Swiss bank St. Galler Kantonalbank (SGKB) is to offer Bitcoin (BTC) and Ethereum (ETH) trading to its customers. Crypto-focused bank SEBA will handle brokerage and custody services.

The product is immediately available to specific SGKB customers after going through a brief testing period. The bank expects to add more cryptocurrencies depending on client demand.

SEBA Brings Wealth of Experience to SGKB Bitcoin and Ethereum Service

St. Galler Kantonalbank serves both institutional and retail clients and managed roughly $58.9 million as of the end of 2022. SGKB’s partnership with SEBA allows bank customers to access digital assets within their investment portfolios.

SEBA’s Bank Head B2B and Custody Solutions, Christian Bieri said of the new partnership,

“We are very pleased to be able to support St. Galler Kantonalbank with our expertise in expanding their services around digital assets.

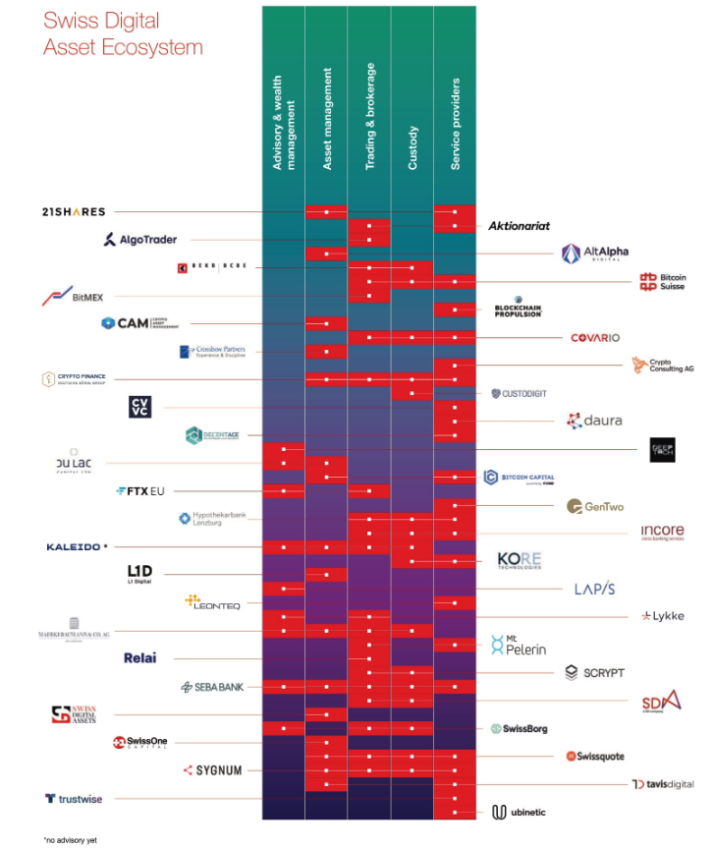

SEBA received a license from the Swiss Financial Market Supervisory Authority in 2019. It has helped several banks offer crypto assets to their clients, including LGT Bank Liechtenstein and Bank Julius Baer.

Swiss Banks Absorb Crypto Demand

Read more: RWA Tokenization: A Look at Security and Trust

Swiss banks have been quick to spot demand for crypto services. Recently, the Singapore branch of Sygnum, also a Swiss bank, received approval to launch a crypto brokerage service after noticing institutional demand from Web3 fund managers.

Demand for crypto services increased after the failures of crypto-friendly US banks, Silvergate Capital and Signature Bank. The rising interest in real-world asset tokenization could further boost the demand for digital asset custody solutions.

Real-world asset tokenization creates a blockchain twin of a physical or digital asset that needs to be stored securely. So far, few regulatory regimes have addressed the safest way to store, for example, a tokenized title deed.

Read more: What is Tokenization on Blockchain?

Swarm, a regulated company, allows DeFi participants to access tokenized bonds and securities stored with Gemini or Coinbase. A withdrawal pulls the tokenized asset from the custodian into a crypto wallet via a trustee.

Mitch DiRaimondo of SteelWave, a US real-estate developer, argues that ownership laws need revision for tokenization to succeed. US laws must recognize owners of digital fractions of real-world assets, not just the owners of entire assets.

Do you have something to say about SGKB offering Bitcoin and Ethereum with SEBA, the crypto custody landscape, or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.