Updated 17:00UTC, March 10: Bank regulators have seized Silicon Valley Bank (SVB) in what has been described as the largest bank failure since the Great Recession. SVB was the eighth-largest bank in the U.S. by total assets.

As if things weren’t bad enough for the crypto industry, an impending U.S. banking crisis could be the tip of the iceberg.

Two major American banks failed in the same week. Earlier this week, crypto bank Silvergate went into voluntary liquidation following a customer exodus.

Just a few days later, on March 9, Silicon Valley Bank (SVB) stock collapsed following the launch of a $1.75 billion share sale to shore up its balance sheet.

In a gloomy economy, which is still reeling from prolonged lockdowns and a year-long war in Ukraine, all eyes are on banks again.

On March 10, BitMEX co-founder Arthur Hayes exclaimed that Federal Reserve Chair Jerome Powell “might have broken US banking system.” His comments come as Bitcoin prices plunged to a two-month low below $20,000 during the Friday morning Asian trading session.

Banking Bunkum Continues

On March 10, billionaire Pershing Square founder Bill Ackman said the U.S. government should consider a bailout for SVB.

“The failure of [SVB] could destroy an important long-term driver of the economy as VC-backed companies rely on SVB for loans and holding their operating cash.”

Investment manager Lyn Alden commented that only a tiny fraction of the total $17.6 trillion in U.S. bank deposits is actually backed up by physical cash.

“Deposits can easily flow from one bank to another, but can’t easily flow out of the banking system in aggregate. Big banks are rather safe. Smaller and riskier banks less-so.”

Goldbug Peter Schiff chimed in commenting that the U.S. may be on the verge of another financial crisis. He suggested that the Fed may return to quantitative easing (QE) again by the end of the month, adding:

“This should send the dollar tanking and commodities soaring, especially gold. This might turn the financial crisis into a U.S. dollar and sovereign debt crisis.”

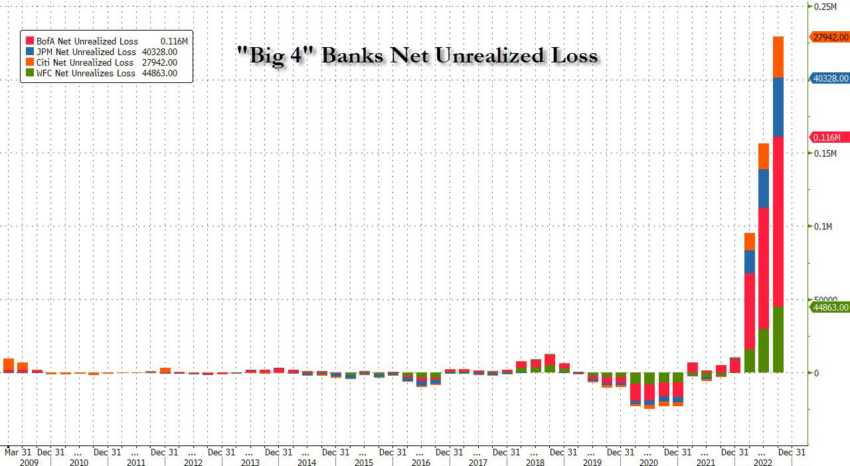

Meanwhile, ZeroHedge tweeted that four major banks, including Bank of America and JPMorgan, were running at net unrealized losses.

Bitcoin Solves This

Bitcoin was spawned from the previous global financial crisis in 2008 which was caused by banks. Satoshi’s vision was a currency that did not involve banks, intermediaries, or fractional reserves. This is where a bank only holds a fraction of the assets on its books, the rest is lent out or invested elsewhere. A bank essentially profits from other people’s money, offering very little in return.

Furthermore, a bank run would be the inevitable end should customers all want their money back at the same time. This appears to have occurred with at least two banks over the past week, and more could follow.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.