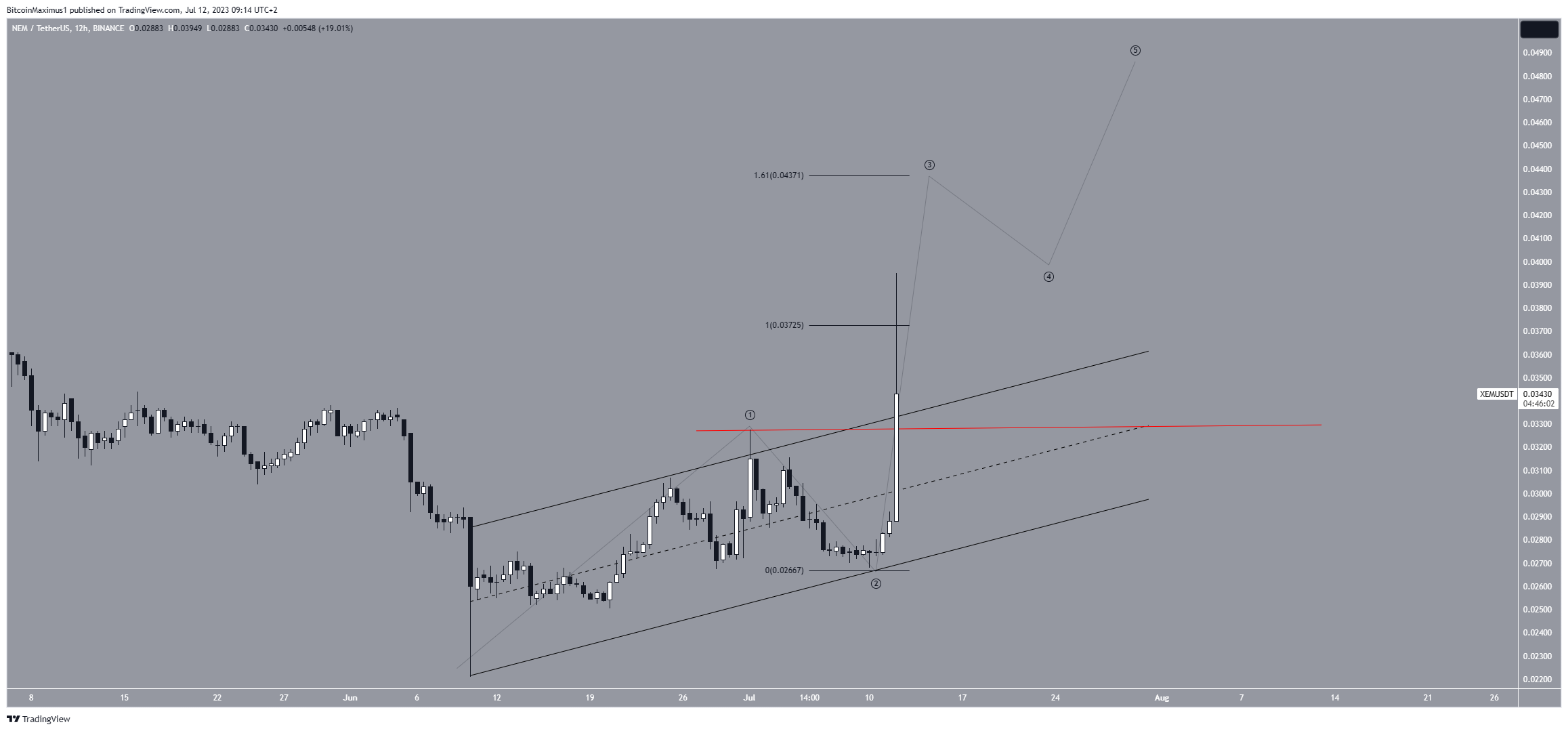

On June 10, the XEM price fell to a low of $0.022 but reversed the trend immediately afterward. The price created a long lower wick (green icon), considered a sign of buying pressure.

After creating several higher lows, XEM accelerated its increase on July 12. So far, the price has increased by 27%. While the price is above the $0.033 horizontal resistance area, it has not closed above it yet.

This is required for the trend to be considered bullish. The next resistance is at $0.043.

The daily RSI supports the continuing increase. The RSI is a momentum indicator used by traders to evaluate whether a market is overbought or oversold, and to determine whether to accumulate or sell an asset.

Readings above 50 and an upward trend suggest that bulls still have an advantage. On the other hand, readings below 50 indicate the opposite.

The indicator is above 50 (green circle) and increasing, both signs of a bullish trend.

Read More: 9 Best Crypto Demo Accounts For Trading

XEM Price Prediction: Beginning of Trend Reversal?

A closer look at the technical analysis for the short-term six-hour time frame gives a decisively bullish outlook. This is because of the price action and wave count.

The price action shows that the XEM price broke out from an ascending parallel channel. Since channels usually contain corrective movements, this makes it likely that the upward movement is not corrective. Rather, it begins a new bullish impulse leading to new highs.

Next, the wave count suggests that the price is in wave three of a five-wave upward movement. Elliott Wave theory involves the analysis of recurring long-term price patterns and investor psychology to determine the direction of a trend.

Elliott Wave theory also states that the third wave is often the sharpest and largest of the bullish waves.

In the case of XEM, wave three has been longer than wave one. However, it has not reached the 1.61 extension yet. So, it is possible that XEM will reach a high of $0.043 before correcting in the short term. This would also align with the long-term resistance area from the two-day time frame.

Despite this bullish XEM price prediction, a decrease below the wave one high (red line) of $0.033 will mean that the trend is bearish. XEM could descend to the next closest support at $0.030 if that occurs.

Read More: Best Upcoming Airdrops in 2023

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.