Ripple (XRP) price recovery rally largely depends on the broader crypto market and the investors’ behavior.

However, neither party favors a price rise, which could cause considerable damage to XRP holders.

Ripple Investors Take a Step Back

XRP price attempts to move upward, but by the looks of it, this effort will be thwarted. This is because Ripple is noting bearishness at the hands of its investors, particularly traders.

Bearish bets against XRP have increased in the futures market, which is evident from the funding rate.

The funding rate in cryptocurrency futures trading is the fee paid or received by traders holding leveraged positions overnight. Market conditions determine it and serve to balance the market between long and short positions. Generally, positive funding rates suggest the dominance of long contracts, whereas negative rates hint at short contracts’ taking the preference.

XRP is witnessing negative funding rates, which suggests traders are betting on a price decline.

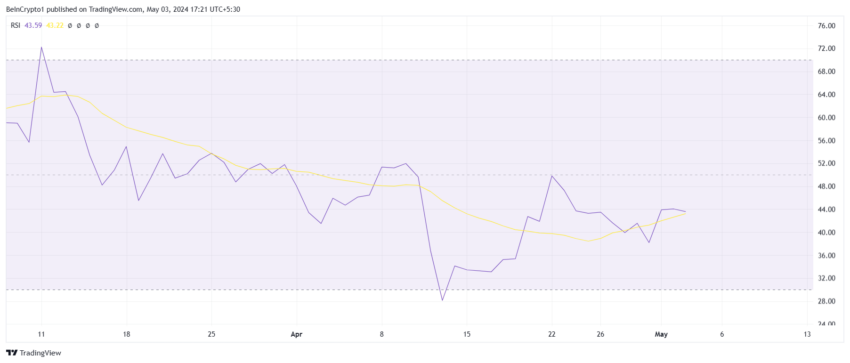

At the same time, the broader market is also exhibiting bearishness, as can be seen in the Relative Strength Index (RSI). The RSI is a momentum oscillator that measures the speed and change of price movement. It is used to identify overbought or oversold conditions in an asset.

Given that XRP is struggling to secure the neutral line at 50 as support, a bearish outcome seems rather likely.

Read More: Everything You Need To Know About Ripple vs SEC

XRP Price Prediction: Another Dip

XRP price trading at $0.51 notes a potential breakout of the symmetrical triangle pattern in effect since early April.

A symmetrical triangle pattern is a technical analysis formation characterized by converging trendlines. It indicates a period of consolidation before a potential breakout. It typically signifies indecision in the market and can lead to a bullish or bearish move.

Considering the aforementioned conditions, the chances are that the XRP price could face a bearish move, which could bring it down to $0.47. Falling through this support will extend the losses by a mile toward $0.42.

Read More: Ripple (XRP) Price Prediction 2024/2025/2030

On the other hand, flipping $0.51 into a support floor can represent a significant milestone. Indeed, it will enable the altcoin to invalidate the bearish thesis and allow the XRP price to eventually secure a 27% rally to hit the target of $0.65, as derived from the triangle pattern.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.