Nearly everywhere you turn, the cryptocurrency community is abuzz about the upcoming Bitcoin halving event, which is planned for about 30 days from now. Gold bug Peter Schiff appears set on spoiling the party, however, warning that cryptocurrency investors should be bracing for pain instead of celebrating any upcoming milestone.

With all of the uncertainties in the world due to coronavirus, such as grappling with when to restart the U.S. economy, one certainty has rung true for the cryptocurrency community and that’s the upcoming halving event.

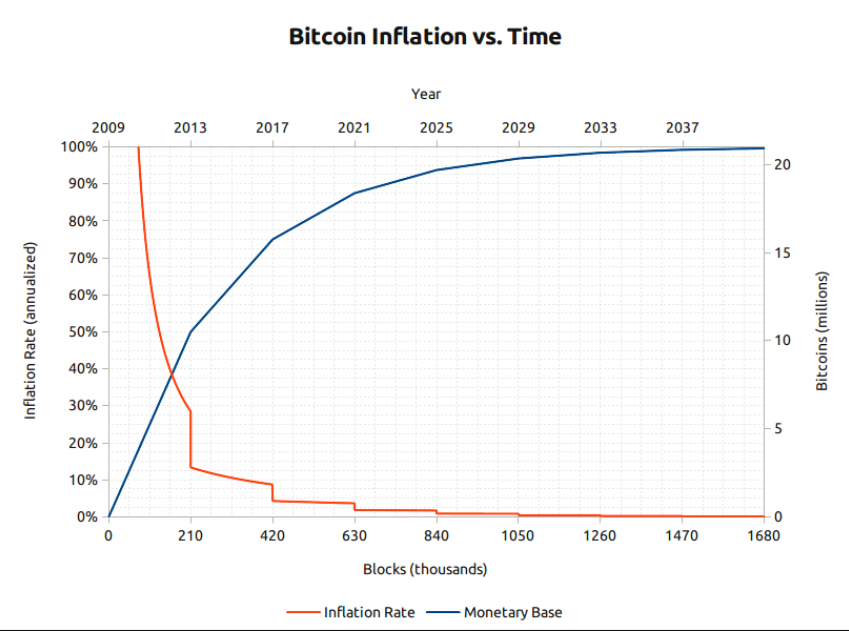

On about May 12, the reward for miners will be slashed in half from 12.5 BTC per block to 6.25 BTC, as per the network’s design by Satoshi Nakamoto. The event has historically been bullish for the Bitcoin price, which has fueled optimism among cryptocurrency investors that this year will hold similar fortunes. Nonetheless, Euro Pacific Capital CEO Peter Schiff has offered an ominous warning to Bitcoin holders, saying in a tweet that they’re “about to learn a very expensive lesson in economics.”

Trying to explain the concept of money to a #Bitcoin hodler is like banging your head against a wall. These guys are about to learn a very expensive lesson in economics and gain a new appreciation for the age old saying "easy come, easy go."

— Peter Schiff (@PeterSchiff) April 13, 2020

More in Common

The thing of it is that Schiff appears to be missing the forest from the trees. While he has been accurately warning of an impending economic crisis for years, and the fragility of the monetary system, he refuses to recognize the shared features between the precious metal gold and “digital gold” Bitcoin.

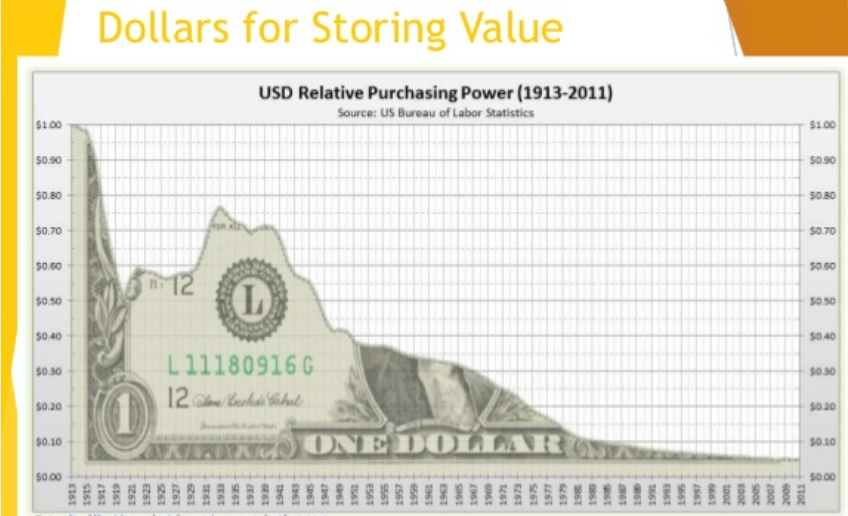

For instance, both assets are scarce, given only 21 million BTC will ever be mined and 171,300 tonnes of the precious metal. [BBC] Both gold and Bitcoin can act as a hedge vs. economic inflation and have been known to trade in an uncorrelated manner to equities, though Bitcoin is still finding its sea legs here. And perhaps most convincingly, neither gold nor Bitcoin are appealing to billionaire investor Warren Buffett. [Forbes]

‘Easy Come, Easy Go?’

Schiff also reminds them of the saying, “easy come, easy go.” The problem with this theory, however, is that barring a few exceptions such as the ICO-fueled bubble of 2017, nothing about Bitcoin has been easy.

The Bitcoin price has taken investors on a roller coaster ride, one that has been impossible to predict even among the most sophisticated traders. Nonetheless its value has increased in a little more than a decade to a current market cap of $123 billion, which reflects the value that investors are willing to assign to the cryptocurrency. Ask long-term investors who have weathered the storm if recent gains have come easy.

Bitcoin is also now in the throes of its first real financial crisis, and while it hasn’t always been smooth sailing, the flagship cryptocurrency is holding its own.

Bitcoin’s model has also threatened the status quo of easy monetary policy, which for any emerging asset class is nothing short of a herculean task. Perhaps the sticking point for gold investors like Schiff is the fact that Bitcoin has introduced another store-of-value and exchanging-value asset to investors, one that threatens to steal even more market share from the precious metal than it already has.