The world’s leading stablecoin issuer Tether claims that its excess of reserves has reached an all-time high.

In its first quarterly assurance report released on May 10, Tether reported an increase in excess reserves, reaching an all-time high of $2.44 billion. Furthermore, the figure marks an increase of $1.48 billion for the first quarter of 2023.

Moreover, Tether’s Consolidated Reserves Report claimed it had consolidated assets totaling $81.8 billion at the end of the quarter.

Furthermore, the majority of its reserves are invested in U.S. Treasury Bills. The firm added that it was reducing its exposure to banks:

“It has also been working to take steps to reduce its reliance on pure bank deposits as a source of liquidity and instead leverage the Repo market as an additional measure to ensure higher standards of protection for its users by maintaining the required liquidity.”

Tether Strives for Transparency

Tether’s reserves “remain extremely liquid,” it said. The majority of its investments are held in cash, cash equivalents, and 85% in “other short-term deposits.”

Additionally, the firm has also reduced its exposure to secured loans from 8.7% to 6.5%. It added that gold and Bitcoin represent around 4% and 2% of the total reserves, respectively. According to the report, all new token issuances were invested in U.S. Treasury bills or placed in overnight Repo.

Tether CTO, Paolo Ardoino, commented

“We continue to monitor the risk-adjusted return on all assets within our portfolio on an ongoing basis and expect to make further changes as the overall economic environment changes and the market cycle progresses as a part of our normal, ongoing risk management processes.”

Meanwhile, Circle CEO Jeremy Allaire has reported that the firm has adjusted its USDC reserves. In an effort to avoid exposure to potential U.S. debt default, he also said that Circle had switched to short-dated U.S. Treasuries.

“We don’t want to carry exposure through a potential breach of the ability of the U.S. government to pay its debts.”

USDT Market Share Surges

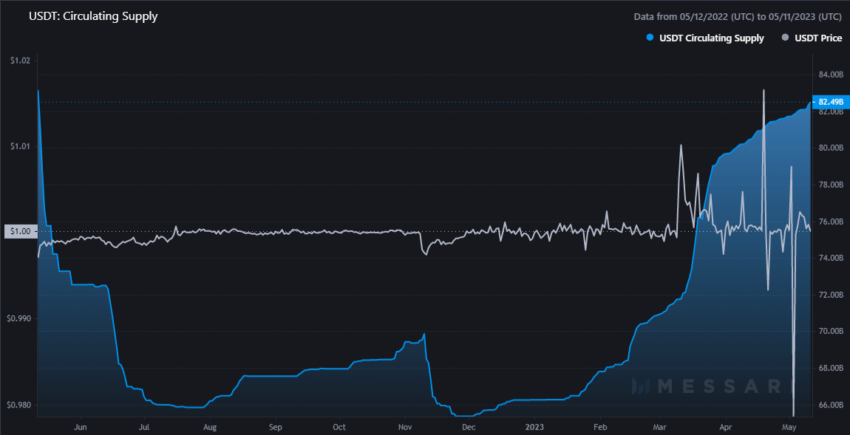

Additionally, Tether’s market share has increased to 62%, with a circulating supply of 82 billion USDT, at the time of writing.

Moreover, since the beginning of the year, the USDT market capitalization has increased by 24% while its rivals have declined.

In related news, New York state proposed legislation on May 10 to authorize fiat-collateralized stablecoins as a form of bail bonds.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.