The TRON (TRX) price has fallen since July 22 and recently broke down from a short-term ascending support line.

The trend is considered bearish due to bearish readings from the daily and six-hour timeframes.

TRON Falls After Rejection From Range High

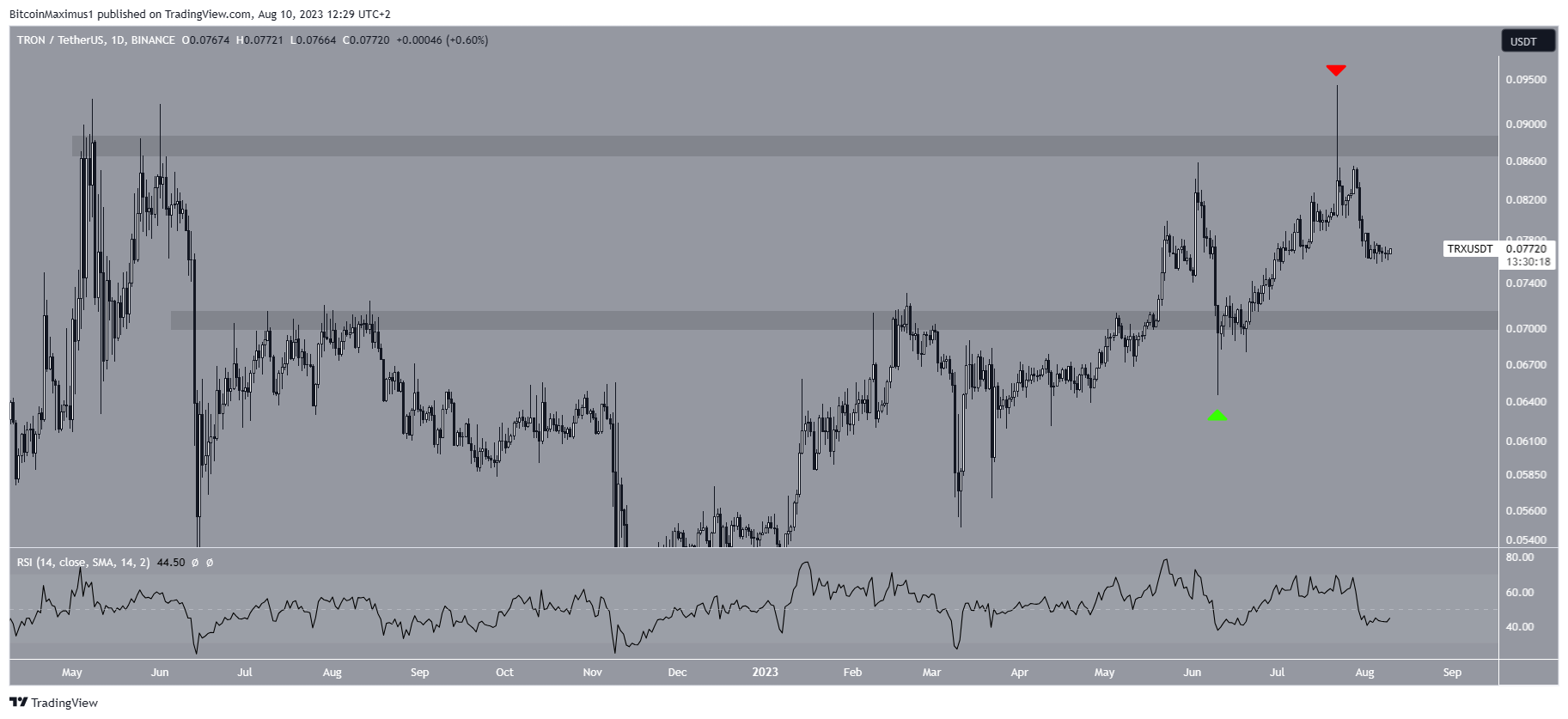

The TRON price has traded in a range between $0.070 and $0.088 since May 20. The price began its most recent upward movement on June 10. At the time, TRX had initially fallen below the $0.070 horizontal support area. But, it immediately created a long lower wick (green icon), saving the potential breakdown.

The increase led to a new yearly high of $0.094 on July 22. While this initially caused a breakout above the $0.088 area, the price fell below it shortly afterward.

Read More: 6 Best Copy Trading Platforms in 2023

Similarly to the decrease on June 10, the increase on July 22 led to a deviation above the $0.088 resistance area, which was followed by a significant downward movement. The rejection also created a long upper wick (red icon), a sign of selling pressure.

Currently, the TRX price trades in the middle of this range.

The daily RSI is bearish. When evaluating market conditions, traders use the RSI as a momentum indicator to determine if a market is overbought or oversold and to decide whether to accumulate or sell an asset.

If the RSI reading is above 50 and the trend is upward, bulls still have an advantage, but if the reading is below 50, the opposite is true. The indicator is falling and is below 50, both signs of a bearish trend.

TRX Price Prediction: Retracement Before Bounce?

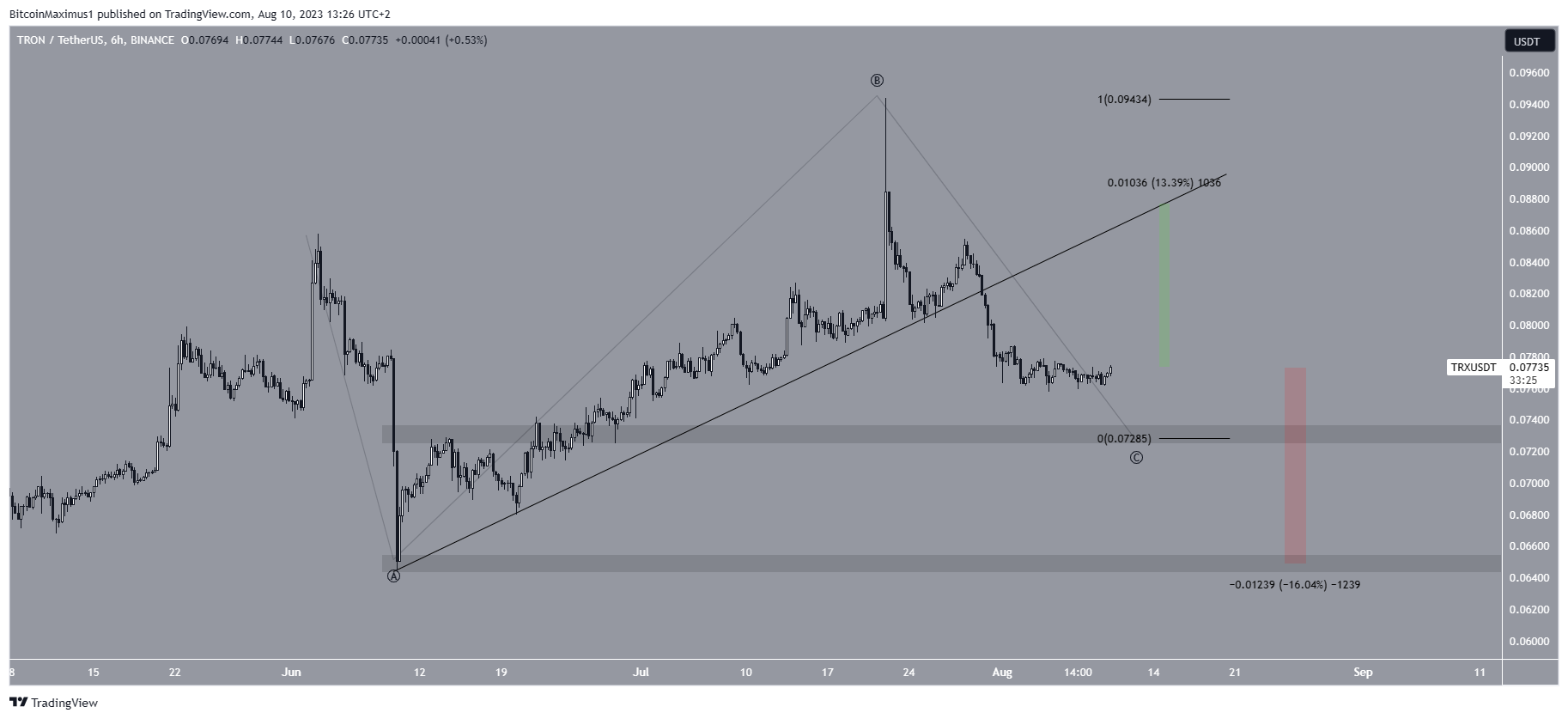

Similarly to the daily timeframe, the short-term six-hour one suggests that the price will decrease soon before eventually resuming its upward movement.

The main reason for this is a breakdown from an ascending support line that had been in place since June 9. This was around when the TRON network celebrated the five-year anniversary of its Mainnet release. This indicates that the previous upward movement has ended, and a new movement in the other direction has begun.

Moreover, the increase alongside the ascending support line looks corrective due to its considerable overlap. Therefore, Elliott Wave Theory suggests wave B was in an A-B-C corrective structure. If so, the TRX price is currently in wave C.

Giving waves A:C a 1:1 ratio will lead to a low of $0.072. This is also a horizontal support area.

However, if wave C extends, the TRX price can fall to the next resistance at $0.066. This would be a decrease of 16%, measuring from the current price.

Despite this bearish TRX price prediction, TRON can increase to the $0.088 resistance area again if it gains momentum.

This would be an increase of 13% and would validate the previous ascending support line.

For BeInCrypto’s latest crypto market analysis, click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.