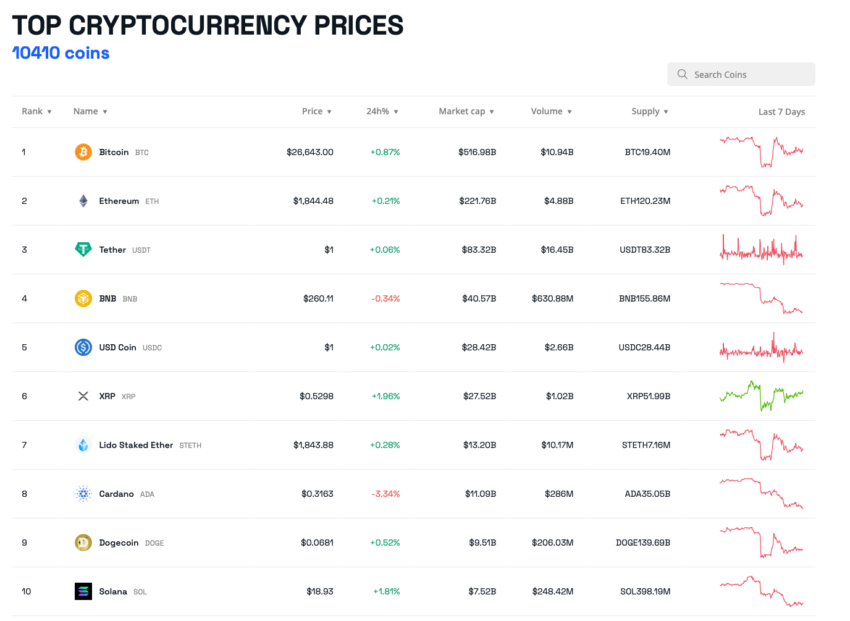

Crypto news: We bring you a round-up of what went down in crypto this week. There’s more bullish news from Ripple in its legal dispute with the Securities and Exchange Commission (SEC).

ChatGPT offers an opinion on what will happen when all the remaining Bitcoin is mined, and there’s optimism for Ethereum HODLers with some very bullish price predictions

A Ripple of Good News?

Crypto lawyer John Deaton has given his thoughts on the latest developments in the long-running Ripple (XRP) vs. SEC saga. He puts the odds of the court case ending in a partial victory for Ripple at 50%.

According to Deaton, the extent of Ripple’s victory will hinge on whether XRP was sold as an unregistered security at any time.

Deaton said in a recent interview:

“I think that XRP itself is not recognized as a security, and sales in the secondary market confirm my opinion. Even if [the judge] decides that Ripple violated the law, this will not apply to the secondary market.”

Read everything you need to know about Ripple vs. the SEC with our Learn guide.

Ethereum to the Moon

Long-term price projections are always a moonshot, but investment management firm VanEck raised eyebrows earlier this week reckoning Ethereum would hit $50,000 by 2030.

The bold claim is based on Ethereum’s focus not being limited to just one sector or industry.

VanEck sees the blockchain revolutionizing multiple sectors, including finance, banking, and payments, metaverse, social and gaming, and Infrastructure.

Coupled with adoption is Ethereum establishing itself as a store-of-value asset for entities looking to optimize their wealth.

This is possible thanks to Ethereum’s yearly token supply reduction. Each transaction fee results in the burning of ETH, reducing the total supply. As supply decreases, the value of the remaining tokens is driven up, increasing Ethereum’s appeal to investors.

But, as always, this does not constitute financial advice.

Crypto Coin News

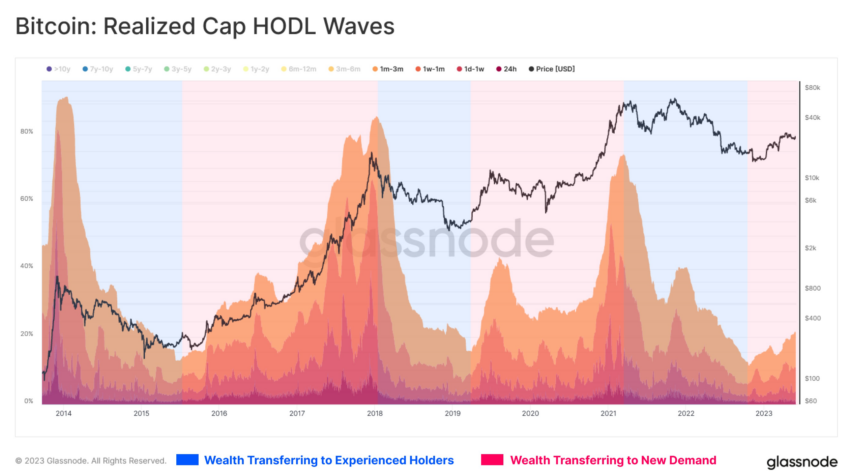

Brace for Incoming Bull Market?

Glassnode has been looking into Bitcoin (BTC) HODL waves and has come to the conclusion that the market cycle is at a transition point. “This suggests that the transfer of wealth from experienced holders to newer demand is occurring,” it noted.

The firm also stated that it was a phenomenon common across cycle inflection points.

Bitcoin analyst Philip Swift predicted that the one-year HODL wave would start to trend down, and BTC prices would start to move up.

“Because when new participants (new demand) enter, HODLers who accumulated at the lows will begin to sell to them at higher prices.”

Bitcoin to the Moon, Too

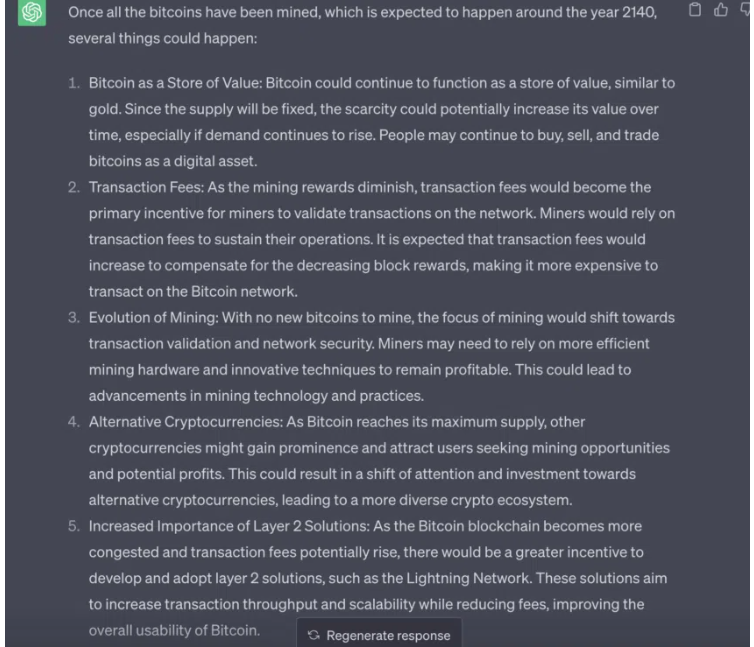

It wouldn’t be a Week in Crypto without a reference to ChatGPT. And this week, the artificial intelligence bot was tasked with answering the question of what will happen once the Bitcoin halving cycles end and supply is eventually exhausted.

The chatbot anticipates the rise of Layer 2 solutions such as Lightning Network to tackle congestion and improve the scalability of the Bitcoin network.

Bitcoin will finally stop being an inflationary token, and its supply would remain stable. Hence, ChatGPT believes that it could function as a store of value, similar to gold.

Try your hand at trading crypto with AI bots here.

Additionally, the chatbot speculates that fixed supply might increase the value of Bitcoin over time. 2140 is a year that corresponds to both the end of Bitcoin inflation and the increase in asset scarcity.

Thus, with rising demand and the obvious scarcity of the asset, the price could reach unimaginable values.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.