Castle Island partner Nic Carter refutes claims by professors John Griffin and Amin Shams that market manipulation by whale collusion drove Bitcoin’s recent rally.

According to Griffin and Shams, the current Bitcoin rally resembles the 2017 bull run, which they concluded was driven by a single whale who manipulated the asset’s price.

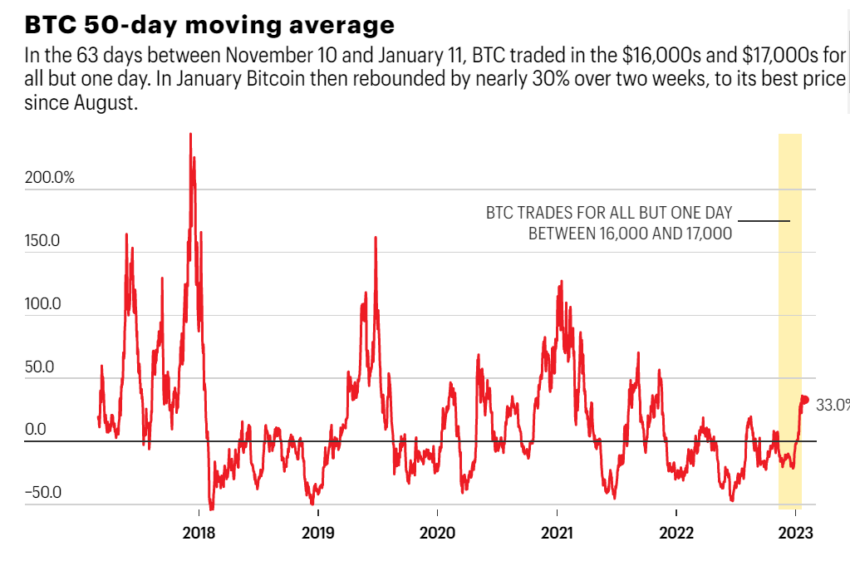

Bitcoin’s Narrow Trading Range Raises Manipulation Concerns

In their 2018 paper, published in the peer-reviewed Journal of Finance, the pair identified that Tether printing and conspiracy to prop up Bitcoin’s price if it fell below a certain level were common to each Bitcoin price rally.

The authors found that Bitcoin’s price surged after one-hour trading intervals accompanied by large Tether mints and Bitcoin purchases. Almost 60% of Bitcoin’s gains between March 2017 and March 2018 followed a similar pattern. In nearly every case, an unidentified whale used the minted Tether to buy large amounts of Bitcoin on Bittrex and Poloniex, causing price reversals in under 60 minutes.

While nothing has been proven, the authors suspect that similar collusion between big market players has underpinned Bitcoin’s suspiciously solid support levels during recent negative market conditions. They point to Bitcoin’s relatively tight trading range between the collapse of FTX on Nov. 11, 2022, where it traded between $16,000 and $17,900 for all but one of 62 days, as the work of canny manipulators.

According to Griffin, “…$16,000…could serve as a coordinating mechanism” to allow whales to artificially drive up the price to the upper limit of about $17,000 before pocketing profits through many small sales that don’t impact the market. In other words, they can profit by limiting Bitcoin’s price range.

Crypto VC Slams Claims, Calls Authors “Stupid”

However, Griffin admitted that no analysis exists to prove this occurred between November 2022 and mid-Jan. 2023.

“We don’t have concrete analysis this time. The truth may emerge in specific stories if there is collusion,” Griffin concluded.

Early-stage venture capitalist Nic Carter dismissed the pair’s manipulation conclusions, calling the business professor “stupid,” adding that the pair’s claims about Tether were wildly inaccurate.

However, the U.S. Commodities and Futures Trading Commission fined Tether $41 million over allegations that the stablecoin issuer only backed its asset with fiat reserves for roughly a quarter of the period between 2016 and 2018, which means that certain mints could have essentially been “free money.” Since then, Tether has reduced its holdings of commercial paper to almost zero, replacing them with higher-quality debt instruments and more liquid assets.

Other analysts who observe Bitcoin’s market daily suggest that prices are rising because of a reduction in forced selling after the collapse of FTX. Others point to more mundane factors like more buyers than sellers.

“Often the best explanation is the most boring one. In this case, the price of Bitcoin is rising because there are more buyers than sellers,” suggests Nansen analyst Andrew Thurman. The collapse of several market makers, including Alameda Research, has also contributed to lower market liquidity and fewer sellers.

When taking a short position, investors borrow an asset believing its price will fall. If an asset price rises instead, a broker can trigger a liquidation, resulting in a buy order. If many investors get liquidated, the flood of buy orders in the absence of sellers generates a “short squeeze,” rapidly driving the asset’s price higher.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.