The decision of federal regulators to backstop the Silicon Valley Bank saved Circle, USD Coin issuer, and Sequoia Capital more than $4 billion, according to a Bloomberg report.

Based on a document released by the Federal Deposit Insurance Corp (FDIC) to the media house, two of the biggest crypto industry firms caught in the crisis at the defunct Silicon Valley Bank was saved more than $4 billion.

Circle and Sequoia Among SVB’s Top 5 Depositors

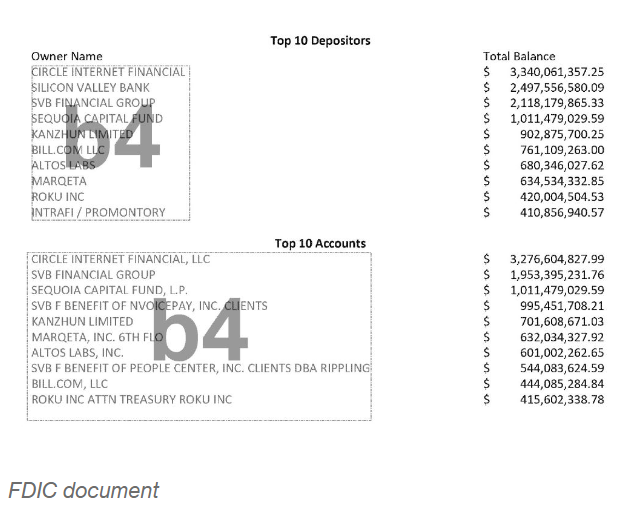

The document showed that stablecoin issuer Circle was the biggest depositor in Silicon Valley Bank. The crypto firm had a balance of $3.3 billion at the bank, which accounted for around 8.2% of its USDC reserves.

Read More: 6 Best Copy Trading Platforms in 2023

On the other hand, Sequoia Capital, a prominent venture capital firm invested in several crypto firms, had $1 billion of its funds at the embattled bank.

Other major depositors at the bank included Kanzhun with $902.9 million and Alto Labs with $680.3 million. Others like Marqeta Inc. had $634.5 million at the bank, Roku held $420 million, and Bill.com had $761.1 million. SVB-related entities held a combined $4.6 billion in deposits.

The decision to backstop cost the FDIC around $15.8 billion, with the top 10 depositors accounting for $13.3 billion.

More From BeInCrypto: 9 Best AI Crypto Trading Bots to Maximize Your Profits

Banking Crisis Effect on Crypto

notablyThe Bloomberg report highlights just how impactful the collapse of Silicon Valley Bank could have been for several companies, particularly Circle, which held $3.3 billion in the bank.

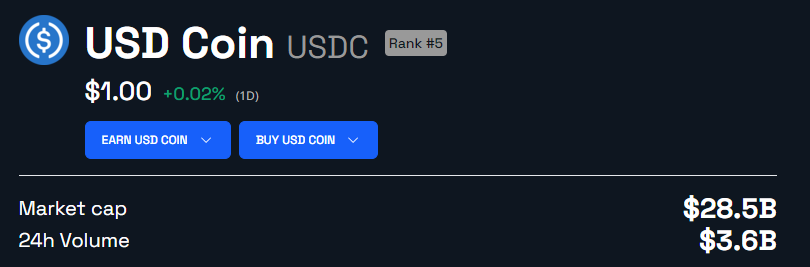

SVB’s collapse shook crypto investors’ confidence in Circle’s USDC. Since the incident, USDC’s circulating supply dropped to $28.18 billion from a peak of over $44 billion.

Before the banking crisis, several federal agencies had warned banks about the liquidity risks crypto poses to the banking industry. The fears were later exacerbated by the collapse of three crypto-friendly banks during a very short period.

Since then, several crypto firms have struggled for new banking partners. For context, Binance.US struggled to find new banking partners before its showdown with the U.S. Securities and Exchange Commission. The current unfavorable regulatory environment has forced the firm to transition to a crypto-only exchange.

Meanwhile, some crypto stakeholders have argued that the government used the banking crisis to restrict crypto access to banking infrastructure.

Read More: Top 11 Crypto Communities To Join in 2023

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.