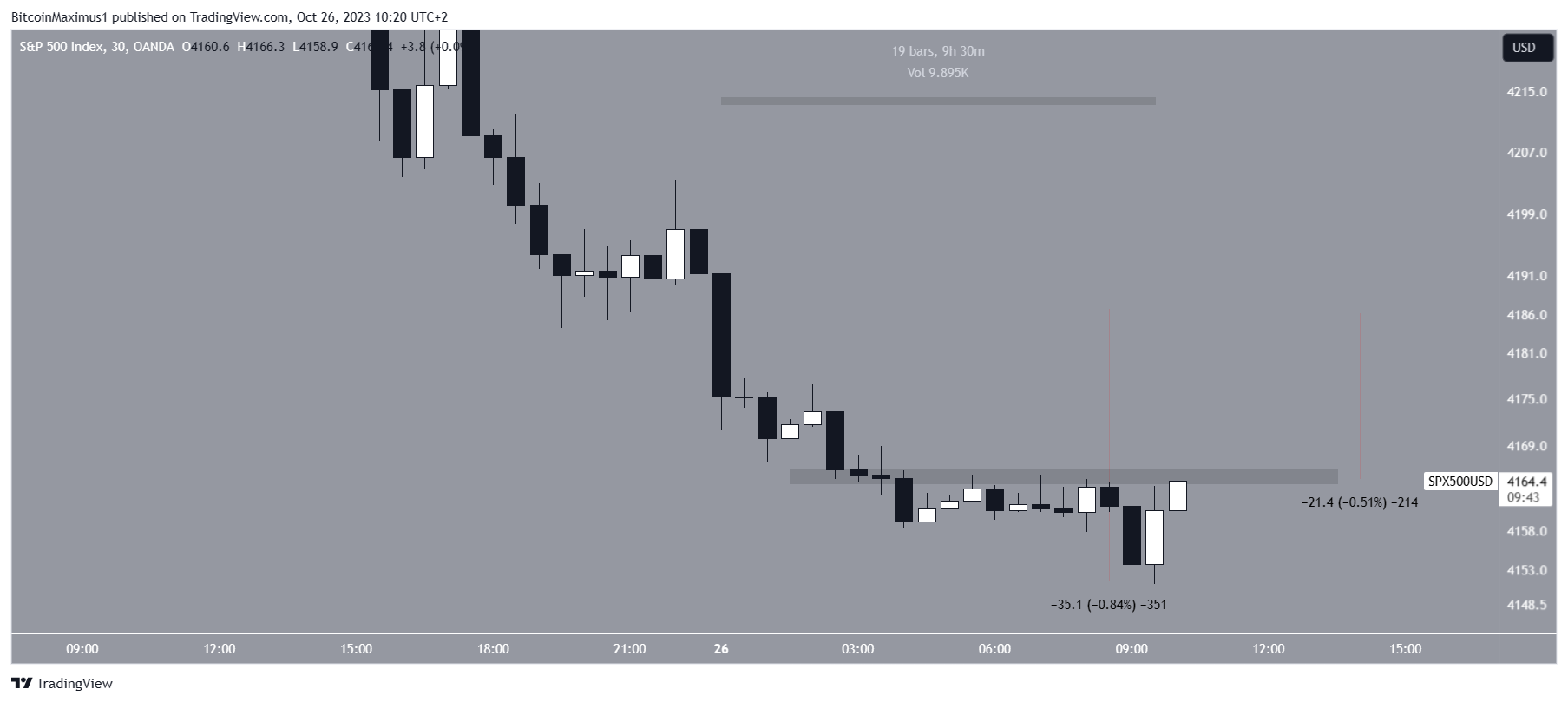

The S&P 500 (SPX) has fallen nearly 1% since the market closed yesterday.

Several stocks have fallen by nearly 20%, while Coinbase Global, Inc. (COIN) has decreased by more than 5%. With that in mind, how will the Bitcoin (BTC) price react to this decrease? BIC looks at the correlations between stocks vs Bitcoin.

SPX Falls During After-Hours

The SPX price began to fall immediately after the market closed last night. The price decreased by nearly 1%, falling to $4,151 early this morning.

A slight bounce has begun, but the price is still 0.8% below yesterday’s close.

The SPX drop has created a resistance area at $4,165, above which the price currently attempts to break out.

Whenever the price of an asset falls considerably during after-hours, it creates a gap since the next day’s opening is lower than the previous one’s close.

Since yesterday’s close is $4,186 and the current price is $4,167, a gap could occur when the market opens today at 09:30 ET.

Similar gaps were created on June 20, August 2, and September 21 (red icons).

Read More: Top 11 Crypto Communities To Join in 2023

When considering the gap’s position, it could be classified as an exhaustion gap. An exhaustion gap occurs at the end of a price pattern and is considered a final attempt at reaching new lows.

The Bitcoin price fell significantly in the two most recent gaps, on September 21 and August 2 (red). However, BTC increased considerably in the June 20 gap (white).

It is worth mentioning that the correlation (blue) between SPX and Bitcoin is currently at – 0.65 (green circle).

A negative correlation means that an upward movement in the SP500 is expected to cause a downward movement in BTC and vice versa.

While this could be seen as a sign that BTC is expected to increase due to the downward gap, it is worth mentioning that the correlation was at -0.60 during the August 2 gap, when the BTC price fell sharply.

Biggest Stock Losers

The five biggest pre-market losers so far are:

- Align Technology, Inc. (ALGN): 25.10% decrease.

- MaxLinear, Inc (MXL): 19.84% decrease.

- Blue Hat Interactive Entertainment (BHAT): 18.97% decrease.

- Akili, Inc (AKLI): 18.50% decrease.

- FaZe Holding Inc. (FAZE): 15.68% decrease.

Cryptocurrency-related stocks are also suffering. This is evident in the COIN price, which trades at $73.41, more than 5% below yesterday’s close.

COIN has traded between $66 and $80 since the start of August, and the decrease put the price in the middle of this trading range.

While bitcoin remains relatively strong this week. Investors will bee keeping a close eye on the stocks vs. Bitcoin correlation this week.

For BeInCrypto‘s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.