Bitcoin price is a rollercoaster ride, with its value experiencing wild fluctuations over the years. For those interested in the leading cryptocurrency, understanding the factors that influence its price is essential.

These top seven factors that impact Bitcoin price can provide investors with the insights needed to make informed decisions.

Bitcoin Supply and Demand

Market Adoption

As with any commodity or currency, the forces of supply and demand play a crucial role in determining BTC price.

As more people embrace Bitcoin for transactions, investments, or simply as a store of value, the demand for digital currency increases, driving up its price. Conversely, if the need for Bitcoin wanes, its value will likely decrease.

Bitcoin Mining and Halving

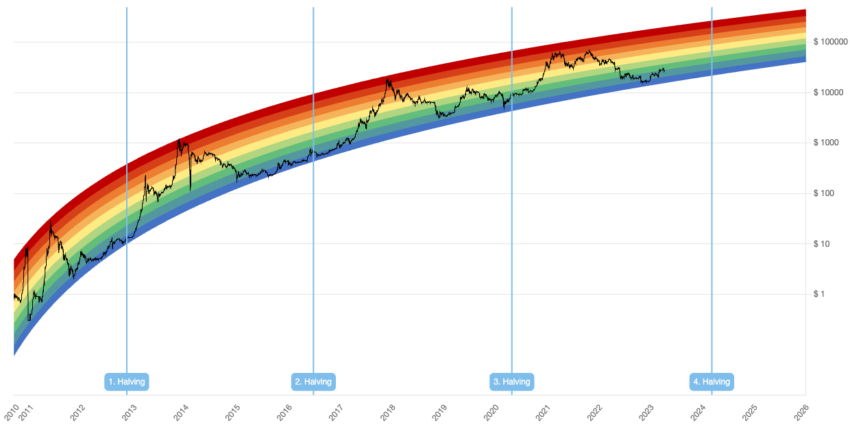

Bitcoin’s supply is capped at 21 million, meaning a finite number of coins are available. Miners generate new bitcoins through mining, which becomes increasingly difficult over time.

Additionally, the Bitcoin halving event, which occurs roughly every four years, reduces the number of new coins entering the market by 50%. These factors contribute to supply constraints, which can impact the price of BTC.

Bitcoin Market Sentiment

News and Public Opinion

News and public opinion play a significant role in shaping market sentiment and influencing the price of Bitcoin.

Positive news, such as increased adoption by large companies or favorable regulatory developments, can raise prices. Conversely, negative news, like security breaches or unfavorable regulations, can trigger a sell-off, driving the price down.

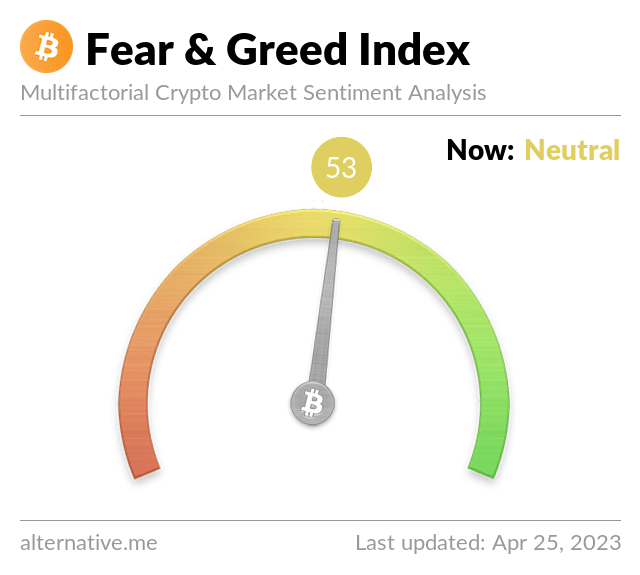

Fear and Greed

Emotions are another key driver of Bitcoin price and one of the most important. Fear and greed often lead to market overreactions, causing rapid price swings.

When the market is optimistic and greedy, people may buy more BTC, causing the price to soar. However, when fear and panic set in, investors may rush to sell their holdings, leading to a sharp decline in price.

Institutional Interest in Bitcoin

Large institutions, such as banks, hedge funds, and other financial entities, can significantly influence Bitcoin price.

As these institutions increasingly invest in and adopt Bitcoin, the price may rise due to its increased demand and credibility as the leading cryptocurrency.

Regulatory Environment

Governments and regulatory bodies play a significant role in shaping the future of cryptocurrencies like Bitcoin.

Positive regulations, such as legalizing Bitcoin or creating clear guidelines, can encourage adoption and drive its price. On the other hand, strict regulations or outright bans can hinder its growth and negatively impact its value.

Bitcoin Technological Developments

Scalability Solutions

One of the challenges Bitcoin faces is its ability to handle a large volume of transactions. Scalability solutions like the Lightning Network aim to address this issue by enabling faster and more efficient transactions.

As these solutions mature and gain adoption, they can positively impact the price of Bitcoin by increasing its utility and fostering greater demand.

Security Improvements

The security of the Bitcoin network is crucial for maintaining trust in the digital currency.

As new security measures and technologies are implemented, they can contribute to a more secure network and boost confidence in Bitcoin. This, in turn, can influence its price positively.

Geopolitical Events

Geopolitical events, such as economic crises, political instability, or global tensions, can impact the price of Bitcoin.

In times of uncertainty, people may turn to Bitcoin as a safe-haven asset, driving up its value. Conversely, if global events lead to increased scrutiny or regulation of cryptocurrencies, it may negatively impact Bitcoin price.

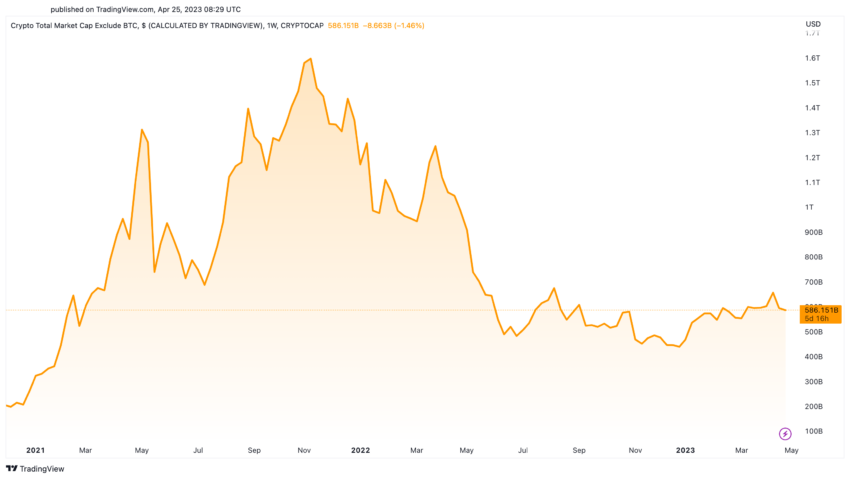

Competing Cryptos

The rise of competing cryptocurrencies, also known as altcoins, can influence the price of Bitcoin. As new coins enter the market, they may draw attention and investment away from Bitcoin.

However, Bitcoin’s status as the original and most well-known cryptocurrency can also benefit its price, as it often acts as a gateway for investors entering the crypto market.

Bitcoin Price Drivers

Understanding the numerous factors influencing Bitcoin’s price can help investors make more informed decisions when investing in or trading cryptocurrencies.

By considering the impact of supply and demand, market sentiment, institutional interest, regulatory environment, technological developments, geopolitical events, and competing cryptocurrencies, investors can better anticipate potential price movements and position themselves accordingly.

What is the most significant factor affecting Bitcoin price?

How does Bitcoin mining and halving impact its price?

Can positive news always increase Bitcoin price?

How do geopolitical events influence Bitcoin price?

Will the rise of altcoins negatively impact Bitcoin price?

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.