Gold is falling because investors are clueless as to what is coming. Their mindset is similar to that of central bankers. They have no idea how bad the consequences of the current monetary & fiscal policy mistakes will be. When they figure it out en masse, #gold will skyrocket.

— Peter Schiff (@PeterSchiff) March 16, 2020

Bitcoin Basher

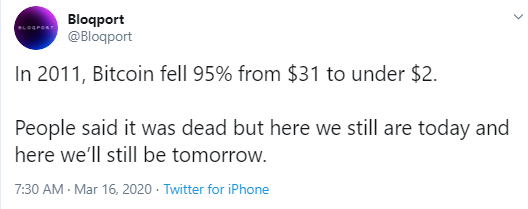

Of course, Schiff couldn’t resist using his soap box as an opportunity to take yet another swipe at Bitcoin. And while it’s difficult to defend the cryptocurrency during this latest market rout, cryptocurrency investors are a resilient bunch, not to mention the fact that this market downturn is not their first rodeo.

“Though gold is down 4% and Bitcoin is down 15%, one Bitcoin still buys three ounces of gold. That’s a great exchange rate. Hodlers had better act quick or they will miss their chance.”

Where’s the gold?

BlockTower Capital CIO Ari Paul was quick to challenge Schiff, reminding him about the 2008 market meltdown in which the price of gold plummeted from $1,000 an ounce to $775 – incidentally in response to the infamous Lehman Brothers bankruptcy on Wall Street. [Gold Republic] As fate would have it, some are comparing today’s gloomy sentiment to the time of Lehman’s collapse. Bitcoin was just a twinkle in Satoshi Nakamoto’s eye at the time. Meanwhile, gold didn’t behave like a safe-haven asset then and it is not acting like one now, either.

Bitcoin was just a twinkle in Satoshi Nakamoto’s eye at the time. Meanwhile, gold didn’t behave like a safe-haven asset then and it is not acting like one now, either.

Schiff isn’t buying it, however. He calls the 2008 financial crisis a “cakewalk” compared to the state of the economy today, stating in a follow-up tweet:Pete you were around in 2008. Did you warn your followers time get out of gold this time? If not, why not? It always falls when equities collapse. I think it will do well at some point fairly soon, but no point owning it at its highs.

— Ari Paul ⛓️ (@AriDavidPaul) March 16, 2020

“All that happened in 08 was real estate prices fell, borrowers defaulted, and lenders lost money. Today global commerce is grading to a halt. Production is shutting down. This crisis is economic, not merely financial.”Always the doom-and-gloomer, Schiff describes a world in which the world has fewer goods as a result of global trade coming to a standstill but an oversupply of fiat money, thanks to the central banks around the world printing more money. He adds,

“Then imagine that none of the dollars the Fed prints are exported. Without goods to buy cash has no value.”Whether he realizes it or not, Schiff just made the argument for Bitcoin.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.