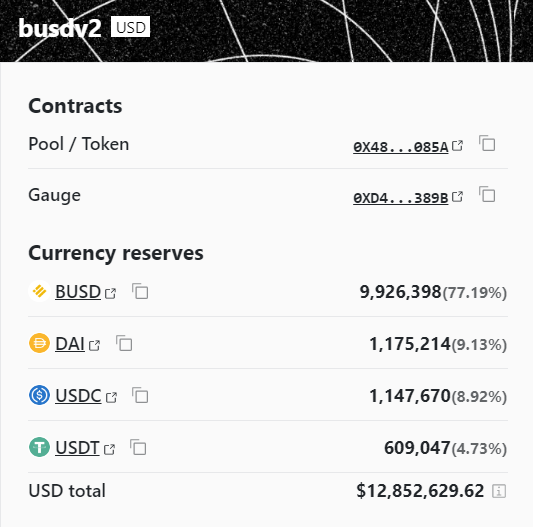

Stablecoin holders have drained BUSD liquidity from Curve Finance’s busdv2 liquidity pool as issuer Paxos faces regulatory upheaval.

Investors increased the proportion of BUSD in Curve’s pool from 69% on Monday, Feb. 13, 2022, to 81% on Feb. 14, 2023, after U.S. regulators ordered the New York-based firm to stop minting BUSD from Feb. 21, 2023.

Curve Pool Shows Lower USDT and Higher BUSD Liquidities

At press time, USDT only made up 4% of the pool, suggesting that traders were fleeing Paxos to seek refuge in Tether, another centralized stablecoin. Outflows from Binance, whose name accounts for the first letter of BUSD, totaled $2.7 billion between Feb. 13 and Feb. 14, 2023.

A stablecoin uses an algorithm, other cryptocurrencies, fiat reserves, or a combination of methods to maintain a value of $1.

On Feb. 13, 2023, the New York State Financial Services Department ordered Paxos to stop issuing BUSD, while the SEC issued a Wells Notice to the firm. A Wells notice allows the firm to defend itself against an alleged irregularity before a potential enforcement action. The notice alleged that BUSD was an unregistered security.

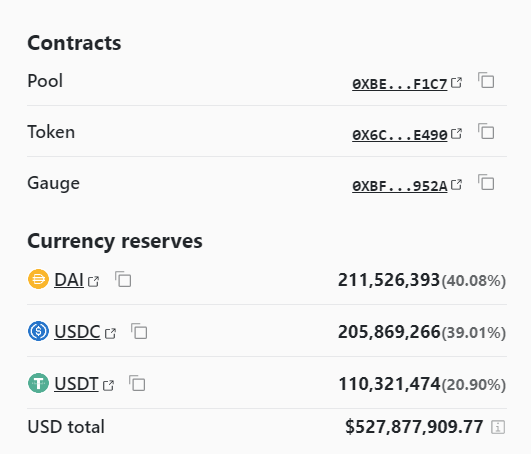

USDC Allocation in 3Pool Rises as Investors Swap USDC for Tether

Data from Curve’s 3pool suggests that investors are also dumping USDC, a stablecoin issued by Circle International Financial, upsetting the pool’s composition, which must have USDT, USDC, and DAI in equal proportion.

The dump comes as investors fear that the SEC will crack down on Circle for offering USDC as an unregistered security.

Since Feb. 13, 2023, the USDC in Curve’s 3pool has risen from 31% to 38%, while Tether’s pool share dropped from 24% to 21% in two days.

Curve is a decentralized exchange for stablecoins created by former Russian physicist Michael Egorov. The Curve protocol trading algorithm drew attention for its low slippage and spread between trading counterparties.

Decentralized Stablecoins Gain Ground

The mass exodus to Tether comes even as accounting firm BDO recently validated the issuer’s USDT reserves recorded in a Consolidated Reserves Report published in Dec. 2022.

In the report, BDO found that Tether cut its holdings of commercial paper and increased the proportion of its reserves held in U.S. Treasury bills to 58% to satisfy stablecoin redemptions after the TerraUSD collapse last May saw USDT briefly lose its value of $1.

Unlike Paxos, Tether is not overseen by a prudential U.S. authority that compels it to hold capital to honor customer redemptions. Accordingly, investors risk losing their money should Tether experience a bank run.

But not all BUSD holders have switched to Tether. LQTY, the token behind the decentralized lending protocol Liquity, rose to an all-time high of $1.07 after the Paxos announcement. Liquidity issues interest-free loans denominated in its LUSD stablecoin, which ETH overcollateralizes. It uses algorithms to set a loan issuance fee.

3pool’s proportion of DAI has increased slightly to 40% after actions against BUSD. DeFi protocol MakerDAO issues permanent DAI stablecoin loans against ETH deposits.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.