The Bitcoin (BTC) price is beginning to show a significant decoupling from the U.S. stock market after months of a positive correlation.

Such a trend, if continued, could strengthen the “uncorrelated asset” argument for BTC, especially as the top-ranked crypto by market capitalization readies for another halving.

Amid the ongoing decoupling, positive Bitcoin sentiment appears to also be growing in momentum from retail and institutional buyers.

Bitcoin Price Pulls Away From Stocks

According to a tweet by Mati Greenspan, founder of Quantum Economics, the Bitcoin price is pulling away from the stock market.

‘Hyperbitcoinization’ at Center Stage as Halving Draws Closer

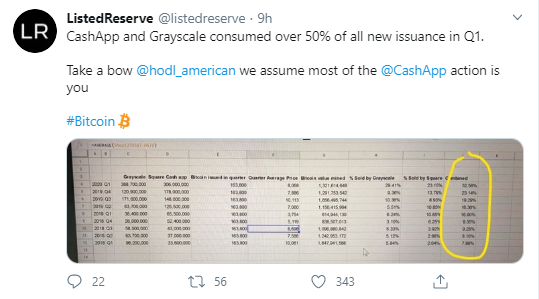

While the Bitcoin price pulls away from stocks, hyperbitcoinization appears to be gathering steam from both retail and institutional quarters. Square’s Q1 report shows Bitcoin volume at about $306 million for Q1 2020 — more than 70% the volume recorded in Q4 2019 and over 400% higher than the figures from Q1 2019.

In Africa, the situation is similar, with reports showing P2P trading across the continent crossing $10 million — a new weekly high for the region. Current trading volume on platforms like LocalBitcoins and Paxful is outstripping the figures seen during the December 2017 bull run.

In Africa, the situation is similar, with reports showing P2P trading across the continent crossing $10 million — a new weekly high for the region. Current trading volume on platforms like LocalBitcoins and Paxful is outstripping the figures seen during the December 2017 bull run.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Osato Avan-Nomayo

Osato is a reporter at BeInCrypto and Bitcoin believer based in Lagos, Nigeria. When not immersed in the daily happenings in the crypto scene, he can be found watching historical documentaries or trying to beat his Scrabble high score.

Osato is a reporter at BeInCrypto and Bitcoin believer based in Lagos, Nigeria. When not immersed in the daily happenings in the crypto scene, he can be found watching historical documentaries or trying to beat his Scrabble high score.

READ FULL BIO

Sponsored

Sponsored