The Bitcoin (BTC) price is beginning to show a significant decoupling from the U.S. stock market after months of a positive correlation.

Such a trend, if continued, could strengthen the “uncorrelated asset” argument for BTC, especially as the top-ranked crypto by market capitalization readies for another halving.

Amid the ongoing decoupling, positive Bitcoin sentiment appears to also be growing in momentum from retail and institutional buyers.

Bitcoin Price Pulls Away From Stocks

According to a tweet by Mati Greenspan, founder of Quantum Economics, the Bitcoin price is pulling away from the stock market.

The Bitcoin price has been surging since late April while the Dow Jones continues to lag. The same decoupling can be seen when comparing the Bitcoin price performance to that of the S&P 500.

Indeed, Bitcoin showed a positive correlation with the U.S. stock market for most of Q1 2020. A Binance report from early April 2020 showed Bitcoin exhibiting a moderately positive correlation with U.S. equities throughout Q1.

The Black Thursday market sell-off — one of the worst in Bitcoin’s history — also further served to strengthen this apparent correlation. While the BTC price fell to $3,800 on March 12, 2020, the broader financial market also saw massive sell-offs, with investors looking to liquidate assets for cash. During the panic, the U.S. stock market saw its largest single-day drop since 1987.

However, this recent coupling flies in the face of the uncorrelated asset narrative for Bitcoin. Indeed, the lack of correlation between Bitcoin and mainstream investment vehicles is one of the often quoted justifications for BTC’s designation as a store-of-value asset as well as a hedge against market uncertainties and unlimited quantitative easing by central banks.

‘Hyperbitcoinization’ at Center Stage as Halving Draws Closer

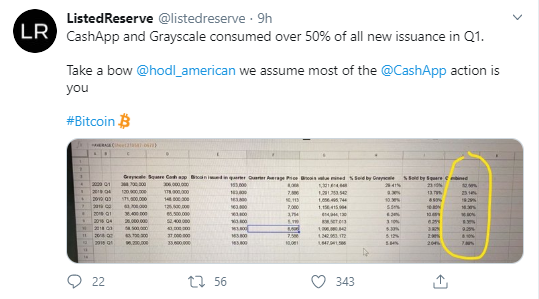

While the Bitcoin price pulls away from stocks, hyperbitcoinization appears to be gathering steam from both retail and institutional quarters. Square’s Q1 report shows Bitcoin volume at about $306 million for Q1 2020 — more than 70% the volume recorded in Q4 2019 and over 400% higher than the figures from Q1 2019.

Tweeting on Thursday, Australian Bitcoin fund manager ListedReserve revealed that the inflows for CashApp and Grayscale Bitcoin Trust account for half of the BTC mined in 2020. However, it is not apparent the percentage of these inflows that came from 170,000 new BTC supply for Q1 2020.

In Africa, the situation is similar, with reports showing P2P trading across the continent crossing $10 million — a new weekly high for the region. Current trading volume on platforms like LocalBitcoins and Paxful is outstripping the figures seen during the December 2017 bull run.