Sushiswap (SUSHI) price reclaimed the $1.15 territory on November 2 before retracing below $0.92 a week later. On-chain data trends explore how traders could react as SUSHI broke the $1 barrier on Friday.

The Sushi price has been stuck in a sideways movement between $1 and $0.90 over the past week. Will traders book profits or continue to HODL in hopes of future gains?

SponsoredInvestors are Making Record-High Transfers Into Exchanges This Week

SUSHI, the Sushiswap native token, has been on an upward trajectory over the past month with a landmark partnership and positive price action. Similar tokens like PancakeSwap (CAKE) and Uniswap (UNI) also experienced a significant uptick as the crypto market rallied and expanded liquidity across Decentralized Exchange (DEXs).

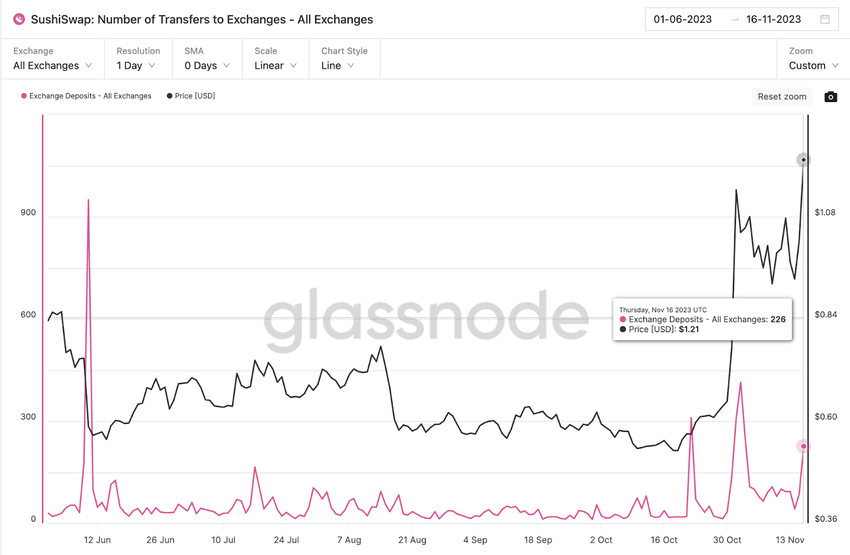

However, as the crypto market slips into a consolidation phase this week, on-chain movements suggest that most SUSHI investors are looking to bail. The Glassnode chart below illustrates that SUSHI holders made 226 Exchange Deposit transactions on November 16.

The Exchange Deposits metric tracks the daily number of unique transactions flowing from cold storage into crypto exchange-hosted wallets. Typically, an increase in Exchange Deposits means that investors are increasingly shifting tokens in crypto trading platforms, possibly to exploit short-term profit opportunities.

Historical data shows that when SUSHI investors show a strong inclination to sell, prices often drop in subsequent days. This phenomenon was observed around June 11, August 17, and more recently on November 2.

If this pattern reoccurs, SUSHI holders can anticipate a price correction in the days ahead.

Looking For a New Exchange? These Are the Best Crypto Sign-Up Bonuses in 2023

SUSHI Sellers Have Taken Over the Spot Markets

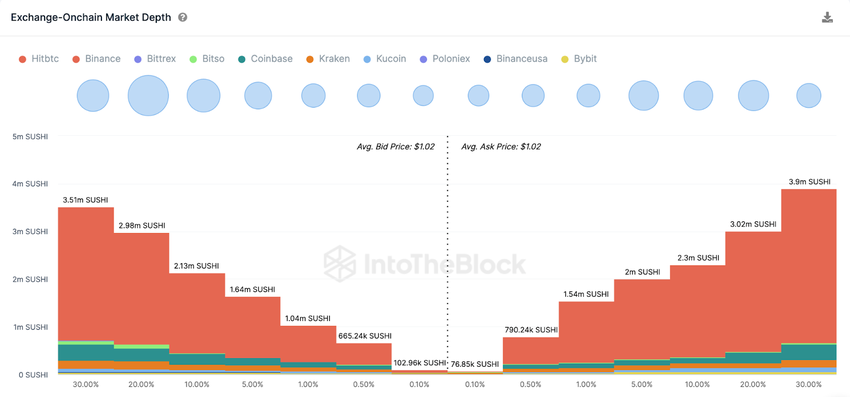

The Aggregate Data from Order Books of crypto exchanges further affirms the aforementioned stance that SUSHI is at risk of a sell-off. Crypto traders currently have 13.7 million SUSHI up for sale, according to IntoTheBlock’s aggregate data pulled from 10 exchanges, including Binance and Coinbase.

The chart further shows that the 13.7 million sell orders exceed the 10.8 million SUSHI buy orders currently listed.

The Aggregate Order Books chart illustrates the price distribution of active buy/sell orders listed for a specific crypto asset across different exchanges. When the bids or buy orders fall short of sell orders, it implies dominant bearish momentum.

SponsoredCurrently, the total SUSHI market demand is 3.1 million SUSHI, lower than the market supply. Hence, if sellers begin to compete by lowering prices to get their orders filled quicker, SUSHI will likely retrace.

Read More: How To Make Money in a Bear Market

SUSHI Price Prediction: Possible Reversal Below $0.90

After delivering 100% price gains over the past 30-days, on-chain data readings suggest Sushiswap investors appear unconvinced the rally could continue. The rapid Exchange Deposits and mounting sell orders now put SUSHI at risk of an imminent price retracement.

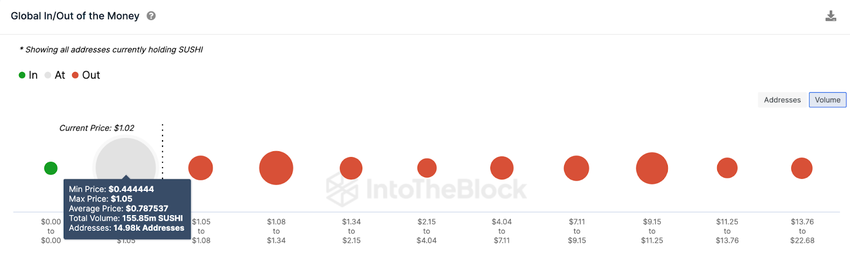

The Global In/Out of the Money data, which groups all current SUSHI holders by their entry prices, also confirms this forecast. It, however, shows that the giant buy-wall at $1.00 could present initial support.

Sponsored SponsoredAs depicted below, 14,980 addresses had bought 155.85 million SUSHI tokens at the maximum price of $1.05. Considering the positive sentiment surrounding the crypto markets, SUSHI could rebound from that range.

But if the SUSHI investors remain unconvinced, they could panic sell and trigger a larger retracement below $0.90 as predicted.

But on the flip side, the bulls could attempt to drive the Sushiswap price rally toward $2. However, in this case, the bears could mount a sell-wall at $1.35. At that zone, 13,450 addresses had bought 29.3 million SUSHI at the maximum price of $1.34.

But if the bulls can flip that resistance level, the Sushsiwap price upswing toward $2 could be on the cards.

Check Out the 9 Best AI Crypto Trading Bots to Maximize Your Profits