The Solana (SOL) price shows signs of short-term weakness, which could cause a breakdown and retracement toward $17.34.

In some interesting Solana news, applications for the next Solana blockchain hackathon have begun. Previous winners of the event include STEPN (GMT) and Dialect.

Additionally, since the beginning of the year, the Total Value Locked (TVL) in the decentralized finance portion of the Solana ecosystem has increased by 33%, outpacing the overall growth of the decentralized finance sector. Even though these levels are considerably lower than before the FTX crash, they have bounced significantly off the lows.

Will Solana Clear Another Resistance?

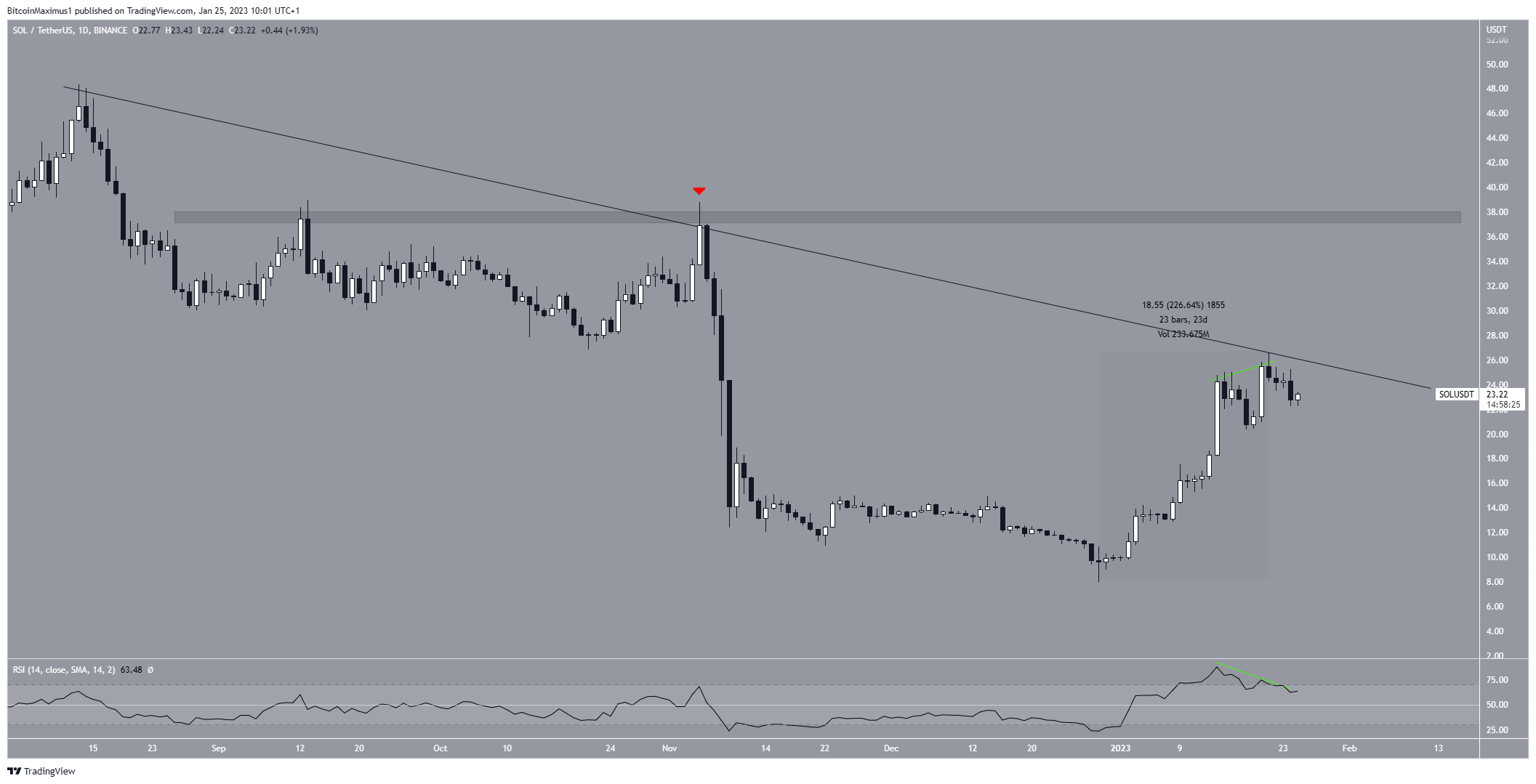

The Solana price has decreased under a descending resistance line since Aug. 13. More recently, the line caused a rejection at the beginning of Nov., leading to a minimum price of $8 on Dec. 29. The price initiated a massive upward movement afterward and has increased by 225% since.

Despite the increase, the Solana price failed to break out from the line. On the contrary, it shows weakness by generating bearish divergence (green line) in the daily RSI.

As a result, it is possible the price may get rejected from the line and retrace a portion of its previous upward movement.

Solana Short-Term Price Prediction: Weakness Could Cause Collapse

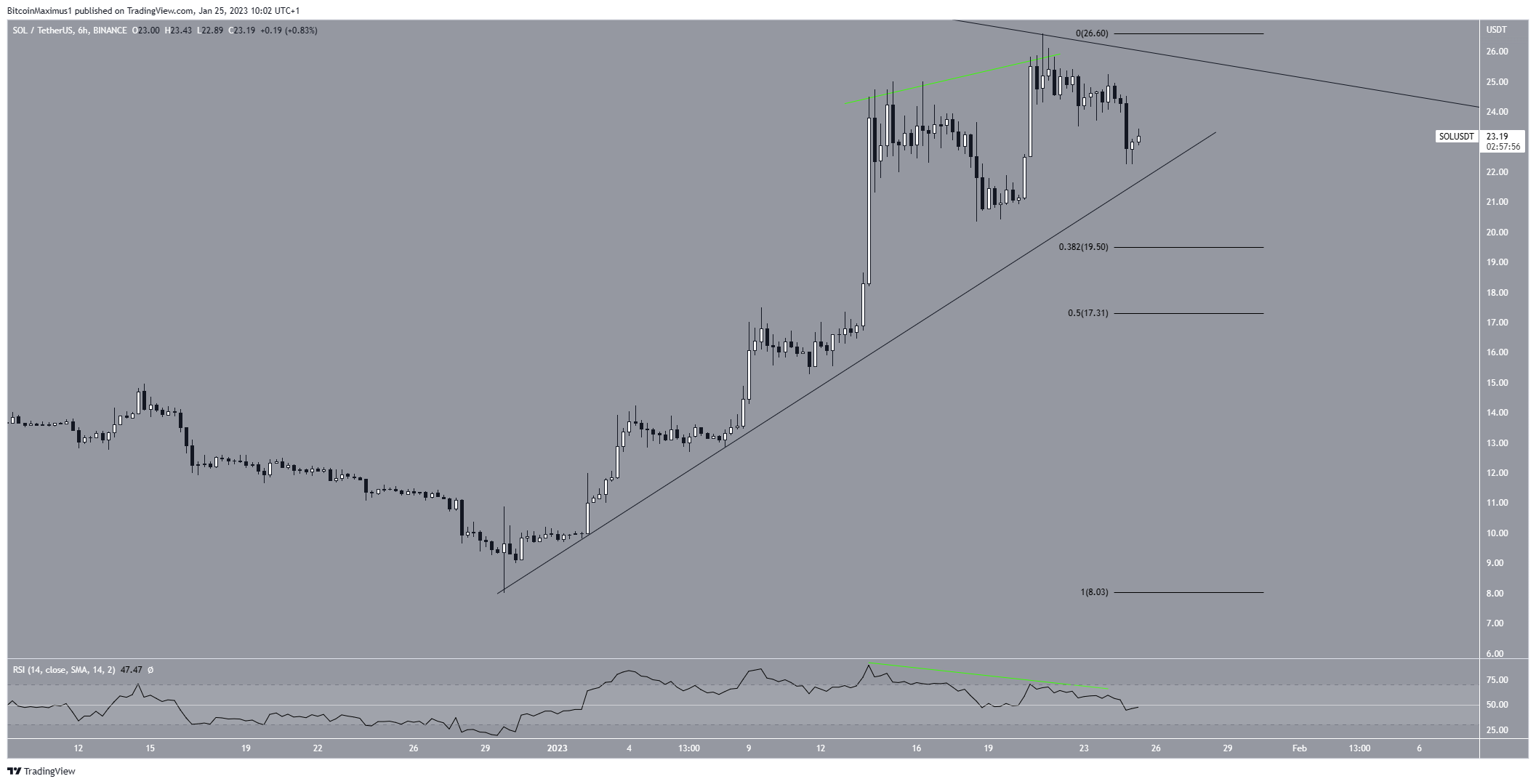

The technical analysis from the six-hour time frame shows that the Solana price has increased alongside an ascending support line since Dec. 30.

However, in the period between Jan. 14 – 22, the RSI generated bearish divergence (green line). This is a sign that often precedes bearish reversals. Furthermore, the divergence was combined with a potential double top, which is considered a bearish pattern.

If the Solana price breaks down from the support line, it could decrease to the 0.382 or 0.5 Fib retracement support level at $19.50 and $17.31, respectively. As a result, the Solana short-term price prediction is bearish.

To conclude, the most likely Solana price analysis is a correction that causes a breakdown from the current short-term pattern. On the other hand, if the SOL price manages to break out from the long-term resistance, it could increase to $37.50.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.