Bitcoin and the Decentralized Finance (DeFi) ecosystem enjoyed some positive outcomes in the first quarter of 2023. Thereby moving away from the bearish sentiments of 2022. But can the momentum continue in Q2 2023?

The cryptocurrency market has come a long way since the early days of Bitcoin’s launch in 2009. Over the past few years, the market has seen massive growth, with more investors and traders entering the space than ever. This has led to a significant increase in the value of cryptocurrencies, despite the periodic bearish sentiments.

In this case, the crypto market showed massive growth in the first quarter of 2023, thwarting some of the bearish sentiments of 2022. However, time will tell what’s next for the market in Q2.

Factors That Helped

One reason for the growth of the crypto market is the increasing adoption of cryptocurrencies by mainstream institutions. More companies are now accepting cryptocurrencies as a form of payment, and governments worldwide are starting to recognize the uses of blockchain technology. This increased acceptance has helped to legitimize the crypto market, making it a more attractive investment option for many.

Another factor driving the growth is the increasing use of cryptocurrencies as a store of value. With traditional fiat currencies subject to inflation, many people are turning to cryptocurrencies to protect their wealth. This has driven demand for cryptocurrencies, which has boosted their value.

Furthermore, the rise of decentralized finance (DeFi) has played a in the growth of the crypto market. DeFi platforms allow people to access financial services in a decentralized manner without intermediaries such as banks. This has opened up opportunities for people long excluded from traditional financial systems. As more people become aware of the benefits of DeFi, the demand for cryptocurrencies will likely continue to grow.

The growth of the crypto market is a testament to the increasing use of blockchain technology and decentralized finance. While the market is subject to occasional bearish sentiments, the long-term trend is upward.

Strong Start in 2023

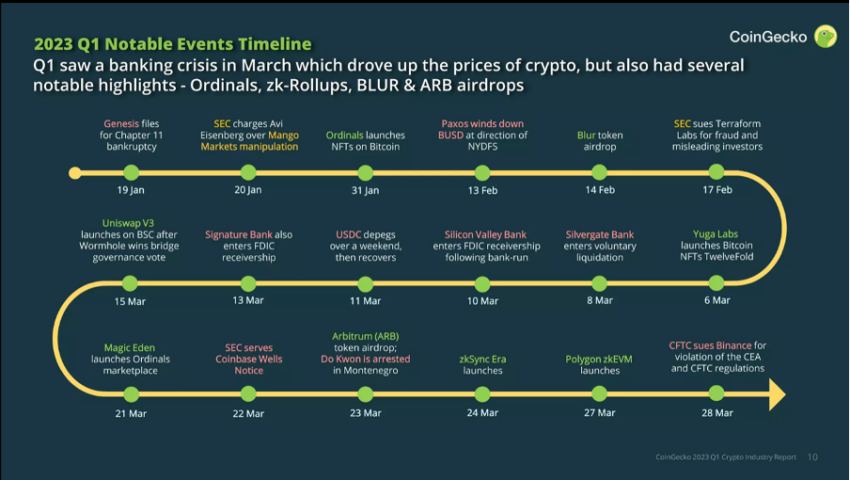

The 2023 Q1 Crypto Report, shared with BeInCrypto, is the work of CoinGecko. It provides an in-depth analysis of the crypto market during the first quarter of 2023. The report covers various facets of the market, including market capitalization, trading volume, and the performance of individual cryptocurrencies.

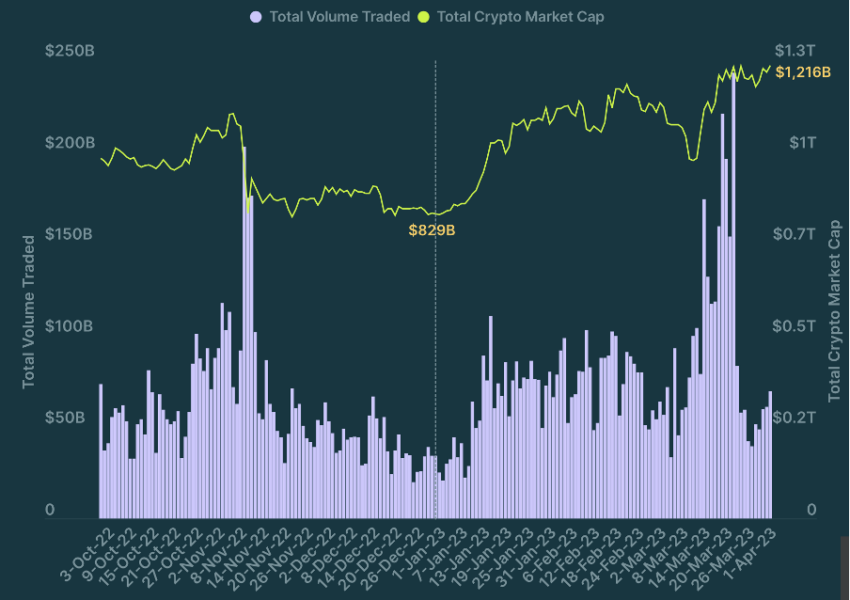

According to the report, the broader cryptocurrency markets have enjoyed a quarter of resurgence, with overall market capitalization reaching $1.20 trillion at the end of Q1. CoinGecko highlights a 48.90%, $406 billion gain from the cryptocurrency market cap of $829 billion at the end of 2022.

Per the graph above, the average daily trading volume also surged. Herein, note the increase of 30% QoQ from -33% in the last quarter of 2022 to a total of $77 billion in 2023 Q1. Speaking on this matter, the CoinGecko team asserted:

“Trading volume saw an upswing in January 2023, when the market started rallying. It then spiked momentarily in early March due to increased volatility from the banking crisis, before tapering off in late March, when Binance removed part of their zero-fee trading incentives for BTC.”

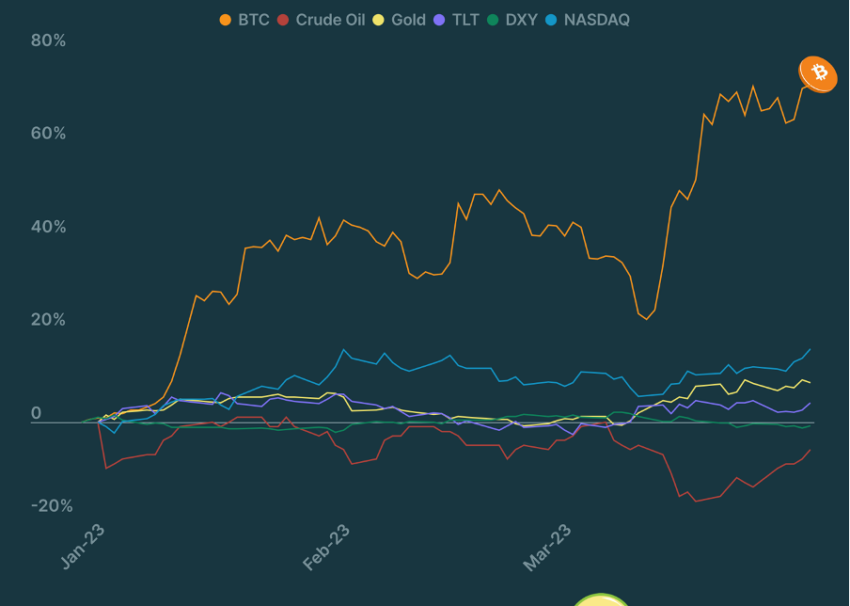

Bitcoin primarily drives the market, showcasing a surge during the abovementioned period. In fact, BTC emerged as the best-performing asset of Q1 2023, with gains of 72.40%. Thereby outperforming rival asset classes such as the Nasdaq index and gold, which marked 15.70% and 8.40% gains, respectively.

Not so surprisingly, regions have started to distance themselves from crude oil. Hence the notable decline. The fall was attributed to United States inflation statistics, which cited a reduction in oil demand.

Other Trends

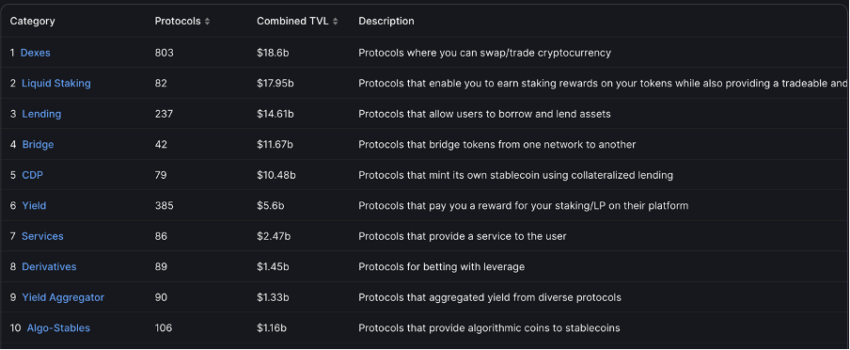

Furthermore, the report notes that decentralized finance (DeFi) continues to be a driver of the crypto market. The cohort skyrocketed more than 65% in the first quarter, “translating to $29.60 billion in gains, mainly driven by liquid staking governance token performance.”

Herein, the latter witnessed a jump of around 210%, reaching almost $18 billion combined total value locked (TVL). Needless to say, Ethereum’s much-awaited Shapella upgrade aided the mammoth hike.

Decentralized Exchanges DEXs continue to lead the DeFi ecosystem. Especially in current times, amid regulators’ crackdown on centralized counterparts (CEXs) worldwide, DEXs saw their growth outpace that of CEXs by nearly two times.

Nevertheless, regulatory uncertainty remains a challenge for the crypto market. Given the surge in DEXs, regulators can initiate rules and regulations to curb innovation.

Concerns Eroding Trust

It is also worth noting that the crypto market is highly volatile, with prices often subject to significant fluctuations. While this can be a source of concern for some investors, it also presents opportunities for traders who can profit from price movements. As such, the volatility of the crypto market has played a significant role in attracting new investors and traders to the space. Crypto prices tend to have a direct relationship with events. The first quarter of 2023 is no different.

Despite occasional bearish sentiments, the long-term trend of the crypto market has been growth. As the world becomes increasingly digital and decentralized, cryptocurrencies will likely play an essential role in the financial system.

However, investors need to be aware of the risks associated with investing in cryptocurrencies, including the possibility of significant price swings and the potential for fraud and scams.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.