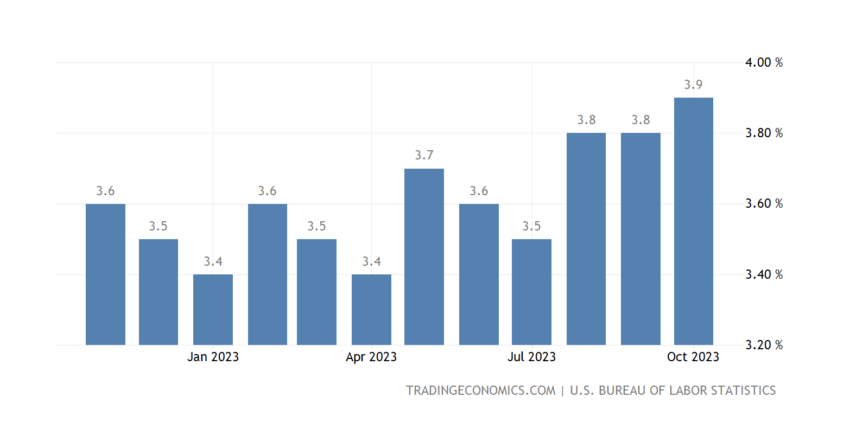

Bitcoin (BTC) was mostly flat after the US added 150,000 nonfarm jobs in October, less than FactSet economists’ forecasts of 180,000. Unemployment rose 3.9%, beating estimates of 3.8%, while average hourly earnings came in softer than predicted, increasing by 0.2% instead of the expect 0.3%.

The lower wage growth and higher unemployment, as well as revised lower jobs for August and September could encourage the US Federal Reserve (Fed) to cut rates in the coming months. In addition to lowering inflation, the Fed wants unemployment and wage growth to rise moderately before it will consider rate cuts.

Higher Unemployment and Lower Jobs Show Cooling

Bankruptcies rose 13% in the year ending Sep. 3, contributing to the increasing unemployment in the US. Meanwhile the autoworkers’ strike potentially shaved off around 33,000 jobs from the nonfarm payrolls number.

Market commentators argue the downturn in employment and wages are promising, but it is still too early for the Fed to cut rates. Bloomberg’s Mike McKee said the Fed would need to see the trends in lower unemployment and wage growth to alter their course.

In the aftermath of the news, yields on 10-year Treasuries fell to a little over 4.5%, and the S&P 500 rose 0.4%. Bitcoin rose marginally from $34,300 to $34,386, while Ethereum (ETH) rose to a hair under $1,800. Solana (SOL) rose from $39.37 to $39.62 before falling back to $39.59.

On Wednesday, the US Federal Open Markets Committee elected to keep interest rates elevated at a 22-year-high of 5.25%-5.5%. Chairman Jerome Powell said that while the move may slow hiring and economic growth, the central bank needs to remain focused on keeping inflation in check.

Bitcoin Exuberance is Building

The muted response from Bitcoin to the jobs report is not a sign of waning optimism, as the asset this week reached levels previously unseen since May 2022. Recent on-chain analysis suggests whale activity increased to 7,000 transactions per day between Oct. 23 and Nov. 1.

In addition, open interest for Bitcoin call options at $40,000, $45,000, and $50,000 are growing, according to Rachel Lin, CEO of SynFutures. Open interest is the number of options contracts, basically agreements, that allow people to buy Bitcoin at a certain price some point in the future, that have not yet been settled.

Read more: How To Trade Bitcoin Futures and Options Like a Pro

ARK Investment Management chief Cathie Wood said in a recent podcast interview that she expects Bitcoin to act as a hedge against falling prices caused by new technologies in the years ahead. She said on the Merryn Talks Money podcast:

“Bitcoin is a hedge against both inflation and deflation because there’s no counterparty risk and institutions are barely involved. It’s digital gold.”

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

Do you have something to say about US jobs report, its effect on Bitcoin, or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.