FTX Debtors have agreed to a new Customer Shortfall Settlement following months of negotiations with FTX’s Committee of Unsecured Creditors, an ad hoc non-US customer committee, and other representatives. The court must approve the proposal that FTX Debtors (FTX) will file as part of their Amended Plan in December.

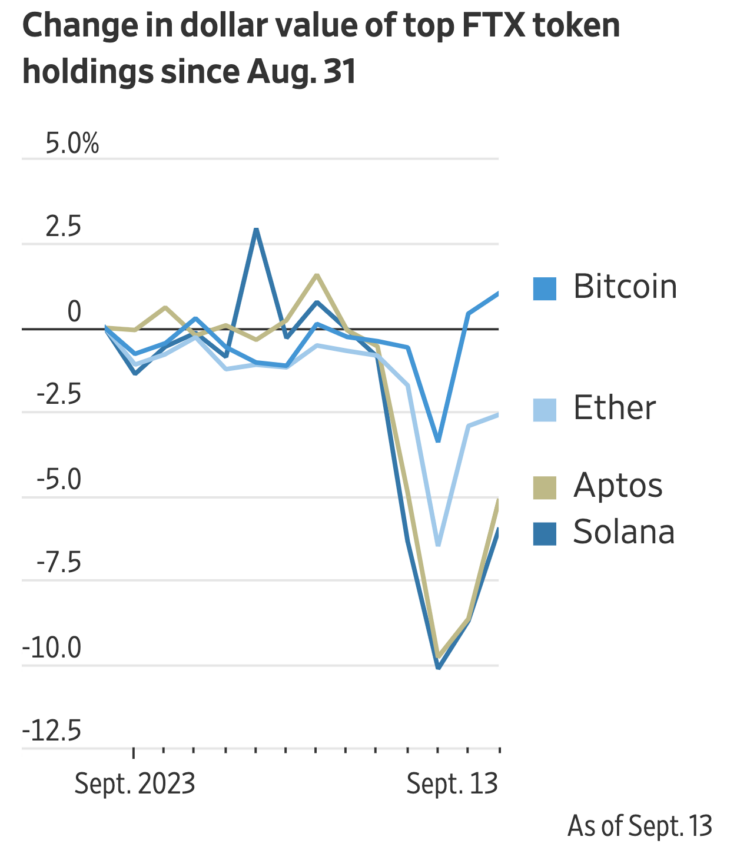

Earlier this year, FTX.com and FTX US creditors filed customer property litigation, arguing they should be prioritized over unsecured creditors. The new plan follows FTX’s announcement to liquidate over $3 billion in crypto assets to make customers whole.

FTX Debtor Chief Hails Creditor Agreement

The amendment, if approved by the court, would see FTX.com and FTX US creditors receive 90% of the Debtors’ distributable assets over a new timeline. However, the Debtors expect that customers of FTX.com would sustain a greater percentage loss, and their final reimbursements would need to account for tax and other government regulations.

Still, the plan represents a milestone in the plan to make FTX customers whole, according to FTX’s restructuring chief, John Ray III.

“The proposed settlement of the customer property issues is another major milestone in our case. [The] debtors and their creditors have created enormous value from a situation that easily could have been a near-total loss for customers.”

Read more: FTX Collapse Explained: How Sam Bankman-Fried’s Empire Fell

The bankruptcy estate has invited customer queries about the proposed Customer Shortfall Settlement. FTX Debtors will file the proposal in court on Dec. 16.

FTX filed for bankruptcy on Nov. 11, 2022, after a leaked balance sheet of its market maker, Alameda Research (Alameda), exposed the latter’s reliance on FTT’s illiquid token. Its former CEO, Sam Bankman-Fried (SBF), was later accused of allowing FTX to borrow unlimited quantities of FTX customer funds.

Bankman-Fried New About FTX Balance Sheet

Witnesses at Bankman-Fried’s trial argued that SBF changed FTX’s code to allow Alameda an unlimited line of credit.

On Monday, former FTX director of engineering Nishad Singh said Bankman-Fried had long known about the $8 billion shortfall in customer funds FTX had because of its risky lending to Alameda. This factor eventually resulted in the company’s bankruptcy.

Read more: 11 Best Crypto Exchanges for Beginners

Last week, former Alameda CEO Caroline Ellison testified how Bankman-Fried allegedly asked her to prepare balance sheets for creditors that doctored the values of assets and liabilities. And Gary Wang, FTX’s former Chief Technology Officer, later testified how Bankman-Fried asked him to change the FTX code to give Alameda special privileges.

Do you have something to say about the FTX Debtors creditor agreement, the trial of former FTX boss Sam Bankman-Fried, or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.