Fetch.ai’s (FET) price at the moment presents a bullish outlook that will likely be successful with the aid of investors.

The altcoin also banks on Bitcoin to benefit from post-halving bullishness.

Fetch.ai’s Investors Remain Optimistic

The actions of the whales have influenced Fetch.ai’s price in the past, which seems to be a condition for the altcoin once again. Amid the sideways movement observed in the last few days, the whales have changed their stance from HOLDing to accumulation.

In the last 48 hours, the addresses holding between $100,000 to $10 million worth of assets have observed an increase of $59 million in their holdings. This is an indication of the increase in optimism towards a rally.

Read More: How Will Artificial Intelligence (AI) Transform Crypto?

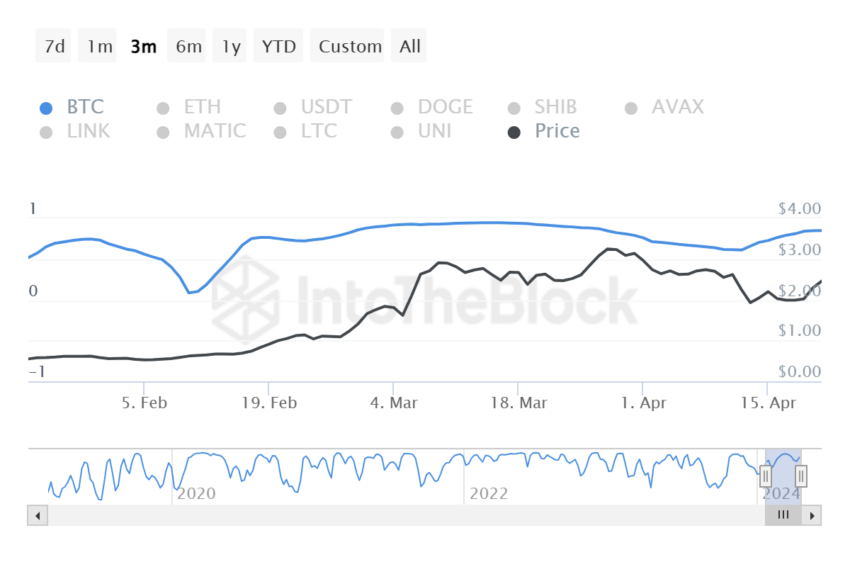

This rally might come sooner rather than later for multiple reasons, one of which is the correlation between FET shares and Bitcoin. The world’s largest cryptocurrency just underwent the halving event, which occurs once every four years and slashes the mining rewards in half.

This induces a supply shock, resulting in a rise in the BTC price. Consequently, altcoins feel the impact of this bullishness and FET sharing a correlation of 0.85 among these assets.

FET Price Prediction: Bullish Reversal Pattern Hints at Rally

Fetch.ai’s price trading at $2.42 is witnessing a double-bottom pattern formation. This bullish technical formation is characterized by two consecutive troughs at nearly the same level, indicating a potential reversal from a downtrend to an uptrend.

FET broke through the neckline marked at $2.28 last week but is yet to validate the pattern. The target set according to the pattern is 14.72% above the neckline, which is still 8% away from the trading price.

Thus, Fetch.ai’s price has room to grow in the coming days.

Read More: 15 Best Penny Cryptocurrencies To Invest In April 2024

But if the market notes bearish cues taking precedence, the altcoin could fall to test the neckline at $2.28 as support. Losing this line would invalidate the bullish thesis, pushing Fetch.ai’s price to $2.10.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.