Nvidia’s recent quarterly report has taken the market by storm, revealing a 769% surge in net income compared to last year. This leap far exceeded Wall Street’s predictions.

Consequently, Nvidia’s shares soared by about 10% in after-hours trading.

AI Tokens Skyrocket After Nvidia’s Stellar Earning Report

The company’s adjusted earnings per share stood at $5.16, surpassing the expected $4.64. Moreover, its revenue reached $22.10 billion, outdoing the forecast of $20.62 billion. The revenue also increased 265% compared to the previous year.

This financial triumph highlights Nvidia’s stronghold in the AI sector. The company’s advanced graphics processors are pivotal for developing large AI models. CEO Jensen Huang remains optimistic about sustained growth. He emphasizes the continuous demand for Nvidia’s GPUs, fueled by generative AI and a shift toward accelerator technologies.

“Strong demand was driven by enterprise software and consumer internet applications, and multiple industry verticals including automotive, financial services and health care,” the company said.

Read more: AI Stocks: Best Artificial Intelligence Companies To Know in 2024

Significantly, Nvidia’s Data Center business, particularly the Hopper series chips like the H100, drove this growth. This segment’s revenue spiked by 409% to $18.40 billion. Such figures underscore AI’s critical role in Nvidia’s strategy.

AI Crypto Tokens Pushed Higher

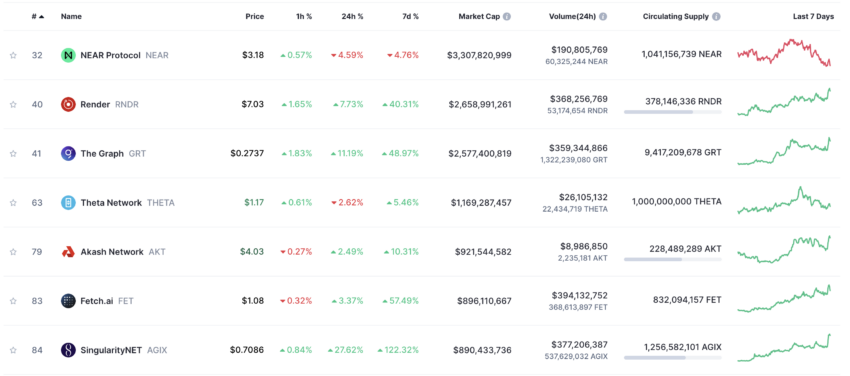

In parallel, the AI crypto token market has responded positively to Nvidia’s earnings announcement. This response underscores the intricate bond between AI advancements and blockchain technology.

For instance, Render (RNDR) witnessed a 7.73% increase in value. This Ethereum-based network facilitates decentralized GPU rendering. Similarly, The Graph (GRT) saw an 11.19% rise. It serves as an indexing protocol for querying blockchain data efficiently.

Moreover, Fetch.AI (FET) and SingularityNET (AGIX) have also seen substantial gains. Fetch.AI, aiming to build a decentralized machine learning network, enjoyed a 4% price increase. SingularityNET, which allows the creation and monetization of AI services on the blockchain, experienced a remarkable 27.62% surge.

Read more: Top 9 Artificial Intelligence (AI) Cryptocurrencies in 2024

These gains reflect Nvidia’s direct impact on the AI token market. They also indicate a broader market belief in AI’s transformative potential across various industries.

Ethereum co-founder Vitalik Buterin’s recent praise for AI applications, particularly in enhancing blockchain security and efficiency, further highlights the growing synergy between AI and blockchain technologies.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.