Tether USDT’s market dominance has risen to its highest level since November 2021, according to DeFillama data. On the other hand, Binance-backed BUSD has seen its supply shrink by roughly $2 billion in the last 30 days.

According to DeFillama data, the top three stablecoins control roughly 92% of the market. USDT is the dominant stablecoin in the crypto space, with its dominance at 49.18%, while stablecoins like Circle’s USD Coin have a market dominance of 31.05%. BUSD’s dominance stood at 11.52% as of press time.

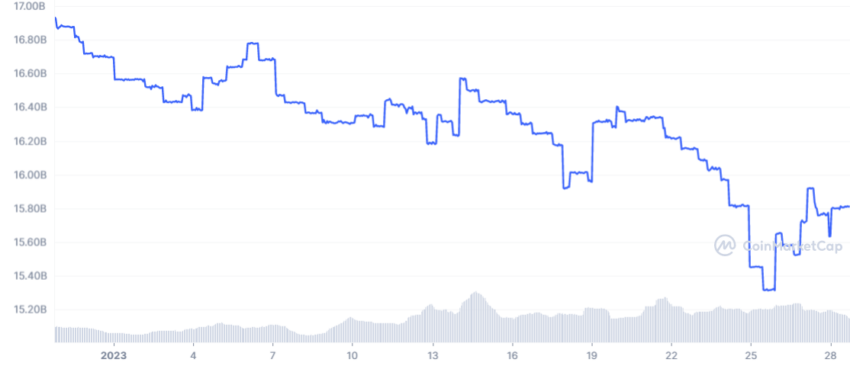

Stablecoin’s Market Cap Declined to $137 Billion

A recently released stablecoins report by CryptoCompare stated that the total market cap of stablecoins has declined for ten straight months to $137 billion this January. The report added that the lowest market cap stablecoins have been since 2021.

According to the report, USDT’s market cap slightly rose 0.82% to $66.7 billion, while its significant rivals, USDC and BUSD, fell 2.27% and 3.97% to $43.1 billion and $16.1 billion, respectively. Meanwhile, the market cap of lesser-known stablecoins like True USD (TUSD) and failed algorithmic stablecoin TerraClassicUSD (USTC) rose 24.5% and 13.1% to $940 million and $225 million, respectively.

BUSD Had a Troubled January

The Binance-backed stablecoin has experienced a turbulent past month after reports emerged about past mismanagement.

Bloomberg reported on Jan. 10 that the mismanagement at times left BUSD’s reserves with over $1 billion in missing collateral. Besides that, the Changpeng Zhao-led exchange admitted that it keeps collateral for its BNB Smart Chain and BNB Beacon Chain tokens in the same wallet as customer funds.

These revelations increased the FUD surrounding the exchange as users withdrew their assets en masse. BeinCrypto reported that Binance’s outflows topped 25% within two months. According to the report, the flows were led by its Paxos-issued stablecoin BUSD and native BNB coin.

Meanwhile, amidst all the uncertainty, Binance’s CZ insisted that the exchange had a healthy balance book. The CEO recently tweeted that traditional finance firm cutting their exposure to crypto due to the failure of recent crypto projects might face “existential implications” in twenty years.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.