Crypto custodian Prime Trust has admitted to losing $8 million in customer and corporate funds through the collapse of TerraUSD. The custodian lost $6 million in customer funds and $2 million from its corporate treasury.

In June, Prime Trust went into receivership after losing access to a wallet hosted by a third party in 2021. According to court documents, the company owes customers about $82 million in fiat and $861,000 in digital assets.

Prime Trust’s Wallet Woes Extend Back to 2021

The Nevada Financial Institutions Division also accused the company of using customer funds to buy crypto companies. The regulators also ordered the company to stop serving retail customers.

Since filing for bankruptcy, the company has removed executives in charge of the wallet scandal, improved measures to protect customers, and downsized staff to reduce costs.

Thinking of abandoning crypto custodians? Find out how to custody your own crypto here.

Prime Trust started to cater to crypto clients in 2018 when the banking industry largely shunned the industry. In addition to holding assets on behalf of customers, the company provided a vital lifeline by keeping customer dollars at various banking partners.

Crypto Laws Zero In on Custody After Recent Meltdowns

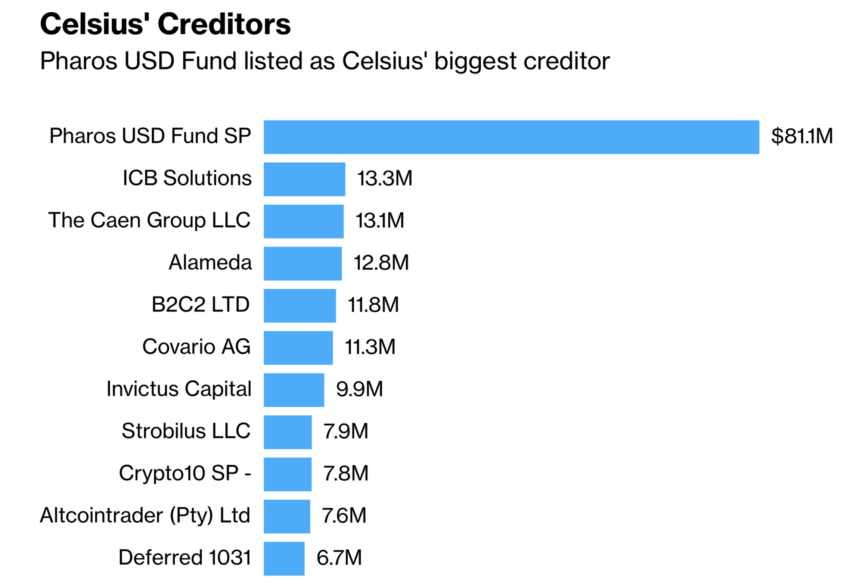

One of its early clients was the crypto lender Celsius, which sued the company to assert ownership of $17 million in crypto assets. A judge overseeing the Celsius bankruptcy rankled the company’s creditors by ruling certain assets customers deposited into Celsius were owned by the lender.

New laws in Hong Kong, South Korea, and emerging regulations in Singapore rule separating customer and corporate assets.

Earlier this year, the US Securities and Exchange Commission (SEC) sued Binance for allegedly mismanaging customer funds. Regulators have also accused former FTX boss Sam Bankman-Fried for commingling customer funds to set up risky leveraged bets.

Got something to say about Prime Trust recently losing $8 million, crypto’s many cases of commingling funds, or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.