Last week’s Bitcoin price crash sent shockwaves through the crypto market, leaving investors and traders scrambling to make sense of the sudden drop. Among the various factors that contributed to this crash, the awakening of dormant whales played a significant role.

So what was the impact of these long-dormant whales, and what other factors are behind the recent Bitcoin price crash?

Crypto Market Overview

The crypto market is notoriously volatile, with prices often experiencing wild fluctuations within short time frames.

The decentralized nature of cryptocurrencies like Bitcoin makes them particularly sensitive to external factors such as regulatory announcements, market sentiment, and global economic events. As a result, it’s not uncommon for sudden price drops to occur.

Despite its growth in recent years, the cryptocurrency market is still relatively young and less mature compared to traditional financial markets. This lack of maturity can contribute to increased volatility.

Consequently, new investors and traders are more susceptible to market manipulations and emotional decision-making.

Factors Behind the Bitcoin Price Crash

The Role of Margin Trading

Margin trading has been a significant factor in intensifying the impact of price movements in the crypto market. It enables traders to borrow funds for trading larger positions.

When the market shifts against their positions, these traders might be compelled to sell their assets to cover their losses, further magnifying price fluctuations. The recent Bitcoin crash was likely influenced, in part, by a series of margin calls and liquidations.

Indeed, an astonishing $160 million worth of leveraged long positions were wiped out in under an hour, primarily affecting Ethereum traders.

Data from Coinglass reveals that liquidations in that hour amounted to $164 million. With 98% originating from leveraged long positions, a mere $4 million came from short sellers, leaving bullish traders to endure the majority of the losses.

Most liquidations were linked to ETH positions within that hour, representing around $36 million. Bitcoin followed closely with roughly $27.6 million, trailed by DOGE and XRP.

This large-scale liquidation wave highlights how margin trading can amplify the consequences of market shifts and contribute to substantial price declines, such as the recent Bitcoin crash.

Regulatory Concerns

The possibility of increased regulatory scrutiny has also played a role in the recent Bitcoin price crash. Regulatory actions, such as tightening restrictions on crypto exchanges or banning certain activities, can create uncertainty and lead to panic selling among investors.

Last week’s crash coincided with rumors of potential regulatory changes in key markets, which likely contributed to the downturn.

For instance, the Biden administration’s communications chief has been instructed to maintain distance from crypto and technology companies he has previously worked with.

President Joe Biden’s Communications Director, Ben LaBolt, is not allowed to interact with his former crypto clients. In the past, LaBolt provided communications services for Uniswap and Andreessen Horowitz, a venture capital firm focused on digital technology.

Additionally, Coinbase CEO Brian Armstrong has called on Congress to intervene in the Securities and Exchange Commission’s (SEC) approach to crypto regulation.

In an April 21 tweet, Armstrong emphasized the importance of regulators establishing clear policies before enforcing them. Instead of starting with enforcement without well-defined rules in place. He argued lawmakers might need to rein in the SEC to prevent the nation’s crypto sector from falling behind.

Armstrong’s tweet underlines the need for a more balanced regulatory approach to ensure the continued growth and development of the cryptocurrency market.

The uncertainty around potential regulatory changes can contribute to market fluctuations and crashes, such as the recent Bitcoin price drop.

Market Manipulation

Market manipulation is another factor that may have contributed to the recent Bitcoin price crash. Manipulative practices, such as “pump and dump” schemes and coordinated sell-offs, can lead to sudden price movements in the crypto market.

While it’s difficult to definitively link any specific instance of market manipulation to the recent crash, it remains a possibility that should be considered.

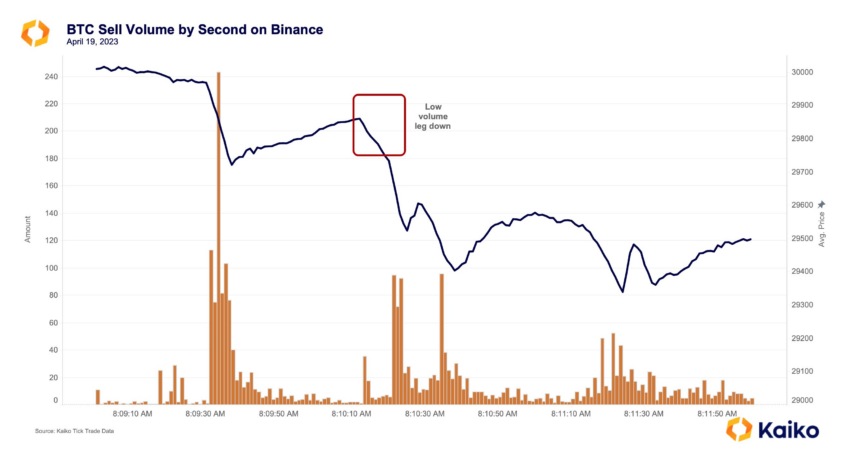

The recent Bitcoin sell-off has raised questions about possible market manipulation, specifically in relation to spot selling on Binance. A detailed analysis of the available data reveals insights into the events that unfolded during the sell-off and helps address these concerns.

The sell-off started at 8:09:31 a.m. UTC, with 113 BTC sell volume recorded on Binance. Comparing this with Bitfinex and Coinbase, a significant surge in spot sell orders larger than 0.5 BTC was noticeable on Binance. The subsequent price drop happened on low volume.

Roughly 86.2 BTC worth of sell orders in just eight seconds led to the price falling from $29,860 to $29,730.

Interestingly, Binance’s BTC-USDT 1% bid depth saw a considerable decline during the sell-off. In just one minute, as the sell-off began, it dropped by a third, and within two minutes, it fell from 600 to 240 BTC.

Analyzing data from other exchanges suggests that the dip originated on Binance, where someone sold a sizable spot position.

These findings highlight the potential influence that individual traders or groups can have on the crypto market. Especially when large orders are placed in low-liquidity conditions.

It is essential for investors to be aware of this potential for market manipulation and take it into account when making investment decisions.

The Impact of Dormant Whales

An essential factor that played a role in the recent Bitcoin price crash is the awakening of dormant whales. These are large Bitcoin holders who have not been active in the market for an extended period.

Three whales holding a combined total of 8,199 BTC ($225 million) have become active after remaining dormant for years.

Even more notably, a giant whale holding 79,957 BTC ($2.19 billion) has awakened after 12 years of dormancy. The price of Bitcoin when this whale received it was only $0.93.

The re-emergence of these dormant whales has contributed to the sudden drop in Bitcoin’s price. Large sell orders can significantly impact the market.

Impacts of the Bitcoin Price Crash

Long-term Effects on Bitcoin

While last week’s Bitcoin price crash was undoubtedly concerning for investors, it’s essential to consider the broader context.

Historically, Bitcoin has experienced numerous significant price drops, only to recover and reach new heights over time. As such, it’s crucial not to overreact to short-term market fluctuations and maintain a long-term perspective on your investments.

Implications for Other Cryptos

The recent Bitcoin price crash also had a ripple effect on other cryptocurrencies, as the market tends to move in tandem.

This highlights the importance of diversification and risk management in your crypto portfolio, as investing solely in a single cryptocurrency can leave you more exposed to market volatility.

How Investors Can Protect from Bitcoin Price Drop

Diversification

One of the best ways investors can protect their crypto investments is through diversification.

By spreading investments across multiple cryptocurrencies and other assets, investors can reduce the impact of any single asset’s price fluctuations on their overall portfolio.

Risk Management Strategies

In addition to diversification, employing risk management strategies can help safeguard crypto investments. This may include setting stop-loss orders, using dollar-cost averaging, and only investing what one can afford to lose.

By managing risk effectively, investors can better weather market fluctuations and protect their investments from significant losses.

Staying Informed

Lastly, staying informed about the latest news and developments in the cryptocurrency space is crucial for protecting investments.

By keeping up-to-date on regulatory changes, market trends, and potential risks, investors can make more informed decisions and respond proactively to market events.

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.