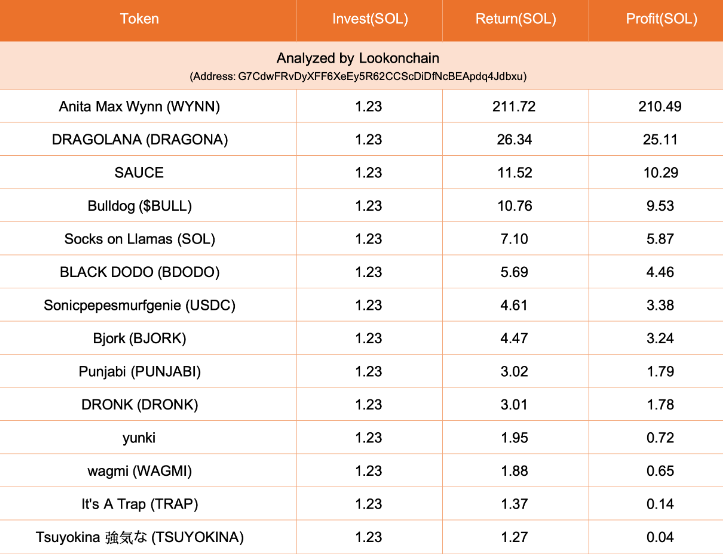

An altcoin trader earned a 171x return on an investment of 1.23 Solana (SOL) in a memecoin Anita Max Wynn (WYNN). They had a 56% win rate from betting on 25 crypto assets with equal amounts of SOL as the Solana Foundation eyes Brazil for further growth.

The investor bought and sold 1.23 SOL of each memecoin within one minute. Ultimately, eight projects were duds, and three were rug pulls.

Solana Altcoin Trader Sees Astounding Growth

Overall, the trader had a win rate of 56% and made a 210 SOL profit from WYNN. The total earnings from 14 coins was around 277 SOL, worth $28,172 at current prices.

Read more: What Is Solana (SOL)?

The trader’s lucky break comes as investments in the Solana ecosystem continue their staggering growth. The total value locked on the Solana blockchain has now exceeded $1.3 billion.

Staking protocol Marinade Finance holds the most value in the ecosystem, with over $1 billion invested. Users stake their SOL on Marinade in exchange for a so-called liquidity token and a chance to earn rewards from securing the network. The liquidity token has the equivalent value of the staked SOL.

Solana has also gained support from USDC issuer Circle Internet Financial. The latter launched its EURC stablecoin on the network in December.

Circle believes cross-chain interoperability is crucial to stablecoin adoption. It highlighted that Solana’s speed will be a drawcard for institutions.

Growth Moves Solana Beyond Altcoin Traders

Solana’s plans for growth include projects embracing industry trends like tokenizing real-world assets. The Solana Foundation has invested $10 million in a Brazilian development team. Hacken, Gate.io, Coin DCX, and Brazil Digital Token (BRX) are the investors financing Solana’s Brazil operation.

“Our intention at the Solana Foundation is to have an ever-decreasing influence on the ecosystem and empower our community to lead the future of Solana,” Dias told a local news outlet.

Led by Solana’s Latin America chief, Diego Dias, the development team will build applications involving art, tokenization, and artificial intelligence. Solana’s fast transactions and low costs could make settling transactions more capital-efficient than on Ethereum. Solana’s expansion into Brazil also intended to streamline the financial system.

The foundation previously announced it had noticed rising engagement from crypto users in Brazil, Russia, Ukraine, and India. It raised $60 million from investors in 2021.

Read more: Top 6 Projects on Solana With Massive Potential

Do you have something to say about the Solana altcoin trade, the networks’ growth, or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.