Ripple (XRP) is holding above a critical psychological support level that has been barely invalidated in the last 11 months. At present, it seems like the whales are pushing to prevent this from happening.

This could be the key to reinitiating a recovery and breaking free from the bearishness XRP has been facing.

Ripple Whales to the Rescue?

Over the past week, the price of XRP has declined from $0.54 to $0.50. This drop has caused the altcoin to lose its support level at $0.51, which aligns with the 23.6% Fibonacci Retracement level that extends from a high of $0.82 to a low of $0.42. As a result, XRP is now on the brink of falling below the $0.50 mark.

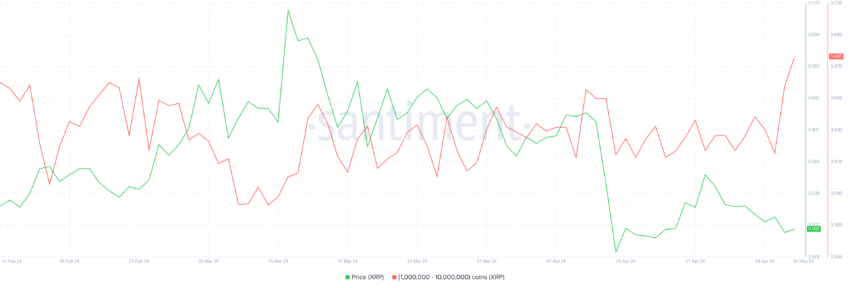

However, the whales seem to have recognized this issue and are likely jumping to prevent this. In the last two days, addresses holding between 1 million and 10 million XRP have added over 70 million XRP to their wallets. This supply worth more than $35 million is the largest bout of buying noted in the last three months.

Read More: Everything You Need To Know About Ripple vs SEC

Another reason for this accumulation lies in the whales’ intention to make profits. The chances of the XRP price falling below $0.50 are bleak, and the altcoin will likely bounce back. The whales could be making the most of this by buying low and potentially booking profits later.

But this attempt could have a market-wide impact, potentially pushing retail XRP holders to load up as well. Presently, the Ripple native token is among the few altcoins that have less than 75% of its supply in profit. This is only the second time in nearly a year that the profitable supply has declined to this extent.

Generally, a market top is formed when more than 95% of the circulating supply is noting gains. This means that XRP still has room for growth, which could serve as a solid incentive for investors to add the token to their wallets.

XRP Price Prediction: Reclaiming Key Support Is Likely

XRP price is trading at $0.50, just under the resistance of $0.51, coinciding with the 23.6% Fib line. Reclaiming this support is likely given the whales’ bullishness, and it would also support further recovery.

The altcoin has been facing a death cross since mid-April, and to invalidate this, a rise to $0.57 is essential. This price is in confluence with the 38.2% Fib, and reclaiming it would confirm a recovery rally.

Read More: Ripple (XRP) Price Prediction 2024/2025/2030

However, if the support of $0.47 is lost, the XRP price could tumble to test $0.42 as support, which would potentially invalidate the bullish thesis, leaving the altcoin vulnerable to further corrections.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.