Major venture capital firms are doubling down on fintech, with the industry dominating the portfolios of firms like Sequoia Capital and a16z. Both firms invested significant amounts into the space in 2022.

According to a report from CB Insights, major investment firms Sequoia Capital and Andreessen Horowitz (a16z) invested a sizable sum into the fintech space last year. The former’s investment budget was used for approximately 25% of its 100 deals. A similar trend was seen for a16z.

The figures are all the more surprising given the tough year that was 2022. While fintech is limited to crypto investments, the global economy saw the start of a rough patch that might continue or worsen in 2023.

Sequoia dedicated 8% of its fintech budget towards crypto investments, with CB Insights showing funding for EDXM and Multis. Most of its funding focused on capital markets, payments, payroll, and benefits. Each of these three represented 16% of the fintech funding.

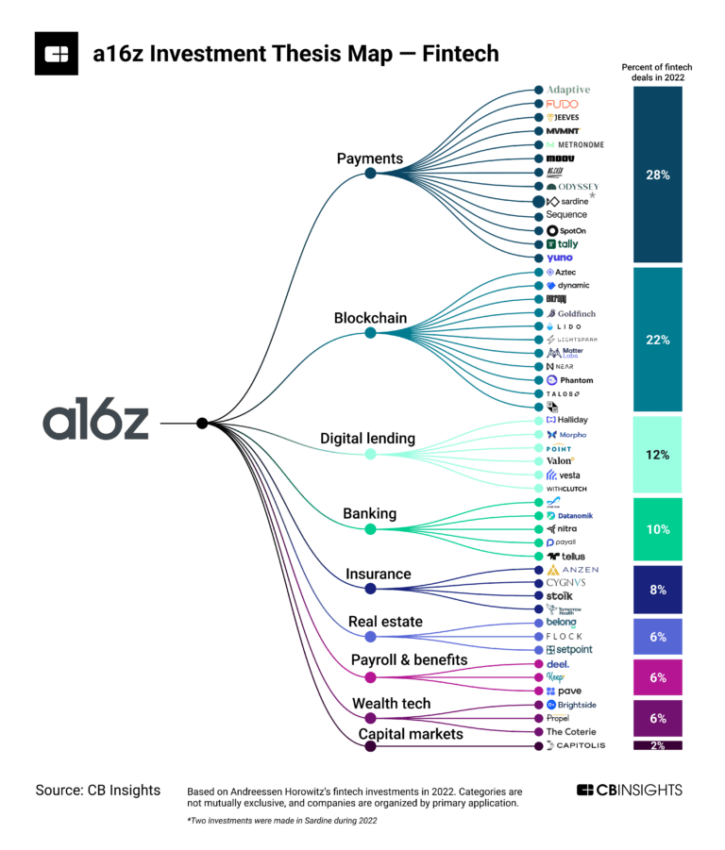

A16z was more prolific went it came to crypto investments, with the firm backing 49 companies. It has long shown an interest in blockchain technology, and the desire is only growing. In A16z’s case, the bulk of the fintech portfolio focused on payments, at 28%.

However, investments in blockchain companies were not far behind, making up 22% of the portfolio. Funded companies included Aztec, Goldfinch, Lido, Near, and Phantom.

A16z Continues Its Funding Spree

A16z has long had a focus on investing in crypto and blockchain technology and has often made the headlines for the targeted interest. Back in 2021, the firm announced a $1 billion crypto investment fund. Countries like India are also a prime target, with startups in the country receiving $500 million in investments from the a16z.

2023 appears to be another year of heavy investment in the space from the firm. Last week, a16z led a $25.5 million investment round in Web3 social media startup Town. A few days earlier, it led a $6 million investment round in Stelo Labs, a Web3 security startup.

Marc Andreessen Is More Bullish on ETH Than BTC

Marc Andreessen is very bullish about cryptocurrencies, specifically ether. In an interview with ReasonTV, the entrepreneur stated that he was more optimistic about the prospects of Ethereum over Bitcoin. The gist of his statements was that he believed that web3 was the future, something the firm has iterated in the past.

A16z, a major holder of the UNI token, also recently voted against a proposal to deploy Uniswap v3 on the BNB Chain using the Wormhole bridge. It used 15 million UNI for the vote, and this formed the bulk of the votes.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.