The S&P 500 has been increasing since March 13, when it reached a low of $2,173. Since then, the price has increased by 28%.

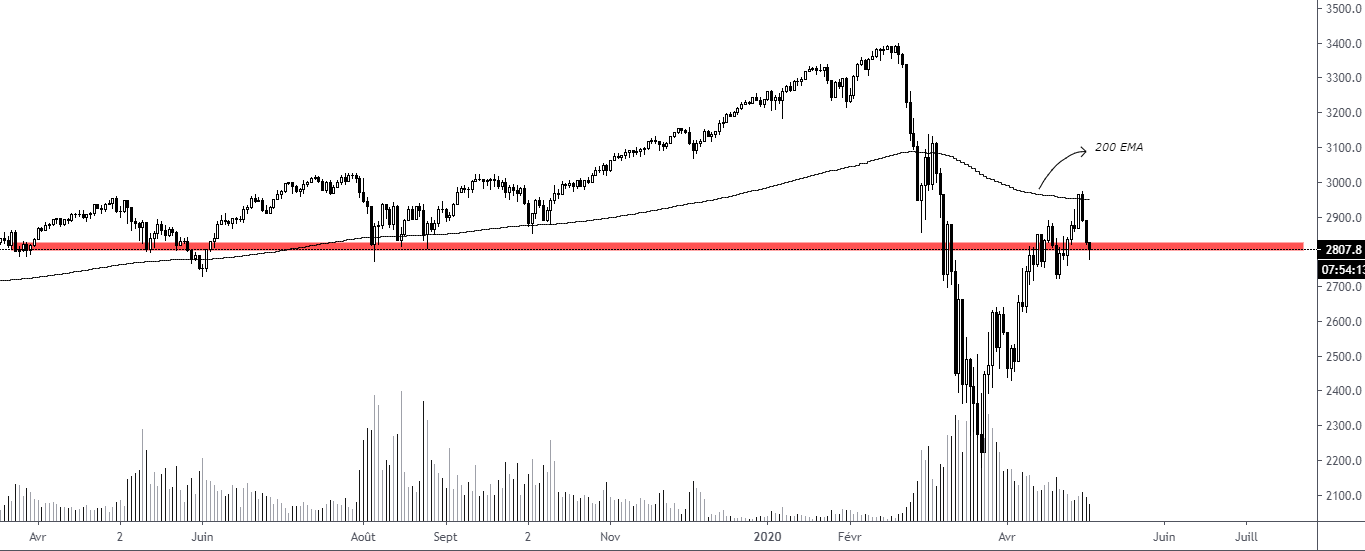

However, the increase has seemingly stalled over the past week, since the price has reached an important resistance level. Well-known trader @Pierre_crypt0 outlined an S&P 500 chart that shows the price struggling to move above its 200-day moving average (MA).

Correlation

The image below shows the price of the S&P 500 (candlesticks) and that of BTC (blue). Since April 23, the movement of both has generally been in the same direction. This is evident especially when the S&P 500 moves upward. However, since April 30, when both assets reached a top, the price of the S&P 500 has been decreasing rapidly while that of BTC has been moving downward at a much more gradual pace. This is even more evident when incorporating the Correlation Coefficient, which shows a value of 1 for perfect correlation and 0 for no correlation at all. The coefficient has decreased during downward moves, as is evident on April 24, and has approached 0, sometimes falling into negative territory. To the contrary, it has been very close to 1 during upward movements. Since April 30, the coefficient has gradually decreased and is currently at -0.25, indicating a very low correlation.

Future Movement

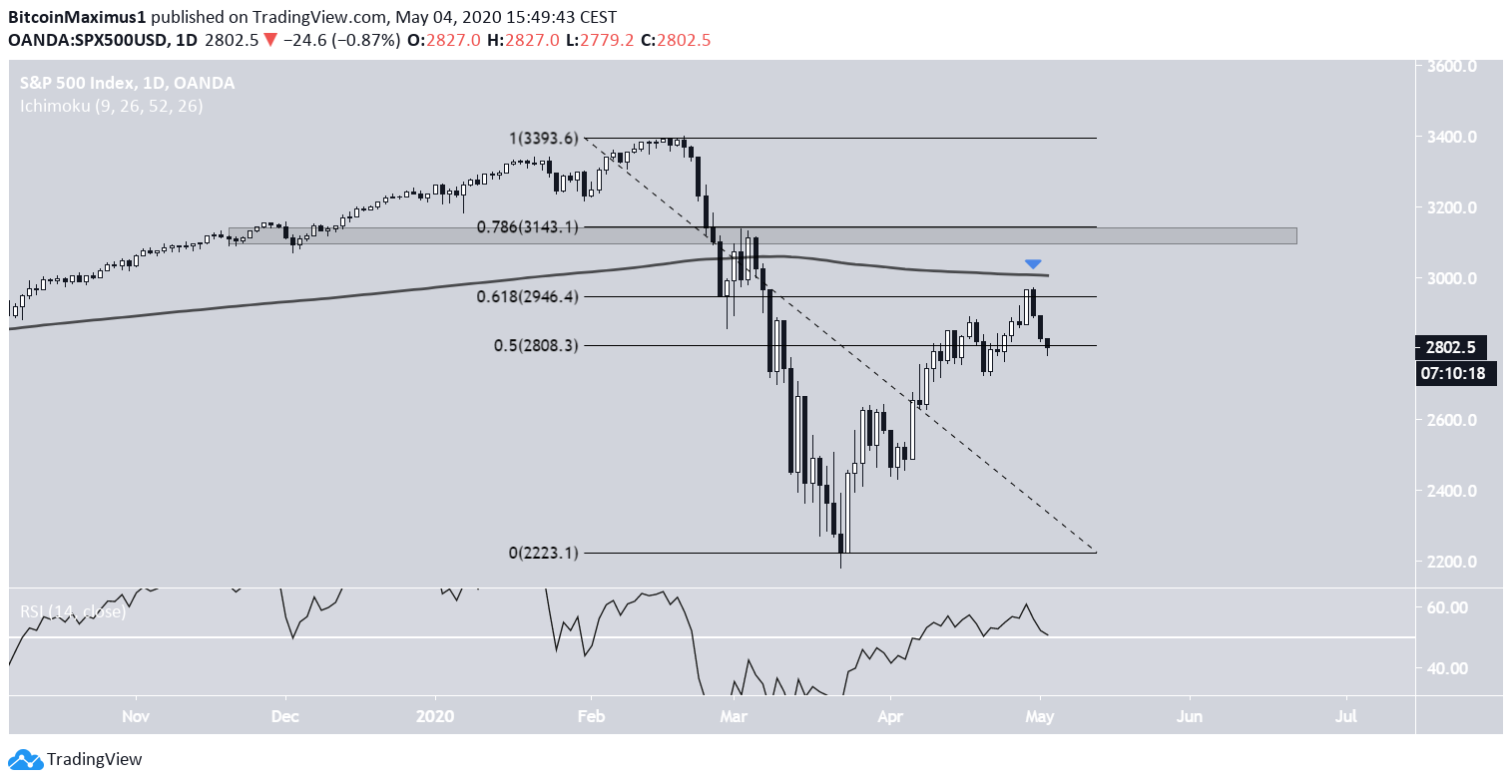

So, we have found that if the S&P 500 were to go up, BTC would very likely follow suit. In this section, we will determine how likely that is to occur. The S&P 500 price has been increasing since it reached a bottom on March 13. However, on April 30, the price was rejected by the 200-day MA along with the 0.618 Fib level of the entire downward move. This is a likely place for a trend reversal. In addition, even if the price were to increase above this MA, it would face resistance at the 0.786 Fib level, which is also a previous support area. Therefore, the current movement is much more likely to be a retracement than the beginning of a new upward move.

Top crypto projects in the US | April 2024

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored