The Solana (SOL) price is approaching a critical support pattern. The reaction to it could determine the future trend.

SOL Price Falls After Rejection

According to the technical analysis based on the daily timeframe, the SOL token price currently trades within a range of $20.50 to $26.00. On April 16, the price reached a yearly high of $26.00 but has since decreased, validating the $26 area as resistance.

On April 19, the SOL price fell sharply, creating a bearish engulfing candlestick (red icon).

The bearish engulfing candlestick is a bearish signal that is created when the entire previous periods increase is negated in the next period. It is characterized by a close below the previous periods opening and means that sellers have taken over.

The Solana price now approaches an ascending support line at an average price of $22. The line has measured the slope of the increase since the beginning of the year. Therefore, the bullish structure can be considered intact as long as the Solana price does not close below it.

The daily Relative Strength Index indicator (RSI) does not help determine if the price will bounce or break down. The RSI is a momentum indicator used to identify oversold or overbought conditions. A reading above 50 and an upward trend imply that the bulls still have momentum. Currently, the RSI is right at 50, approaching the line from above. This means that the trend is losing strength.

Solana Price Prediction: Bounce or Breakdown?

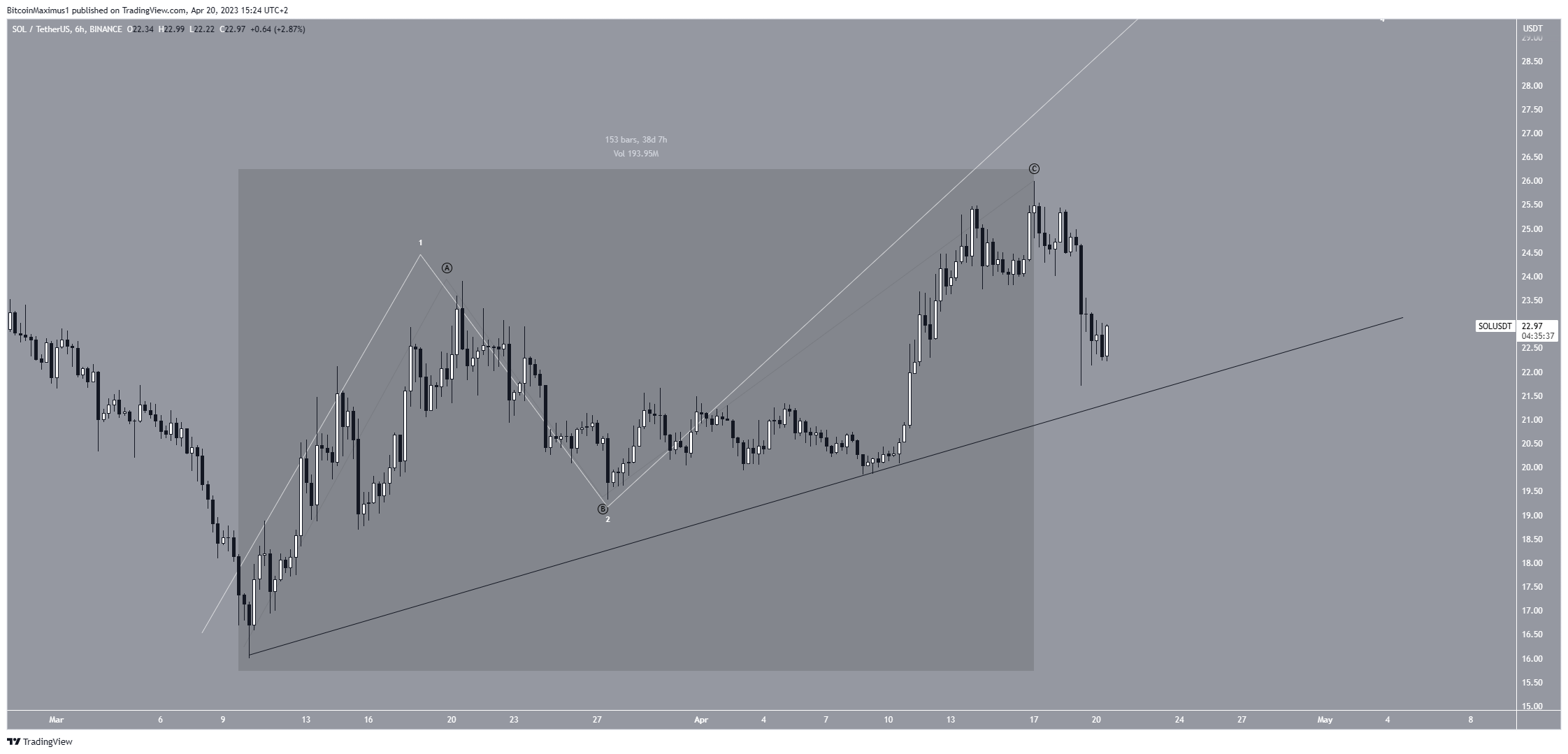

The short-term six-hour time frame does not help in determining the trend’s direction. The main reason for this is the uncertainty in the wave count. Technical analysts employ the Elliott Wave theory as a means to identify recurring long-term price patterns and investor psychology, which helps them determine the direction of a trend.

The wave count in the increase since March 10 is unclear. The bearish count shows a completed A-B-C corrective structure (black). If this is the correct count, the SOL price will break down from the ascending support line, since it would mean that the dominant trend is bearish.

The bullish count shows a five-wave upward movement in which SOL is currently in the third wave. The third wave is the sharpest of the bullish waves. Therefore, if the price would break down from the ascending support line, the slope of the third wave would be less steep than that of the first one, hence invalidating the count. If not, the SOL price will continue to grow and likely break out from the $26 resistance area.

Therefore, whether the SOL price bounces or breaks down from its ascending support line will likely determine the future trend’s direction. While a bounce could lead to a retest of the $26 resistance area, a breakdown could cause a sharp fall to at least $20.50.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.