Ripple (XRP) price has observed consistent declines for the past couple of weeks in terms of price as well as investors’ interest.

With April underway, this bearishness was expected to subside; however, that does not seem to be the case.

Institutions Divest Ripple

XRP price has had a slow recovery, and in part, this is due to the lack of interest from institutional investors. These large wallet holders tend to sway the price of an asset; however, such is not the case with the Ripple token.

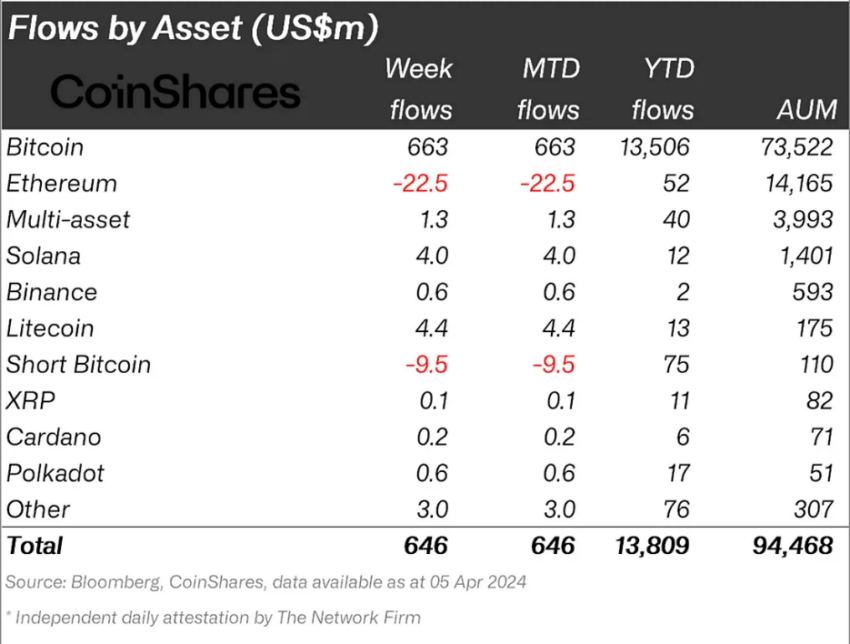

According to the CoinShares digital asset fund flows report, XRP noted only $0.1 million worth of inflows from institutions for the week ending April 5. In comparison, the likes of Litecoin, Polkadot, and even Binance’s BNB coin registered $4.4 million, $0.6 million, and $0.6 million, respectively.

This shows that the payment processor token is losing the support it once had among institutional investors.

In addition to this, retail investors seem to be pulling away from digital assets. This is visible in the downtick observed in the network growth.

This metric estimates whether the project is losing or gaining traction in the market. This is done by measuring the rate at which new addresses form on the network.

At the moment, Ripple’s network growth is at a multi-month low, flashing a bearish signal for the price action.

XRP Price Prediction: A Crucial Level to Hold

XRP price, at the time of writing, is trading above the 38.2% Fibonacci Retracement of $0.81 to $0.47. Marked at $0.60, this Fib level is crucial as losing it would result in a drawdown to the 23.6% Fibonacci level at $0.55.

This is the likely outcome for the Ripple native token as not only the aforementioned conditions, but also the Ichimoku Cloud is exhibiting bearish signals. The Ichimoku Cloud is a technical analysis tool that displays support/resistance levels, trend direction, and momentum.

Therefore, with the candlesticks hovering below the cloud, this can be considered a bearish indication for XRP.

Read More: Ripple (XRP) Price Prediction 2024/2025/2030

However, if the 38.2% Fib level is flipped into support, the XRP price would have a shot at breaching the 50% Fibonacci Retracement at $0.64. Flipping it into support would invalidate the bearish thesis, sending the altcoin beyond $0.65.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.