MATIC price dipped to a new 2023 low of $0.50 on Sept 11, days after Binance confirmed it would delist Polygon Network from its NFT Marketplace. On-chain data analysis examines how the recent exchange inflows of 41 million tokens could intensify bearish pressure on MATIC’s price.

On Sept 8, cryptocurrency exchange giant Binance announced that it would discontinue support for the Polygon Network assets on its NFT Marketplace by Sept 26, 2023. Since that announcement, Polygon (MATIC) price has declined by another 10% to hit a new 2023 low. Can whale investors intervene to defend the $0.50 support territory?

MATIC Holders are Bracing for More Sell Action

The Binance delisting announcement last Friday appears to have further exacerbated massive inflows of MATIC tokens into exchanges.

On September 2, on-chain data compiled by CryptoQuant shows that Polygon investors held 942.06 million MATIC tokens in exchange wallets. But by September 11, the Exchange Reserves had increased by another 41 million tokens to hit 983.7 million MATIC.

Notably, about 3.5 million of those new inflows were deposited between September 9 and September 11 after the NFT Marketplace delisting announcement.

Exchange Reserves tracks the total balances that Polygon investors currently hold in recognized crypto exchange wallets. Typically, when investors begin to move assets into exchanges, it suggests that they may be looking to sell or swap them for other assets in the short term.

In fact, the chart above shows that MATIC’s price has dipped significantly since the Exchange Reserves began to rise on September 2. Hence, a further increase in the Exchange Reserves will likely push MATIC prices further downward without a corresponding uptick in market demand.

Whale Investors Are Also Pilling on Sell Pressure

Over the past week, a price-savvy cohort of crypto whales holding 10 million to 100 million tokens seem to have also intensified their selling pressure. As of Sept 2, on-chain data shows that the whales held cumulative balances of 189.7 million MATIC tokens. By Sept 11, they held only 158.3 million tokens, having rapidly offloaded 31.4 million tokens from their holdings.

This reveals a connection between the flurry of exchange inflows which began on September 2, just as the whales began to sell.

Currently valued at $0.50, the whales’ 31.4 million tokens recently sold are worth approximately $15.7 million. Due to their substantial holdings, whales’ trading activity often moves the market significantly.

More so, the chart above shows emphasizes how the recent MATIC price actions have been closely correlated to changes in the whales’ balances. Hence, if their ongoing selling trend persists, MATIC holders could experience more downside.

MATIC Price Prediction: Free fall to $0.33?

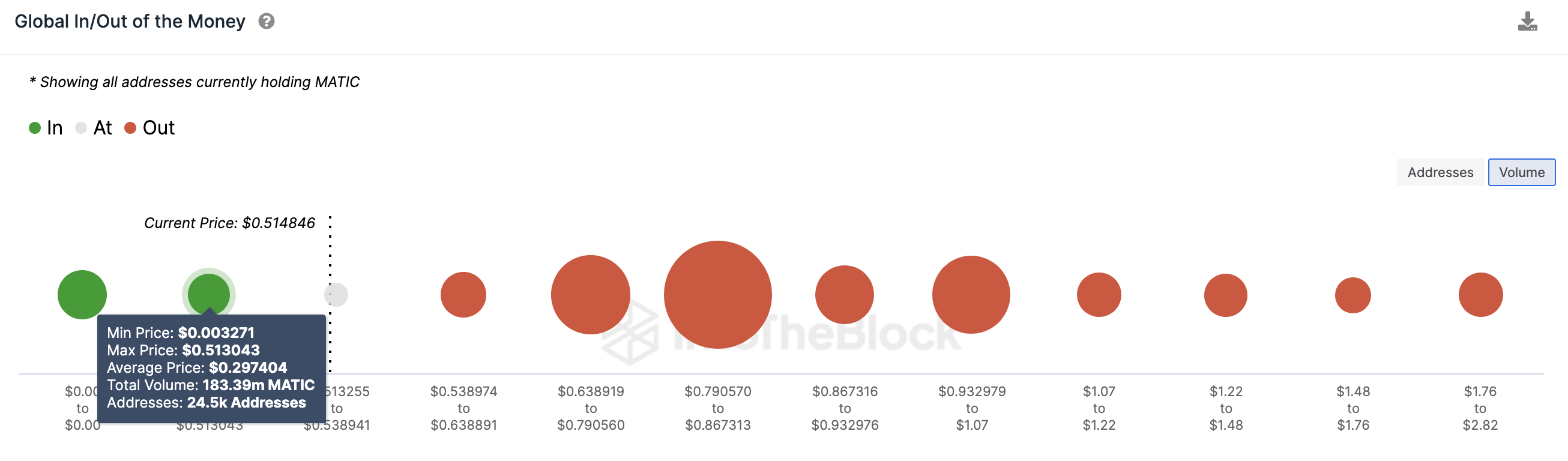

From an on-chain perspective, losing the $0.50 could trigger a free fall toward the $0.32 level before the MATIC price finds significant support. The In/Out of Money Around Price data, which outlines the purchase price distribution of the current MATIC holders, also depicts this vividly.

The GIOM data shows that beneath the $0.50 level, MATIC’s next significant support level is $0.32, the average price that 24,500 addresses had bought 183.4 million tokens. If they make spirited last-ditch buys to cover their positions, MATIC’s price could rebound.

But if the bearish sentiment intensifies as predicted, MATIC’s price will likely drop toward $0.32.

Still, Polycon bulls can regain control MATIC price rebounds above $1. But as seen above, 58,000 addresses had bought 4.1 billion tokens at the average price of $0.80. That resistance level could prove daunting because this is the largest cluster of MATIC holders.

But if the bulls manage to push past that sell wall, then MATIC’s price could potentially break above $1 for the first time since May 2023.