American banks are not out of the woods yet, as the latest deposit figures reveal a disturbing downtrend. Moreover, the Federal Reserve continues to bail out distressed banks with its banking loan facility, which has reached an all-time high.

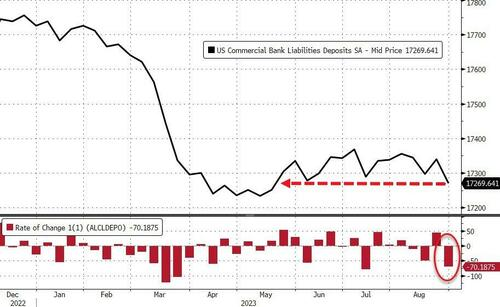

According to macroeconomics commentary outlet The Kobeissi Letter, banks in the United States have just had their biggest weekly deposit outflows since the collapse of Silicon Valley Bank (SVB).

Banking Crisis Continues

Total bank deposits (on a seasonally-adjusted basis) plunged by more than $70 billion last week alone, it noted on September 12.

“This puts bank deposits at their lowest levels since May,” it added, questioning whether the regional bank crisis was really over.

Moreover, market analyst Joe Consorti backed up the figures, stating that US commercial banks lost $71.2 billion in deposits last week. He added:

“If this was 2008, that would’ve been the 3rd largest outflow during the entire Great Financial Crisis. Since the March 2023 banking panic… It’s only the 8th largest. Troubled waters lie ahead.”

Consorti continued, stating that 60% of the bank deposits are going into higher-yielding, safe, and liquid money market funds. They are offering 4.5% or more in annual returns, more than the average high street bank.

Read more: 2023 US Banking Crisis Explained: Causes, Impact, and Solutions

It gets worse.

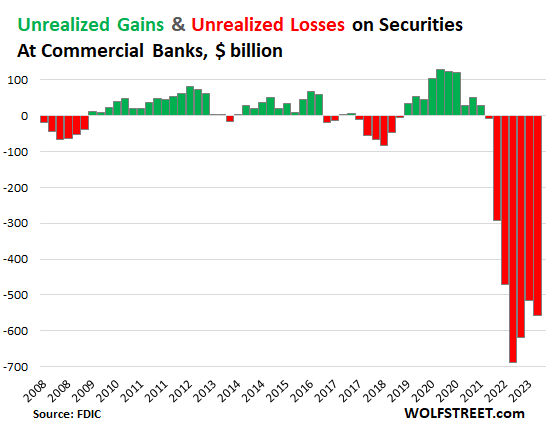

The balance of unrealized losses on securities at FDIC-insured commercial banks rose by $43 billion, or 8%, to $558 billion in Q2.

These are mostly Treasury securities and government-guaranteed mortgage-backed securities, according to reports. Wolfstreet explained:

“In the free-money periods, when yields fell and bond prices rose, banks had “unrealized gains” (green). And in the periods when yields rose and prices fell, banks had “unrealized losses” (red).

The outlet predicted a worse scenario for Q3 since ten-year Treasury yields have closed higher. Furthermore, they are likely to at the end of September, meaning greater unrealized losses for banks.

Fed Bailout Fund at ATH

Moreover, the Federal Reserve’s Bank Term Funding Program (BTFP) has reached a peak of $107.8 billion, according to the St. Louis Fed.

The bailout fund was created in March 2023 to make additional funding available to eligible depository institutions (banks in trouble).

Usage of the Fed’s emergency bank funding facility jumped by $328 million last week, according to the Kobeissi Letter.

In August, Moody’s downgraded several banks while issuing warnings over potential downgrades for more.

With the figures and evidence stacking up, it appears that the regional banking crisis in the US is just getting started.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.