The Sandbox (SAND) price dipped to a new all-time low of $0.29 on September 13 as bearish headwinds surrounding the metaverse heightened. On-chain data trends reveal how the SAND price could move as Binance looks to discontinue Sandbox NFT Staking.

Sandbox (SAND) price entered another downswing on September 8, after cryptocurrency exchange Binance announced that it would discontinue support for the Sandbox NFT Staking program. Will bearish whale investors drive the SAND price closer to zero?

Sandbox Whales Have Sold Tokens Worth $2M in 5 days

The Binance delisting announcement last Friday appears to have sparked bearish sentiment among Sandbox whale investors. On-chain data reveals that once the news broke, the whales appeared to have halted their week-long buying trend and started selling.

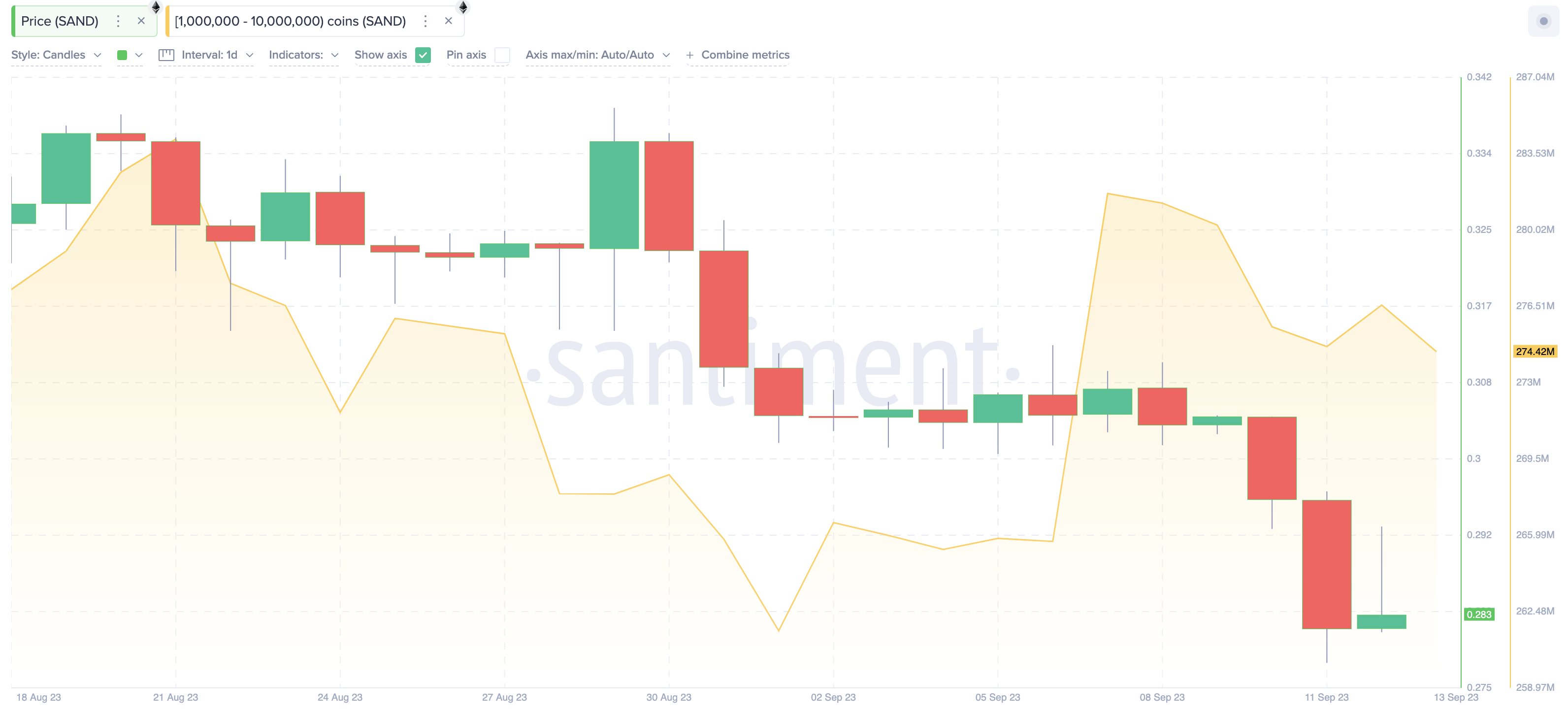

According to data from Santiment, the crypto whales with balances of 1 million to 10 million SAND held a total of 281.7 million SAND as of September 7. But the chart below illustrates that as of Sept 13, that figure has dropped to just 277.4 million SAND.

This means that since the Binance announcement hit the newsreels on Sept 8, the Sandbox whale investors have already sold off 7.3 million SAND tokens.

When valued at the current price of $0.29, the 7.2 million SAND tokens recently sold by the Sandbox whales are worth approximately $2.2 million. Historically, due to their substantial holdings, the whales’ trading activity has often moved the SAND markets significantly.

Hence, if their ongoing selling trend persists, SAND holders could experience more price downside in the coming weeks.

Read More: Top 11 Crypto Communities To Join in 2023

Despite Low Prices, No New Demand in Sight For SAND

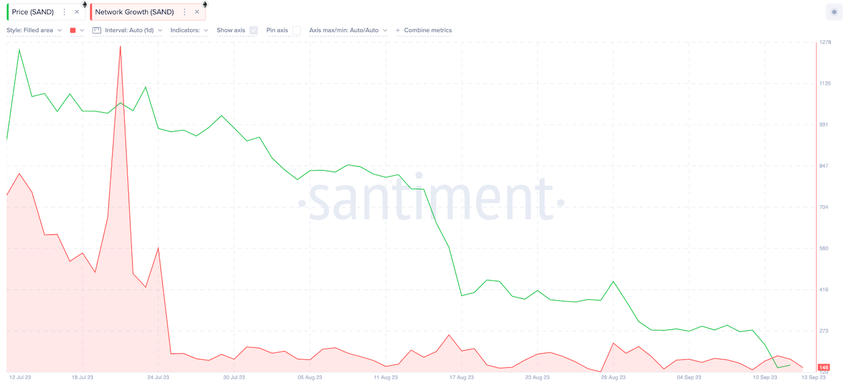

At $0.29, Sandbox prices are currently at an all-time low. But despite the heavily discounted prices, SAND has failed to attract a significant increase in new demand.

In fact, the daily Network Growth chart below illustrates that Sandbox has not registered up to 200 new wallet addresses this month. At the close of September 13, only 146 new wallet addresses were created on the Sandbox network, a 37% decline from the 231 addresses recorded on August 29 when the price briefly retested $0.35.

A decrease in Network growth typically implies that the underlying token is struggling to attract new demand. Notably, the SAND NFT Staking program allows many SAND holders to generate utility and passive income from their holdings. With Binance NFT Marketplace set to slam that window shut on September 26, the SAND Network could become even less attractive now to new investors.

In summary, the whales continue piling sell pressure amid dwindling network growth, and Sandbox price could move closer to zero in the coming weeks.

SAND Price Prediction: $0.10 is the Next Support Line

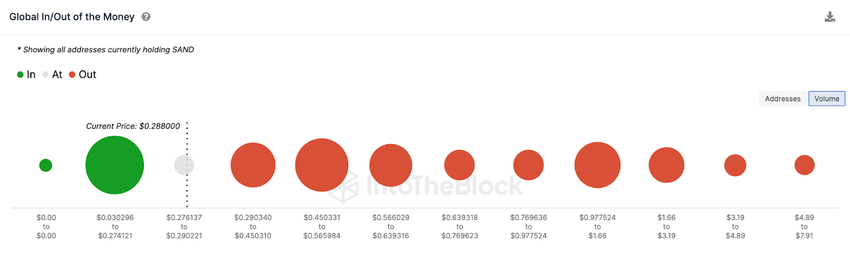

With most SAND token holders under water amid weak market demand, Sandbox price will edge closer to zero in the coming weeks. From an on-chain perspective, losing the $0.27 could send SAND into a prolonged downswing toward $0.10.

The In/Out of the Money Around Price (IOMAP) data, which shows the entry price distribution of current Sandbox token holders, also confirms this thesis. It depicts that after the $0.27 level, the SAND price has no significant support until it hits $0.10.

As seen below, the 513 addresses bought 17.2 million SAND tokens at a minimum price of $0.27. If the HODL, they could trigger a rebound, which is unlikely amid the current weak network demand.

So, if the support wall caves as predicted, the SAND price will likely drop toward $0.10.

Still, Sandbox bulls could stage an unlikely comeback if the SAND price rebounds above the $0.50 level. However, 17,380 addresses had bought 602.7 million tokens at the minimum price of $0.45. If the Binance delisting and weakening market demand push them to close their positions early, Sandbox price could retrace.

But if that resistance level does not hold, the SAND price could break above $0.50 again.