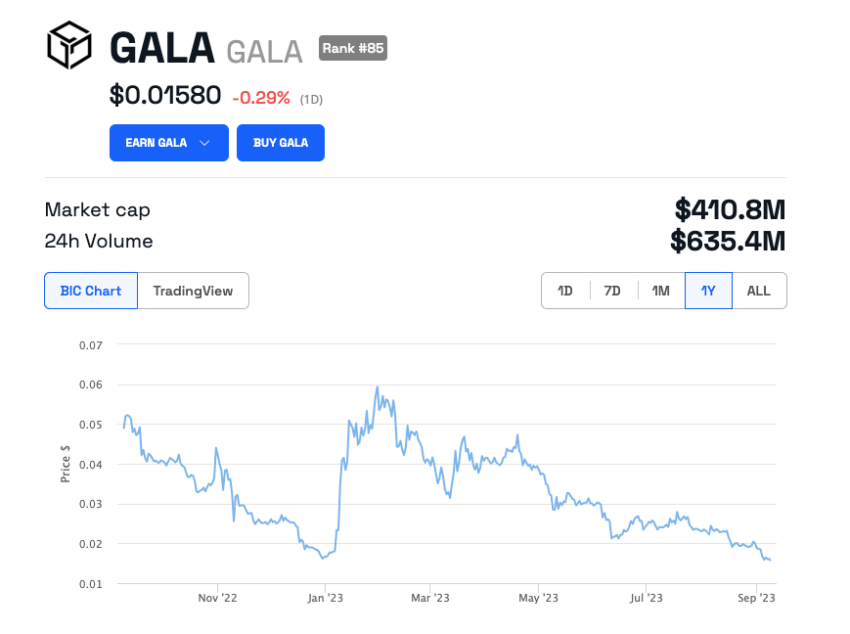

Crypto news: It’s been fun and games this week for Gala Games’ leadership team which became embroiled in a dispute that led to the value of the blockchain’s native token falling 8%.

The company’s CEO, Eric Schiermeyer, alleges that co-founder Wright Thurston unlawfully acquired and traded $130 million worth of GALA tokens. And in response, Thurston is retaliating by claiming Schiermeyer mismanaged the company’s assets and engaged in deceptive practices.

Execs Go Head-to-Head

With two stakeholders at each other’s throats, other senior executives are remaining diplomatic. The company’s president, Jason Brink, said he welcomes the transparency the lawsuits will bring.

GALA holders appear to have voted with their feet, however, sending the price of the token to an all-time low. The token has struggled for over a year and is now down 97.9% from its peak of $0.83.

How the Other Half Lives

A Crypto Wealth Report gives a tantalizing glimpse into the lives of crypto millionaires. And, somewhat unsurprisingly, it reveals that of the 182 crypto individuals with crypto holdings of $100 million or more, 78 are Bitcoin investors.

Where’s best to invest in 2023? Crypto or stocks? Click here for our guide.

But more interestingly, six of the world’s 22 crypto billionaires have amassed their fortunes from trading Bitcoin. And even more interestingly than that, it’s still not too late to join the party.

Jeff D. Opdyke, a personal finance and investment expert, reckons the current bear market represents a golden opportunity to buy Bitcoin at a low price. And he believes that BTC is unlikely to see these prices again in the future.

“Crypto today, in the wake of a bear market, is a replay of 1999 to 2001 – in other words, a fantastic opportunity to buy when blood stains the streets because we’re not likely to ever see these prices again,” he said.

But obviously this is only his opinion and does not constitute financial advice.

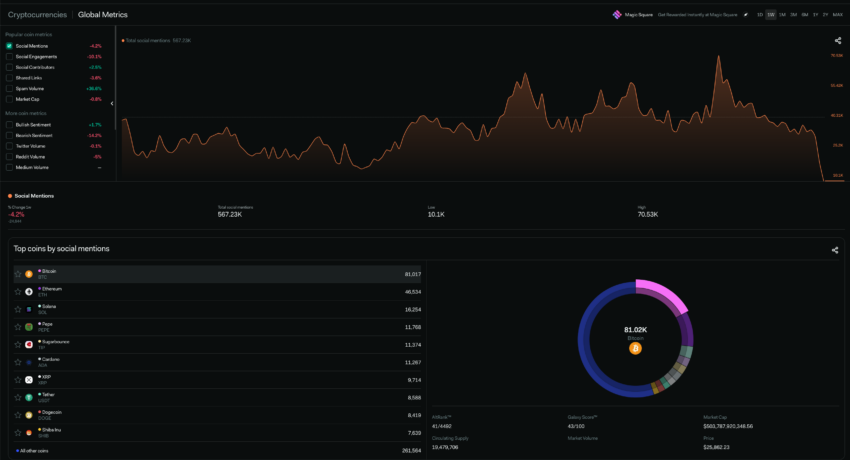

Crypto – Socially Speaking

Talking Turkey

On the topic of Bitcoin adoption, citizens in Turkey are rapidly embracing crypto. But unlike in many other countries around the world, their reason is not to make a quick buck, rather to build long term wealth.

The Turkish lira has depreciated over 50% against US dollar, making crypto a haven from inflation,” the KuCoin survey said. And it would appear the response from the Turkish government is only likely to increase interest.

The monetary policy committee of the Central Bank of the Republic of Turkey has recently declared its intention to continue tightening monetary policy until the situation is resolved:

“Monetary tightening will be further strengthened as much as needed in a timely and gradual manner until a significant improvement in the inflation outlook is achieved.”

And good luck with that.

New to crypto and keen to learn more? Click here for our crypto guide for beginners.

Are Exchanges on the Way Out?

While the crypto world anticipates the approval of a spot Bitcoin exchange-traded fund (ETF) with bated breath, a Bloomberg analyst points out that any approval would have a major knock-on effect for crypto exchanges.

Eric Balchunas predicts traditional crypto purchases could soon be replaced by buying Bitcoin ETFs on stock markets within a few years. This shift could particularly affect exchanges that fail to adapt their fees to remain competitive.

Balchunas reckons that purchasing an ETF will be more cost-effective for consumers. To illustrate, he compares it to the gold ETF. He mentions the fee for this ETF is around “35 to 40 basis points,” or roughly 0.35% to 0.40%.

In contrast, crypto exchanges vary in their fee structures, with some providing attractive introductory rates or offering zero fees for the first month. However, once this initial period concludes, certain exchanges may levy transaction fees as high as 1.5%.

No one said competition was a bad thing.

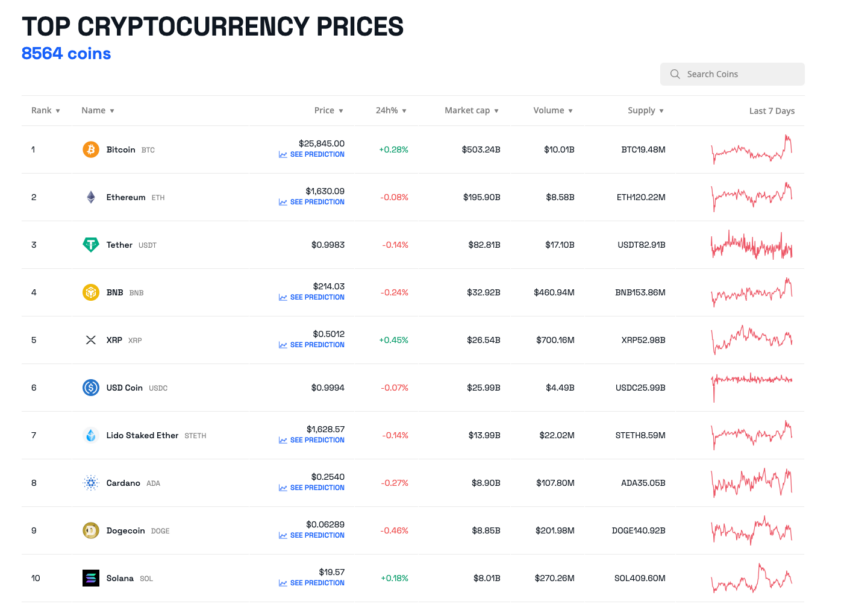

Top 10 Crypto Performers This Week

Got something to say about events this week in crypto or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.