The prices of both Bitcoin (BTC) and the S&P 500 have been positively correlated with each other since February 13 — meaning that, as one moves in one direction, the other follows suit. Additionally, since the rapid decrease at the beginning of March, the correlation has been almost perfect.

The movements of both assets were shown in a chart by well-known trader @CanteringClark on Twitter, who posted a side-by-side image comparing Bitcoin’s price movements to that of the S&P 500 (SPX) using the one-minute time-frame.

$BTC still traded with the $SPX for the earlier part of the day, it actually looked as though $SPX had a small lead. Mid afternoon things changed with #Bitcoin holding up while $SPX broke down on $GILD remdesivir news. More upside capture and less downside capture for the day.In this article, we will take a closer look at the price movement of both Bitcoin and the S&P 500 to determine if there is a correlation between the two.

Long-Term Bitcoin-to-SPX Correlation

The price of Bitcoin (candlesticks) and that of the S&P 500 (blue) are shown side by side in the image below, in a time period that begins in October 2019. Initially, the prices of both assets did not move in a synchronized manner. While the Bitcoin price was subject to a rapid increase followed by a decrease of more than 100 percent beginning on October 26, the S&P500 only increased gradually. This all changed on February 13, when the prices of both assets began a downward move. 75 days later, they have not reached these prices again. The decrease greatly accelerated on March 7 for the SPX and on February 13 for the Bitcoin price. Since this decrease (meaning over the past 75 days) the prices of both have been positively correlated with each other — almost mimicking the other’s movements.

April Correlation

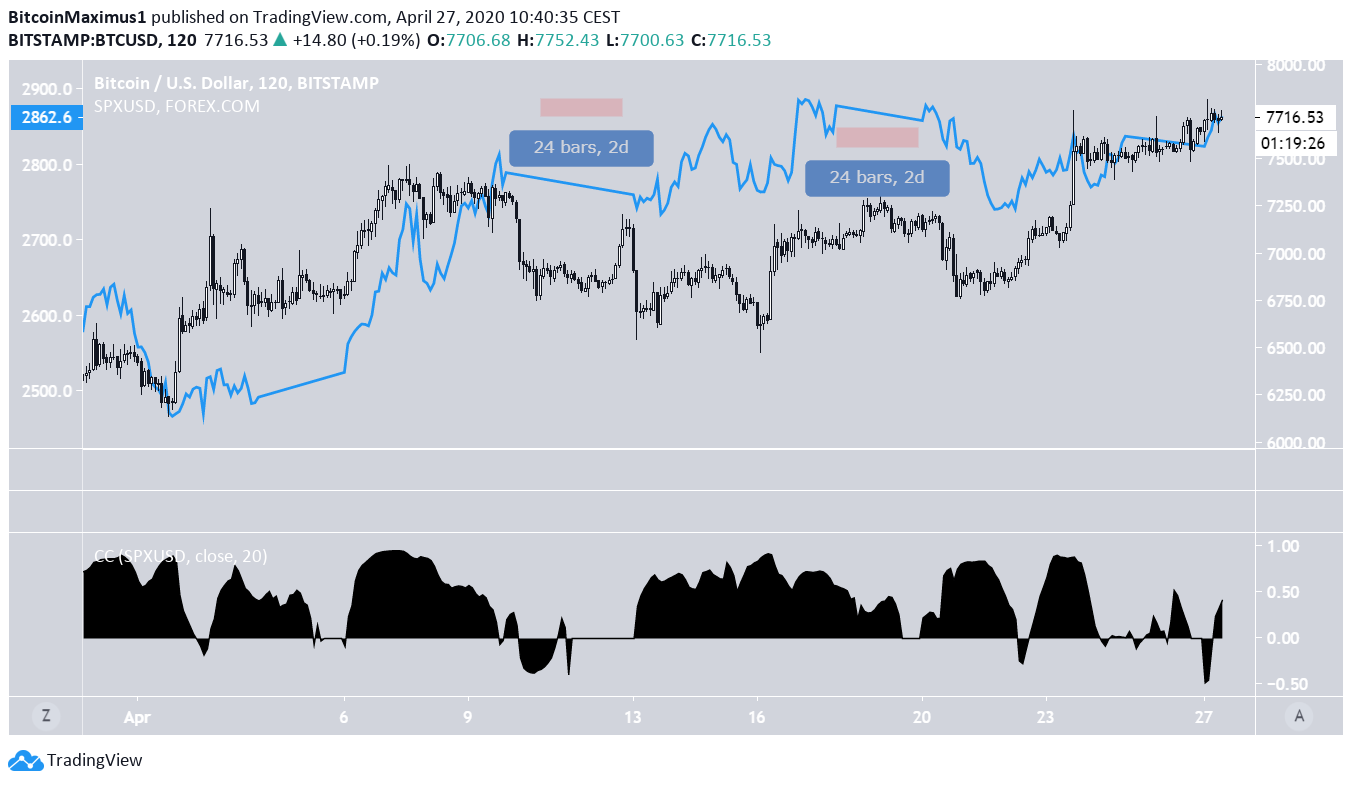

Looking at a shorter-term chart — more specifically, that which covers the price movement since April — we can see a similar correlation. There are, however, some divergences between the two. The correlation coefficient shown in the lower portion of the chart — in which a value of one indicates a perfect correlation and that of negative one shows no correlation at all — confirms this correlation. In addition, the periods that have had the least correlation are during the weekends, in which the SPX market is closed. Besides these periods, the prices have generally moved in the same direction, as can be seen by the scarce periods of time in which the correlation coefficient is below 0.

Conclusion

To conclude, the Bitcoin and S&P 500 prices have been positively correlated for the past 75 days — more specifically, since February 13. While there have been short-term divergences (especially on weekends), the price of one has followed the other almost perfectly.Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored