The legal tug-of-war surrounding crypto and digital assets has reached an unprecedented level of intensity in 2023. Industry giants have fallen foul of US regulators, and some of the biggest names are facing criminal charges.

BeInCrypto spoke with Charles Slamowitz, the founder of Slam Legal, a firm specializing in tech sectors like Web3 and AI, about battling the SEC, the challenges of lawyering across borders, and more. Slamowitz pointed to a number of dangers that many exchanges even now are ill-prepared to face.

Crypto Exchanges Need Diverse Legal Strategies

However you slice it, the big crypto exchanges are in trouble. The recent charges against Coinbase and Binance by the Securities and Exchange Commission (SEC), accusing them of violating multiple securities laws, have sent shockwaves through the industry.

Binance, the world’s largest crypto exchange, is also facing an exodus of executives as rumors swirl of a Department of Justice investigation and potential criminal charges.

On February 9, the SEC charged Kraken, another exchange, for not registering its crypto asset staking service, which promised investors up to 21% annual returns. To settle the charges, Kraken agreed to stop offering the staking service and pay $30 million in penalties. It also agreed to a final judgment that permanently bars it from violating certain securities laws.

But did things have to be this way? According to Slamowitz, one approach for crypto behemoths like Coinbase and Binance should be, first and foremost, to “actually protect and structure as correctly as possible.” This means using lawyers in multiple practice areas and coming to the table prepared, before the courts can read the riot act.

Exchanges need to know when regulators expect registrations and when they will offer a pass. Have you structured your operation in such a way that you are exempt?

While obtaining a No Action Letter from the SEC is challenging, working with the SEC as early as possible is paramount, Slamowitz said.

“There are certain ways in financing and operations that Coinbase could have structured themselves, in our view, to avoid certain legal issues now raised,” he added.

Firms and Crypto Exchanges Are Not Aware of Cybersecurity Risk

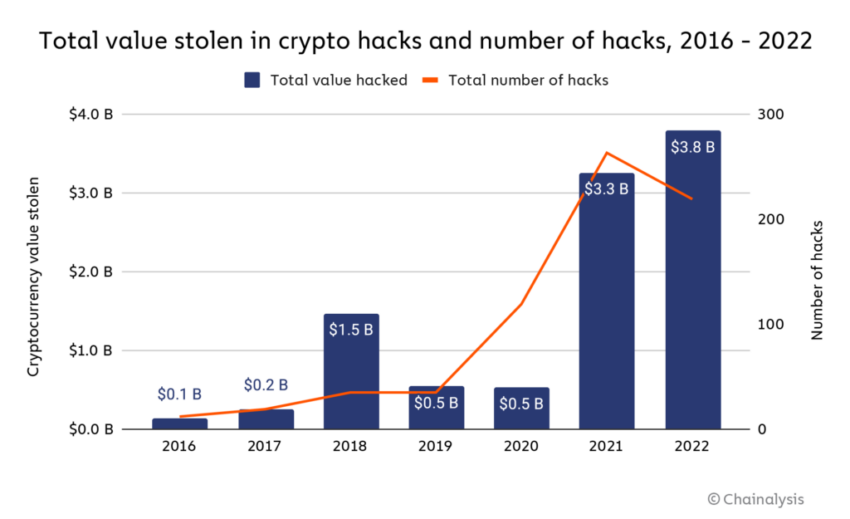

Barely a week goes by in crypto without some hack—large or small—hitting the crypto industry. Whether it’s cross-chain bridges or crypto exchanges, these entities have become honeypots for the hardened cybercriminals.

Despite the market downturn, last year was also the most prolific for crypto hacks on record. According to Chainalysis, hackers stole $3.8 billion from cryptocurrency businesses in 2022, with exploits having profound knock-on effects for many retail investors.

However, Slamowitz raised concerns that even digital-first businesses like those in Web3 are failing to consider the risks.

“For instance, one company we counseled, without providing further detail, was hacked and lost millions of dollars due to a cyber security breach,” he explained. “Security touches on one of the larger operational vulnerabilities for the Web3 space to continuously consider.”

There are also significant legal repercussions for directors and executives for not keeping their cybersecurity house in order. Slamowitz pointed to a Delaware case where a company and its executives were accused of breaching their fiduciary duty by failing to adequately monitor cyber risks.

Following a 2019-2020 cyberattack on the company, SolarWinds now faces the likelihood of charges from the SEC. And the legal landscape is evolving fast, too.

Last year, the Department of Justice criminally prosecuted former Uber security chief Joseph Sullivan for mishandling a 2016 data breach. It marked the first such cybersecurity case against an executive, one of many to come as operational risks move online.

“Most law firms and companies in the space do not actually realize the real significance that cyber security law plays,” added Slamowitz.

NFTs: A Step Into the Legal Unknown

One of the most controversial crypto assets to arrive on the scene has undoubtedly been non-fungible tokens. NFTs, as they are mostly known, represent unique digital assets on a blockchain (hence the “non-fungible”). Some have made headlines for their exorbitant price, while others have been ridiculed as “expensive JPEGs.”

Although, as Slamowitz acknowledged, people no longer see them as clubbable profile pictures. Musicians like Rihanna and Justin Bieber are using them for their music, and Snoop Dogg has released a range of digital collectibles that evolve as his tour progresses.

NFTs and cryptocurrencies are certainly still in a nascent and emerging phase, he said. However, the utilization of such technologies is already maturing at breakneck speed.

“We believe that NFTs are still considered to be ‘fringe’ with respect to most legal representation of the integration of such technologies,” said Slamowitz.

Although perhaps those with an NFT project in mind should pause and think before minting. “There simply are not established precedents yet or regulation[s] as we see in other industries,” he commented.

Lawyers Without Borders

Of course, one of the challenges of providing legal counsel to an industry that spans the globe is its mix of jurisdictions. Furthermore, the infancy of Web3 has led to considerable inconsistency in regulatory approaches among different countries.

A cross-border practice can prove difficult and time-consuming, even for lawyers who entered an industry with a definite sense of borders. However, the biggest challenge is on the companies themselves. Slamowitz explained:

“Indeed, jurisdictions have vastly different laws, from the clearest to the murky at best or non-existent. It’s not uncommon in our legal practice and profession to discuss jurisdictional precedent and alignment.… The disparate nature of the regulatory regimes does currently pose an issue to companies looking to navigate and work in the crypto space.”

Although, the global nature of Web3 law can bring a much-needed dose of variety to a lawyer’s job.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.