Tether reportedly bought 52,670 Bitcoin (BTC) with the interest it earned from government Treasuries backing its USDT stablecoin.

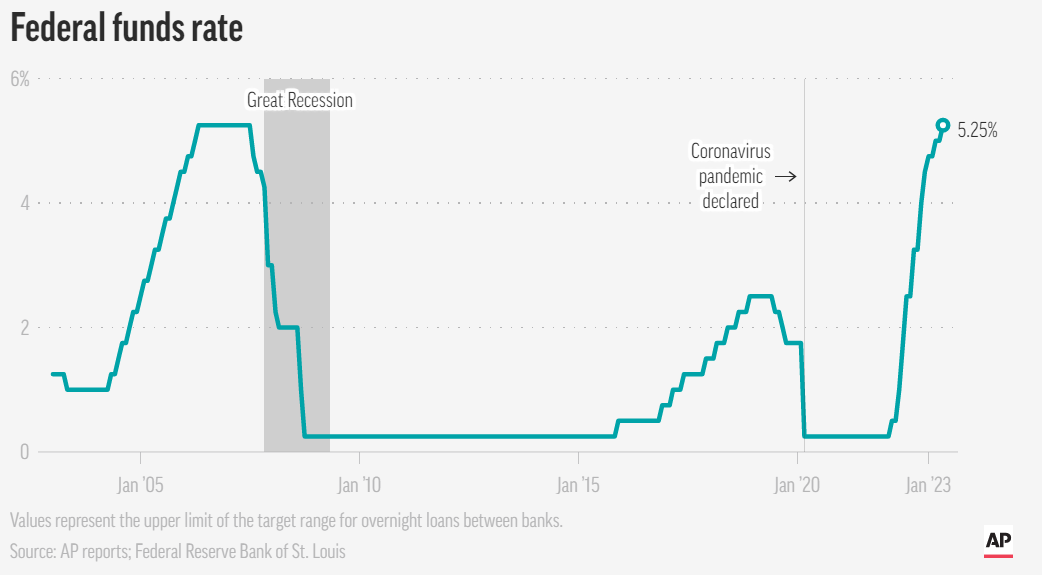

The returns from its government Treasuries have risen substantially amid a roughly 500-basis point hike in the federal funds rate in the last 13 months.

Tether Confidence Booms Amid Rival Woes

In addition to Bitcoin, the firm holds $3.3 billion worth of gold bars and $140 million in corporate bonds.

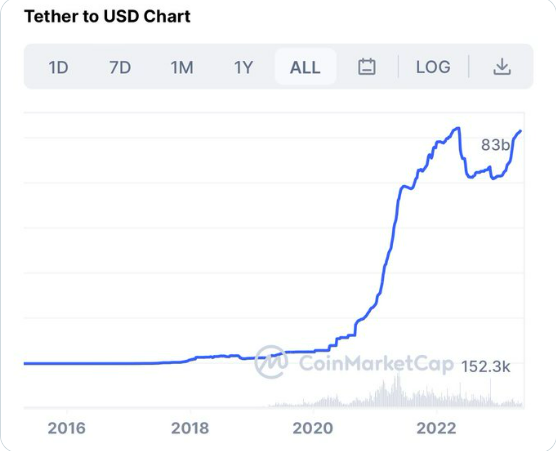

USDT issuance has also increased despite the opportunity for investors to earn higher returns at banks. There is now $83 billion worth of USDT in circulation, revealing a healthy desire for digital dollars outside the U.S. banking system.

Crypto investors buy stablecoins to trade digital assets without a dollar bank transfer. Stablecoin issuers keep the value of their assets at $1 through on-chain or off-chain assets.

USDT issuance benefited from a regulatory clampdown on rival stablecoin BUSD, which New York regulators ordered Paxos to stop minting.

Its rival Circle suffered a blow when it lost access to deposits backing its stablecoin at a failed bank over the weekend of March 10.

Tether denied exposure to Silvergate Capital after the firm filed for voluntary liquidation.

Tether mints one USDT for every dollar deposit it receives. It uses the deposits to buy liquid financial instruments it can sell if customers redeem their USDT. It does not insure customer deposits.

The firm has been criticized for excessive USDT printing. It recently authorized about $1 billion USDT for cross-chain swaps and future mints.

Tether Rides Wave of Fed Policy to $1.5 Billion Profit

Twitter user girevik blamed the Federal Reserve (Fed) and the U.S. Treasury for aiding Tether’s Bitcoin purchases by increasing interest rates to 16-year highs.

Tether holds a significant portion of its USDT reserves in T-bills sold by the U.S. Treasury at a discount or face value. A buyer can redeem the bill before its maturation date of four to 52 weeks.

The interest earned depends on how close the redemption date is to the maturation date. Higher interest rates affect the discount prices of bills and how much profit the buyer can realize on redemption.

Tether earned $1.5 billion profit from Treasury returns boosted by rising rates in Q1 2023.

The Wall Street Journal recently wrote a scathing piece accusing Tether of using shell companies to access U.S. banks after Wells Fargo stopped providing banking services in 2018.

Tether denied the charges. It previously claimed it is registered with the Financial Crimes Enforcement Network and follows the bureau’s money laundering rules.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.