OpenSea sees their trading volume decline 13% to $303 million, its lowest level since June 2021, as other NFT marketplaces take a slice of its revenue.

The secondary NFT marketplace is experiencing low volumes despite onboarding collections from Ethereum layer-two solution Arbitrum in Sep. 2022.

OpenSea and major NFT collections suffer

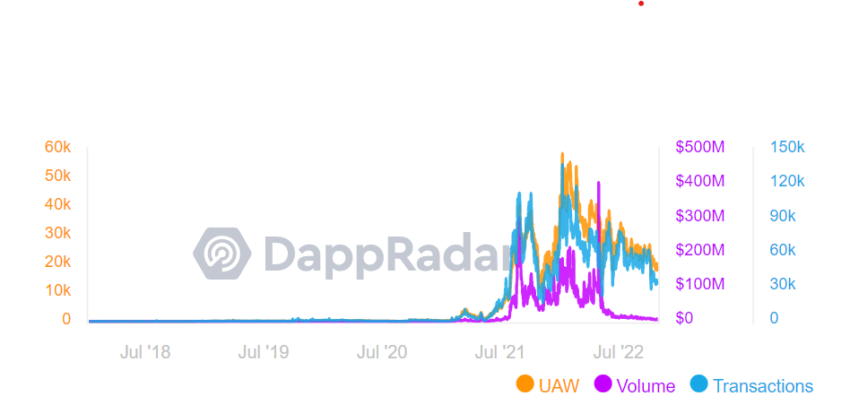

OpenSea’s trading volume is down 94% since hitting an all-time high of $4.86 billion in Jan. 2022. Data from Dune Analytics also shows a decline of about 86% in the ETH trading volume since the beginning of the year. OpenSea supports NFTs from multiple blockchains, including Ethereum, Solana, Avalanche, and Klatyn. Layer-two solution Arbitrum recently announced that its NFTs would be listed on OpenSea.

Transaction data from DappRadar also shows a sharp decline in NFT transactions on the secondary marketplace from over $406 million in May 2022 to $7.63 million at press time, a drop of 98%.

The price floor for the Bored Ape Yacht Club NFT collection, the NFT collection with the highest sales volume of all time, has dropped from a peak of 144.9 ETH on May 1, 2022, to 64.7739 ETH at press time. CryptoPunks, another popular NFT collection, has seen its price floor drop from around 122 ETH on Aug. 30, 2021, to 100 ETH.

Bear market to blame?

This downtrend is in line with a new Activate Technologies report that suggests the hype phase for NFTs is over. The number of adults 18 or older buying NFTs declined from 76% in 2021 to 51% in 2022. This data is backed up by a recent report by Binance Research, suggesting that a decline in OpenSea users is a symptom of the broader decline in cryptocurrency markets, which prompted investors to dispose of riskier and more speculative asset classes.

NFT analyst NFTkek said that the number of NFTs minted had decreased in the last month, suggesting that NFT artists are creating fewer collections.

OpenSea also faces a growing threat from multichain marketplaces like Magic Eden. Magic Eden began as a marketplace for NFTs minted on Solana. It has since expanded its product offering. Its range includes Ethereum NFT collections like ArtBlocks, Otherdeed for Otherside, the Bored Ape Yacht Club, and CryptoPunks. Popular social media site Reddit has also seen an explosion of interest in its NFT collection, with users creating 3 million wallets.

While challenging for marketplaces like OpenSea, multichain listings benefit the end user. This is because there is a possibility of trading NFTs across different blockchains, improving the liquidity of the NFTs and potentially increasing their value. Users could turn to other blockchains on a marketplace offering lower fees than the Ethereum network.

At press time, CryptoPunks had the highest Ethereum NFT trading volume of 881,800 ETH on Magic Eden.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.