After a long period of consolidation, OmiseGO (OMG) is in the process of breaking out. Ravencoin (RVN) is still in its own consolidation period but has shown several reversal signs.

Ravencoin (RVN)

The Ravencoin price has been decreasing since reaching a high on April 26. During this time, it created a descending resistance line. On June 27, the RVN price broke out from this resistance line, but reached the 100-day moving average (MA) and then retraced. The 100-day MA has been a particularly good price predictor of the trend so far. RVN has not traded above it since February 2020. A breakout above would most likely mean that RVN has begun a bullish trend, and will move towards the April 26 high at 275 satoshis. On a positive note regarding MAs, RVN has moved above the 50-day MA and validated it as support. This particular MA has not been as good a trend predictor as the 100-day MA one. Furthermore, the daily RSI is bullish and sits above 50. The purported breakdown below the 210 satoshi support area and subsequent reclaim suggest that the price movement is bullish and that RVN will soon begin to move upwards.

$RVN: How you like to play with my heart…still waiting for the breakout, not quite ready yet. Expecting more ranging between 200-240. I shall continue to wait…#RVN #RavenIn the short-term, RVN is following an ascending support line, and possibly trading inside a descending wedge. The price has almost reached the end of the wedge, so a breakout is expected to occur soon.

OmiseGO (OMG)

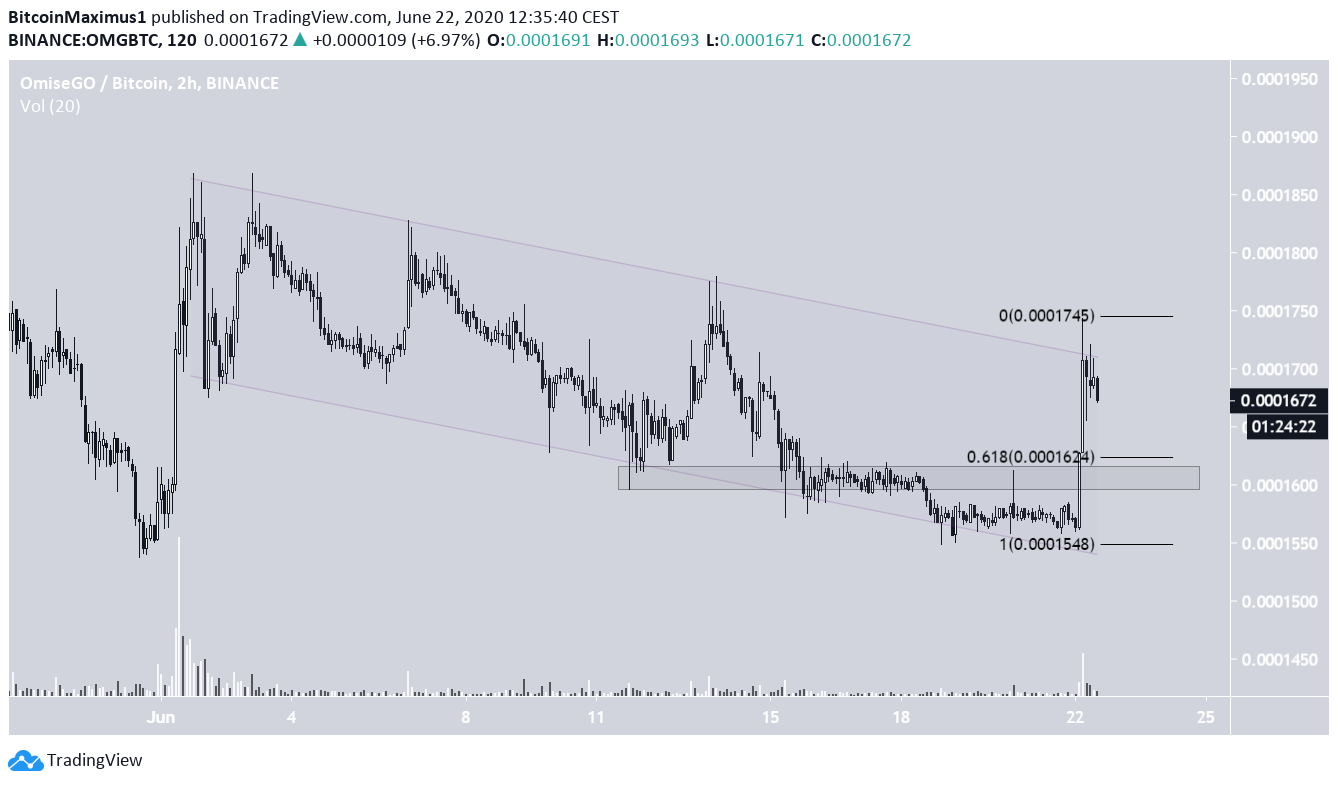

The OMG price has been retracing since reaching a high on May 22. It has already bounced twice on the 0.5 Fib level of the entire upward move, most recently on June 22. The latest resistance breakout took place on above-average volume. However, the price has yet to reach a close above the MA. If it continues moving upwards, the next resistance areas would be found at 18,500 and 21,000 satoshis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored