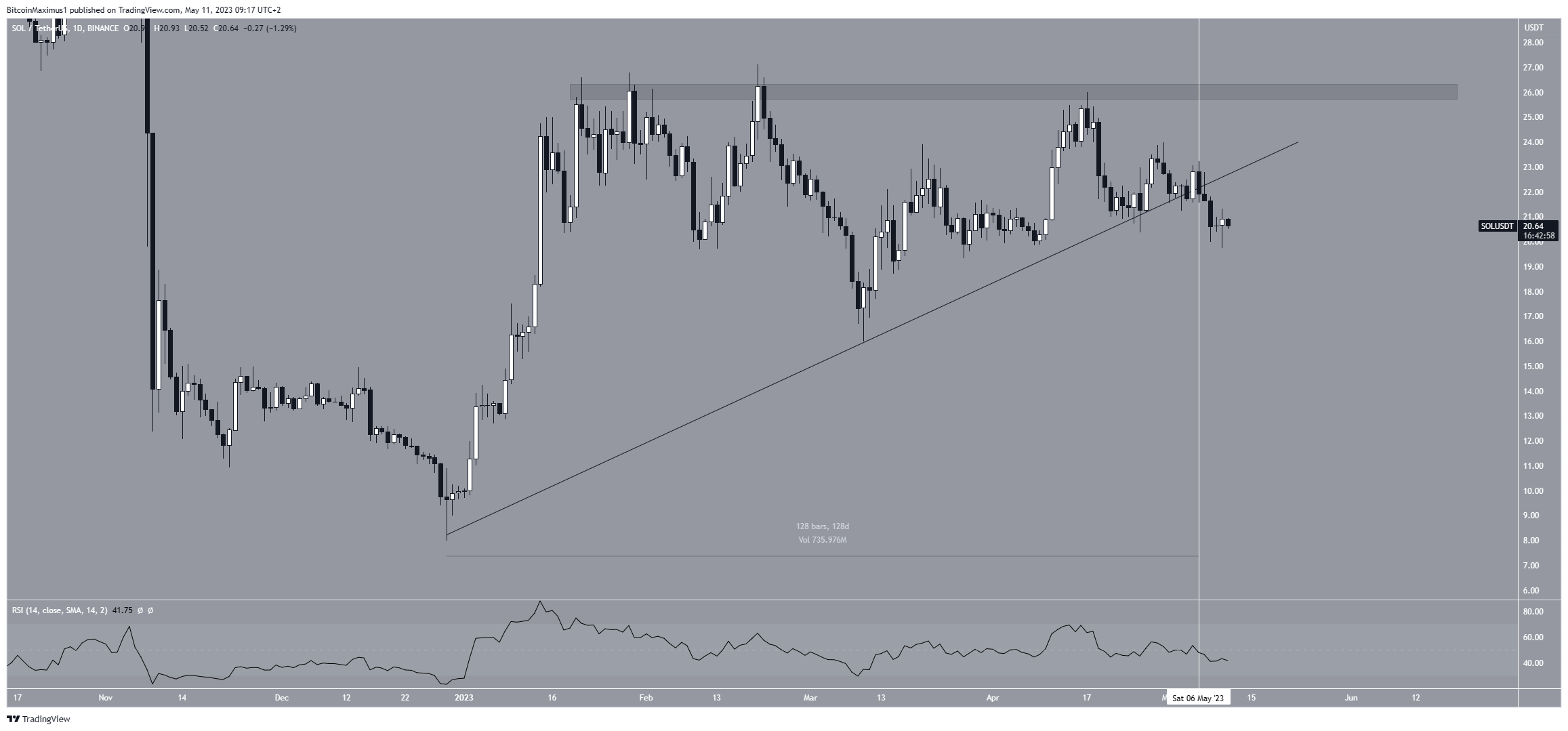

The Solana (SOL) price has finally moved below an ascending support line that had previously been in place for 128 days.

The breakdown from the line indicates that the entire upward movement that began in January has ended. If so, the SOL price will correct in the near future.

Solana Price Finally Breaks Down from Long-Term Structure

Since the beginning of 2023, the SOL price has been on the rise, following an ascending support line. It hit a yearly high of $27.12 on Feb. 20. However, the price created a lower high on April 20 and has been falling since.

On May 6, after following the line for 128 days, the SOL price finally broke down from the ascending support line. A significant movement in the other direction usually transpires when such a long-term support level is lost.

The Relative Strength Index (RSI) is currently showing a bearish reading. Traders use the RSI as a momentum indicator to determine whether a market is oversold or overbought and to decide whether to buy or sell an asset.

If the RSI reading is above 50 and the trend is upward, then the bulls still have the upper hand, but if the reading is below 50, the opposite is true.

During the same day in which the price broke down (white line), the RSI also moved below 50, validating the legitimacy of the bearish SOL price movement.

SOL Price Prediction: How Long Will Correction Continue?

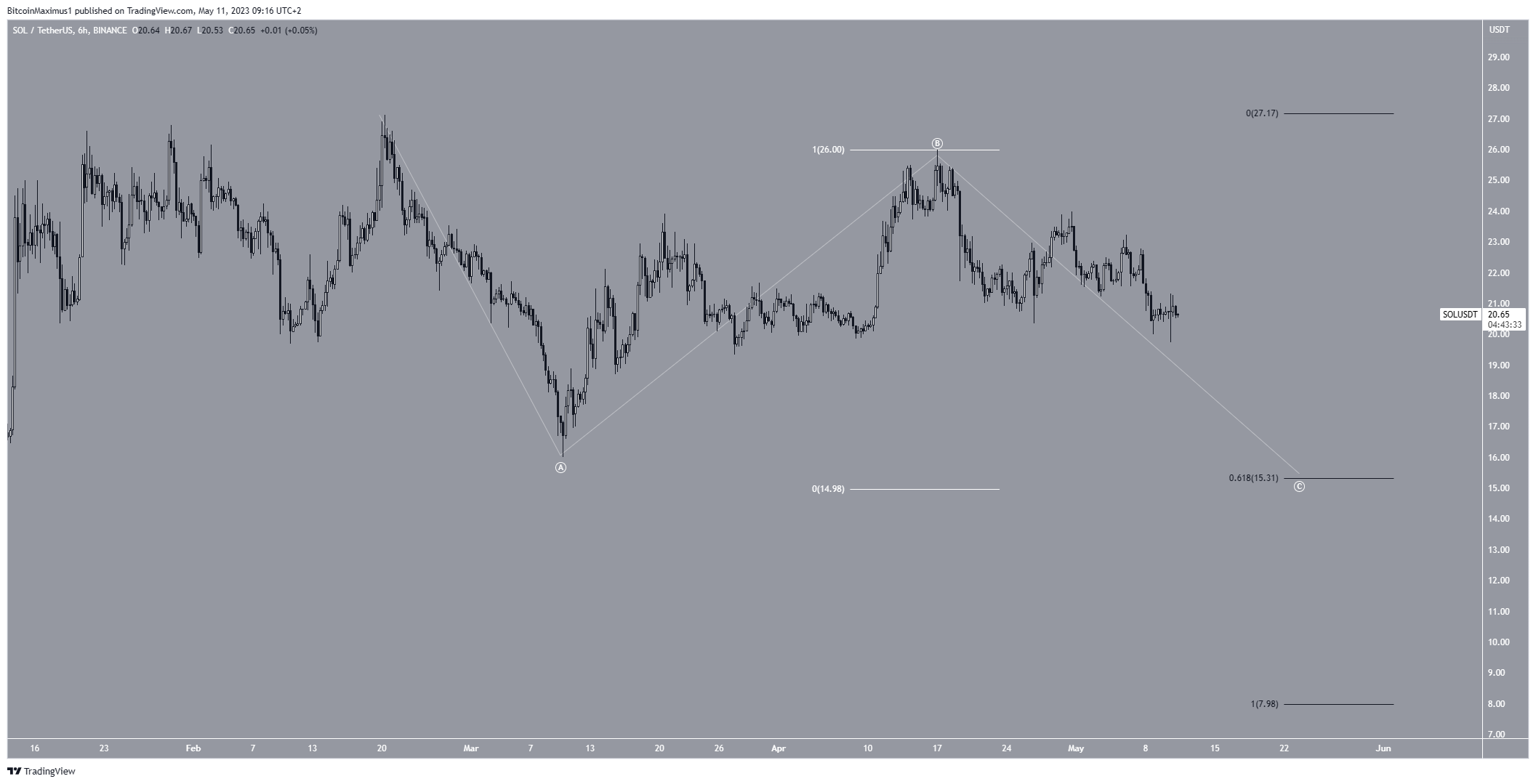

Based on technical analysis and price action on the six-hour time frame, the downward trend in Solana is likely to persist, resulting in a bearish SOL price prediction.

This is mainly due to the wave count, which is studied using the Elliott Wave theory to determine the direction of long-term price patterns and investor psychology.

The movement since March is likely to be a short-term A-B-C corrective structure (white). If so, the SOL price is currently in the C wave of the correction.

There is a confluence of support levels near $15, created by the 0.618 Fib retracement support level (black) and the 1:1 ratio of waves A:C (white).

Fibonacci retracement levels suggest that after a significant price change in one direction, the price will revisit a previous price level before resuming its original direction, making this area likely to act as a bottom for the SOL token price.

Therefore, it is possible that the area will act as the bottom.

In conclusion, the closest support area is at $15, while the next resistance is at $26. A decrease toward the former is the most likely SOL price prediction.

However, if the SOL price surpasses $26, it will indicate a bullish trend, and the price may continue to climb toward at least $32.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.