The core US Personal Consumption Expenditure (PCE) index rose 2.3% year-on-year. The US economy grew 5.2% in Q3, beating estimates of 5%, and is the highest level of growth since Q4 2021, signaling US Federal Reserve policy has not yet put the economy into a recession.

According to the Bureau for Economic Analysis, the initial gross domestic product (GDP) estimate of around 4.9% was revised after considering revisions to nonresidential fixed investment and state and local government spending. The GDP increase is a symptom of strong private sector demand, according to Gregory Daco, a chief economist at EY News.

Fed Looks Set to Keep Rates Elevated

So-called headline PCE rose 2.8% quarterly, undercutting an advance estimate of 2.9%. Core PCE also came in 0.1% lower than expected. The PCE is the US Federal Reserve’s preferred inflation gauge, as it tracks changes in consumer spending habits and is a more accurate gauge of how prices are affecting households.

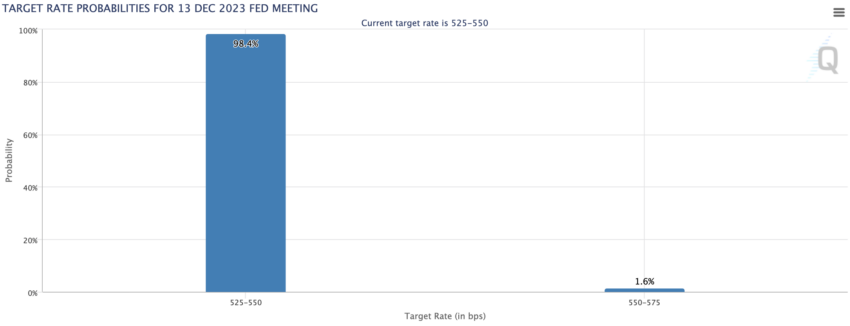

Experts predict the central bank is unlikely to raise rates at its next meeting after declines in the Consumer Price Index and the strength of the US jobs market suggest its monetary policy is working. It has resisted increasing or decreasing rates at two previous meetings of the Federal Open Markets Committee (FOMC).

How Markets Viewed PCE and GDP

Bitcoin spiked briefly from $38,190.95 to $38,246.74 following the news, while Ethereum rose from $2,055.58 to $2,061.98. The top two cryptos have been fairly indifferent to most US economic data releases in recent months. The markets are waiting for the approval of exchange-traded funds that track the prices of Ethereum and Bitcoin.

Read more: How To Prepare for a Bitcoin ETF: A Step-by-Step Approach

The news is bullish for the stock market since it allays immediate fears of a US recession. It is also good for the bond market since the Bloomberg US Aggregate Bond Index has increased 4.3% in November and appears destined for its best monthly performance since 1985. The yield on the 10-year US Treasury has fallen from 5% one month ago to 4.3% on Wednesday, driven by sentiment the US Federal Reserve could soon cut interest rates.

Read more: 7 Must-Have Cryptocurrencies for Your Portfolio Before the Next Bull Run

Do you have something to say about the US economy, GDP growth, the US Federal Reserve policy or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.