Layer-1 (L1) blockchain Solana (SOL) has recently shared insights from a report titled “Overview of Real World Assets on Solana” by Reflexivity Research.

This report highlights the blockchain’s strong infrastructure, solid developer community, and cutting-edge technology, which make it an ideal platform for real-world asset (RWA) tokenization.

Why Solana Stands Out in the Real-World Asset Tokenization Sector

Solana has become a significant platform for deploying RWAs due to its high throughput and active trading ecosystem. Its ecosystem supports tokenization through decentralized exchanges (DEXs), oracle services, on/off ramps, and bridges.

Solana’s advantages in hosting RWAs include scalability, low gas fees, and high transaction speed. These are essentials for the frequent trading of tokenized assets. The development of specialized infrastructure, including RWA-specific tools, further supports the growth of tokenization on Solana.

Read more: RWA Tokenization: A Look at Security and Trust

It also uses standardized tokens, such as the Solana Program Library (SPL) token and Metaplex standards for non-fungible tokens (NFTs), to ensure secure, efficient transactions and enhanced liquidity. Solana’s SPL token standard handles everything related to tokens on its network.

“This ensures that users can trust that transferring any specific SPL token doesn’t involve malicious code capable of stealing their funds,” the Solana team wrote.

In January, Solana introduced an iteration called “token extension,” which allows collaboration with large, regulated institutions. These extensions address the needs of real-world asset tokenization, offering features such as confidential transfers and interest accumulation.

Austin Federa, Head of Strategy at Solana, explained that Solana’s token extensions include more than a dozen features designed to meet the needs of developers, enterprises, and financial institutions.

“Token issuers, from game developers to stablecoin issuers, can choose to enable any combination of token extensions, which reduce the amount of work your engineering team has to do and provide capabilities that weren’t previously possible,” Federa explained.

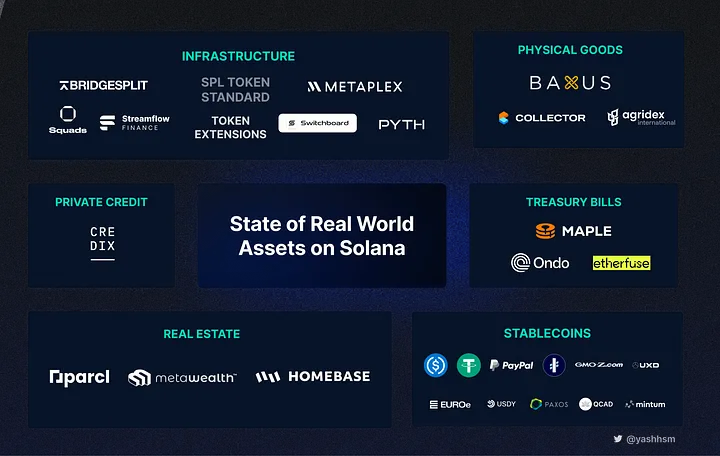

Key Projects Driving RWAs Tokenization on Solana

Solana’s real-world asset tokenization ecosystem spans yield-bearing assets such as US Treasuries and non-yield assets like real estate, private credit, and physical goods. Key projects in tokenized US Treasuries include Ondo Finance (USDY) and Maple Finance (cash management). Additionally, Etherfuse on Solana offers ‘stablebonds,’ a tokenized bond offering aimed at retail investors in Mexico.

Parcl on Solana enables investing in specific geographic real estate markets without requiring direct property ownership for non-yield-bearing assets. HomebaseDAO tokenizes real estate assets and allows fractional ownership using NFTs on Solana.

Meanwhile, private credit platforms like Credix Finance allow investors to allocate stablecoins (e.g., USDC) into the liquidity pool or invest in specific tranches of deals. Credix facilitates USDC borrowing for borrowers, typically fintech companies in emerging markets.

Additionally, Solana’s ecosystem includes tokenized physical goods. BAXUS enables buying and selling tokenized spirits, Collector Crypt tokenizes physical cards, and AgriDex tokenizes agricultural commodities.

The Pyth Network oracle also provides real-time data feeds for trading and financial applications, leveraging Solana’s rapid block times and low transaction costs. This diversity illustrates real-world asset tokenization’s extensive applications and potential on Solana.

Despite its potential, the real-world asset tokenization sector faces challenges, including regulatory compliance, enforceability issues, and reliance on oracles. New standards and third-party audits are needed to build trust and prevent fraud. Borys Pikalov, Co-Founder and Managing Partner at tokenization firm Stobox, emphasized the importance of regulatory compliance for blockchain providers.

Read more: What is The Impact of Real World Asset (RWA) Tokenization?

“Developers of chains with a heavy RWA focus should comply with technical standards for the securities infrastructure to be selected by regulated entities for their RWA operations. Given that most RWA transactions will likely be regulated, the lack of such compliance would leave RWA-focused chains with a relatively small market,” he told BeInCrypto.