In today’s analysis, BeInCrypto looks at the Wyckoff schematics, which can explain the current accumulation phase of the Bitcoin (BTC) price. This pattern, known from traditional markets, has already been used to correctly identify the peak of the cryptocurrency bull market in 2021.

However, if Wyckoff accumulation is to play out according to its basic pattern, Bitcoin should not fall below the Nov. low at $15,476. Moreover, in the near future, the largest cryptocurrency needs to reclaim support at $18,000 and then move towards $22,500.

What Does Wyckoff Schematics Mean?

Richard Wyckoff (1873-1934) proposed his classic analytical pattern. He was one of the pioneers of modern technical analysis, founder of the Magazine of Wall Street and a trader in traditional stock markets. It was in the analysis of these markets that the diagram became popular.

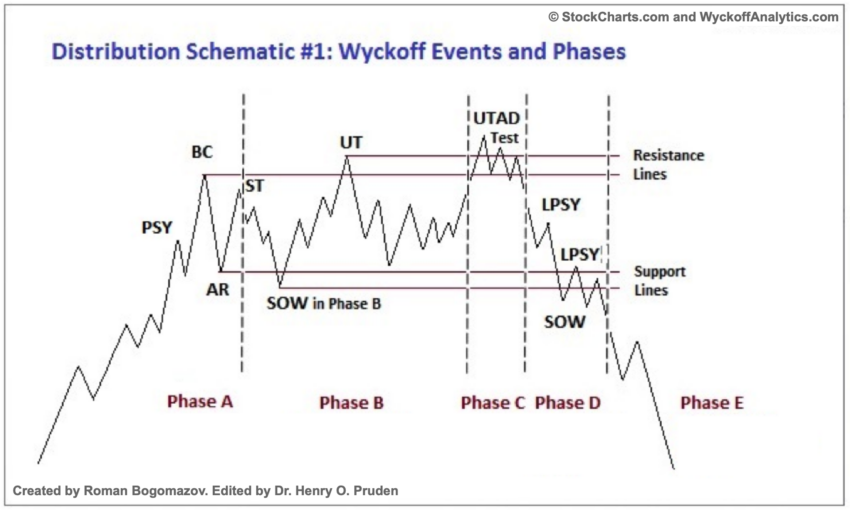

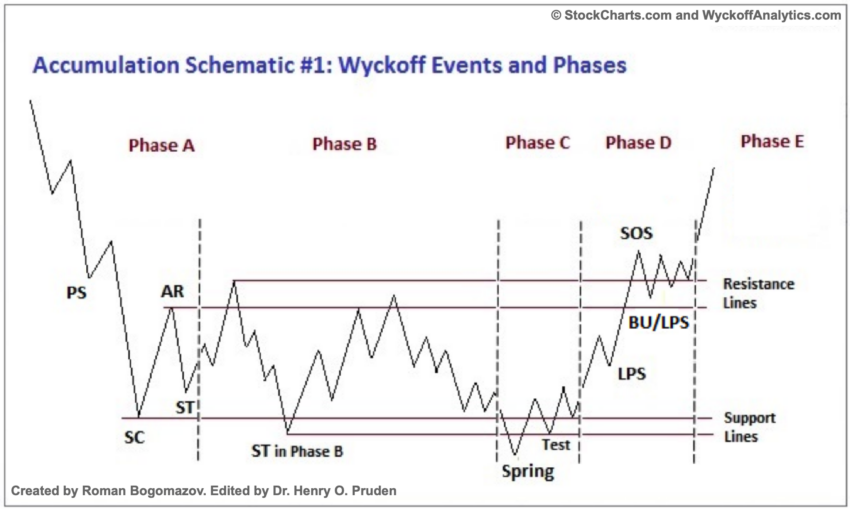

The structure of a typical Wyckoff schematics consists of a series of sharp up and down price movements that form a kind of extended distribution or accumulation. This pattern often occurs after long-term declines or increases in a given asset. One of the tops or bottoms of the pattern is the peak or bottom for the selected period of price action. Once it is reached, the trend reverses and the decline or increase accelerates.

In order to make good use of the Wyckoff schematics, one must first recognize it correctly. For this, trading ranges, volatility of the asset and trading volume are used. Based on this, appropriate buying or selling decisions are made. The main principle here is gradual selling during the distribution period and gradual buying during the accumulation period. Roughly speaking, the two periods are mirror images of each other.

Distribution is a sideways market trend that takes place after a long uptrend. It is a phase in which smart traders and big institutional players try to sell their positions without pushing the price down too much.

Accumulation is the exact opposite of distribution. Accumulation is a sideways market trend that occurs after an extended downtrend. It is a phase in which smart traders and big institutional players try to buy positions without moving the price up too much.

Wyckoff accumulation in 6 phases

The Wyckoff schematics provides detailed guidance for identifying periods of accumulation and distribution. These can be determined based on certain patterns that appear within these range bound trends. In this way, the entire schematics can be divided into six phases. While they are analogous for both periods below we present how Wyckoff accumulation proceeds:

1. Preliminary Support (PS)

A preliminary support is a level that forms after a significant drop in market prices. Institutions and traders try to take long positions after a strong decline. It will be difficult for the market to fall below this level due to strong buying pressure.

2 Selling Climax (SC)

A selling climax is characterized by a sharp decline below initial support. Panic selling is absorbed by big institutional players or smart traders. It often goes hand in hand with FUD and negative market news.

3 Automatic Rally (AR)

An automatic rally is an upward movement that occurs after a selling climax is reached. Prices rise, only to then fall quickly after reaching a local peak. The highest point of these increases often coincides with the level of initial support (1), which now acts as resistance. After this phase, trader activity decreases and bearish sentiment becomes weaker.

4 Secondary Test (ST)

A secondary test occurs after an automatic rally. It indicates that the price of an asset has reached a market bottom. It is common for several secondary tests to occur as the market tests the strength of buyers.

A Spring into Life

5 Spring

A spring is a strong and definitive shock that often happens during the accumulation phase. Prices will often fall below SC and ST levels. The loss of the trading range is short-lived. The price quickly returns to confirm a false breakout. Large players mislead retailer, and to purchase assets at a lower price. Wyckoff accumulation is confirmed in this phase.

6 Sign of Strength (SOS)

A signal of strength takes place after the spring and indicates the return of bullish sentiment to the market. In this phase, the price recovers the area of initial support of the entire Wyckoff accumulation. Sometimes its recovery is preceded by the Last Point of Support (LPS) phase, which is a retest of previous resistance. The sign of strength phase confirms the advantage of buyers and the start of an upward trend.

Wyckoff accumulation on the Bitcoin chart

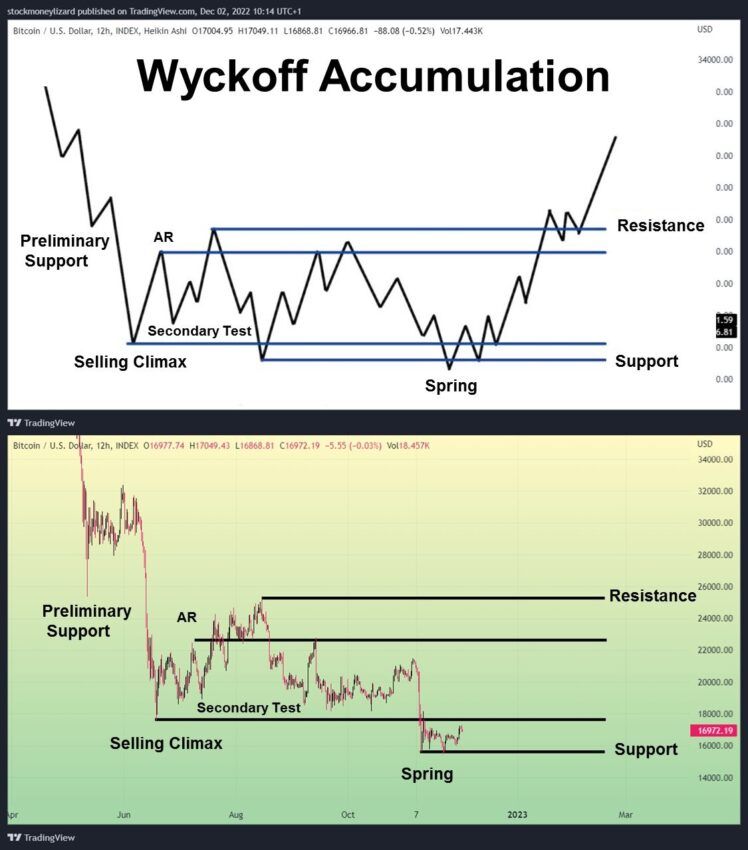

Popular cryptocurrency market analyst @StockmoneyL recently suggested that Bitcoin may currently be pursuing successive phases of Wyckoff accumulation. In his tweet, he compares the daily BTC price from mid-May 2022 to now with the Wyckoff pattern.

According to this comparison, Bitcoin has already passed through the first four phases of Wyckoff accumulation and experienced a selling climax (SC) in the $18,000 area. Currently, it is at the 5th phase and at the same time at the lowest point of accumulation, the spring phase.

If this is indeed the case, the BTC price should no longer drop below the bottom at $15,476 on November 21. Moreover, it should quickly regain the SC area and confirm it as support. We can conclude that the current phase (spring) was only a false breakout, and the price managed to return to the accumulation range.

Going forward, the BTC price would have to attempt to regain the $22,500 area – the peak of the AR phase reached in July and retested in mid-Sept. On the other hand, the final confirmation of the end of Wyckoff accumulation would be the recovery of the PS level near $26,000, which is the May low resistance.

A Bitcoin drop below the current bottom at $15,476 would lead to rejection of this version of Wyckoff accumulation. Similarly, a too-long stay of the BTC price below the $18,000 level would also falsify this pattern.

For BeInCrypto’s latest crypto market analysis, click here.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.