Sequoia Capital has slashed its crypto venture fund from $585 million to $200 million as investment focus shifts to seed-stage ventures.

The company also announced a reduction in its ecosystem fund from $900 million to $450 million.

Sequoia Capital Focuses on Liquidity Amid Corporate Restructuring

The cutbacks mean the company will be able to provide liquidity to entities that contribute funds to Sequoia’s investments. In the past three years alone, the VC firm has returned $15 billion to investors.

Additionally, the company’s shift comes amid a broader decline in private markets and the move toward artificial intelligence. These market changes and rising geopolitical tensions have also led to the exit of several executives and a new Chinese spin-off.

Find out which artificial intelligence stocks are hot right now.

Sequoia announced the departure of long-time partner Michael Moritz last week, as well as a junior who invested in FTX. Growing US-China tensions prompted the company to create two separate business units to cover China and Southeast Asia in June.

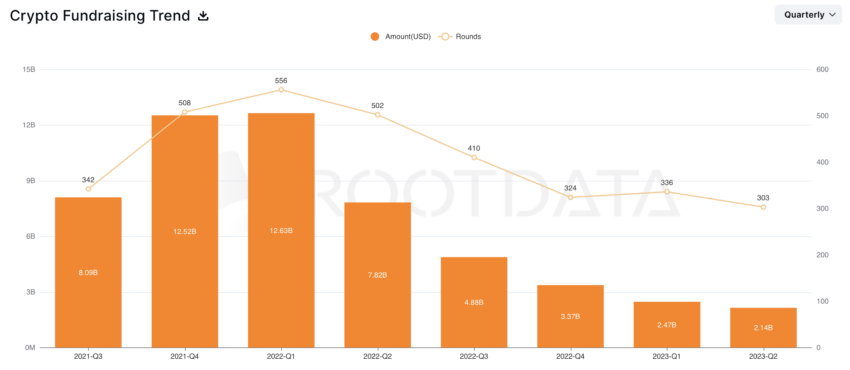

Sequoia launched its ecosystem and crypto investment funds last year amid a boom in private markets. Several crypto firms riding the high from the 2021 bull market cashed in as the clock ticked over into Q1 2022.

VC Investments Drop as Caution Prevails After FTX

However, by Q1 2023, crypto investments had fallen 80%, as a series of crypto collapses prompted more careful scrutiny of the financials of early-stage startups.

Earlier this year, Sequoia Capital was among VC firms criticized for bankrolling crypto firms without conducting proper due diligence. In November last year, the venture fund lost over $200 million when Bahamian exchange FTX failed.

John Ray, the trustee appointed to oversee the failed exchange’s Chapter 11 case, called FTX’s corporate governance a “complete failure.”

FTX’s former CEO, Sam Bankman-Fried, faces multiple fraud charges and will be tried in October 2023 and March 2024. Several former executives at the firm have pled guilty to varying degrees of cooperation with Bankman-Fried.

Got something to say about Sequoia Capital crypto investments or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.