The Binance.US crypto exchange has decided to temporarily halt all USD deposits and withdrawals while it awaits the next action from the SEC. The change will happen on June 13 and will make the platform crypto-only.

While the Binance-SEC case rages on, the platform is doing what it can to serve its customers.

Binance-SEC Lawsuit Sparks Significant Changes

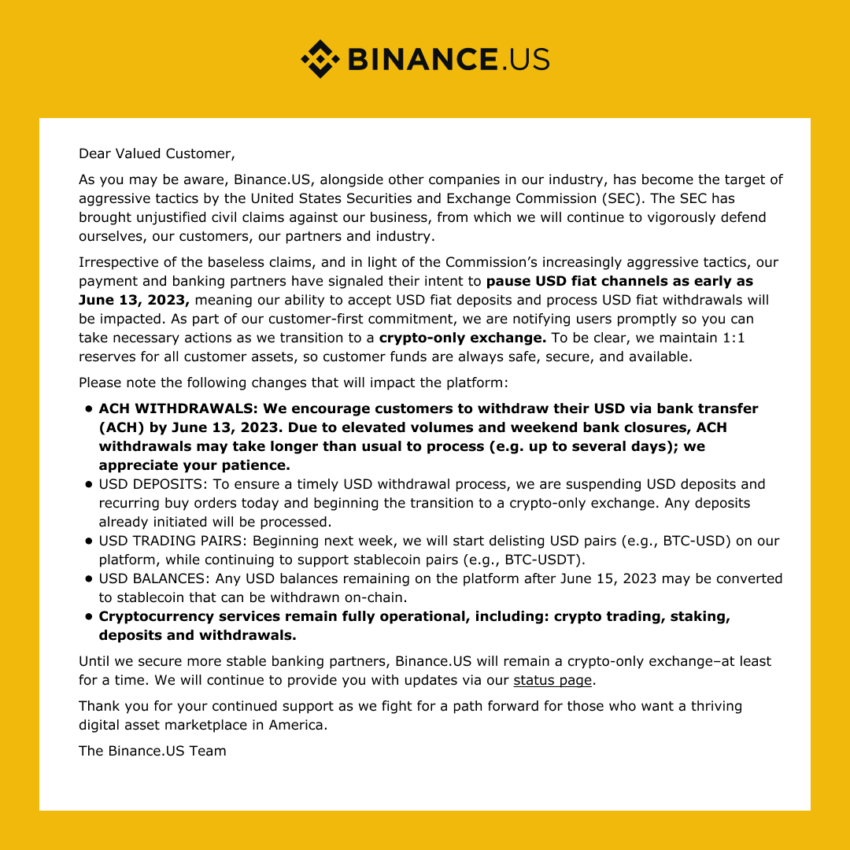

Binance.US, the U.S. arm of one of the world’s most popular exchanges, posted the update on USD channels on June 9. The announcement encouraged customers to withdraw their USD via bank transfer by June 13. The withdrawals may take longer than usual because of the high volume.

Binance.US was quite direct in its statement, describing the situation as follows,

“The SEC has taken to using extremely aggressive and intimidating tactics in its pursuit of an ideological campaign against the American digital asset industry. Binance.US and our business partners have not been spared in the use of these tactics, which has created challenges for the banks with whom we work.”

It also clarified that it maintained 1:1 reserves for customer assets. As it works through the SEC case, it will continue to remain functional, albeit crypto-only. Binance.US has already delisted 10 trading pairs and paused OTC trading.

Binance and Binance.US are two separate entities and must follow different rules. Read more about how the two differ here:

Binance vs. Binance.US: A Detailed Comparison

Community Reacts Strongly to SEC’s Actions

The crypto community has reacted strongly to the news, both about the halting of USD channels and the case itself. Managing Partner of the Deaton Law Firm John E Deaton spoke about the SEC’s approach in a Twitter thread, stating that

“the Coinbase and Binance lawsuits share some common themes and characteristics but, at the same time, are quite different.”

Deadton also said that the SEC has an agenda and it was not acting in the best interests of retail crypto holders. He also published a Google form to make sure users of the relevant platforms have their voices heard.

The rest of the crypto community was fairly harsh with the SEC. Some believe that Gensler is not behaving impartially, while controversial crypto commentator BitBoy claims to have information that Binance earmarked $1 billion for the case.

Binance CEO Confidently Takes Fighting Stance

There have been a lot of updates in the Binance-SEC case with respect to CEO Changpeng Zhao as well. Reporter Colin Wu published an internal letter where Zhao spoke of the fact that the company would continue building products and reminded employees that chat logs may be brought up in the case.

Zhao also roundly dismissed claims that Binance had predicted $12 billion in funds to firms controlled by him. He emphasized that Binance.US never had that much in funds and that the SEC’s claims were just plain false.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.