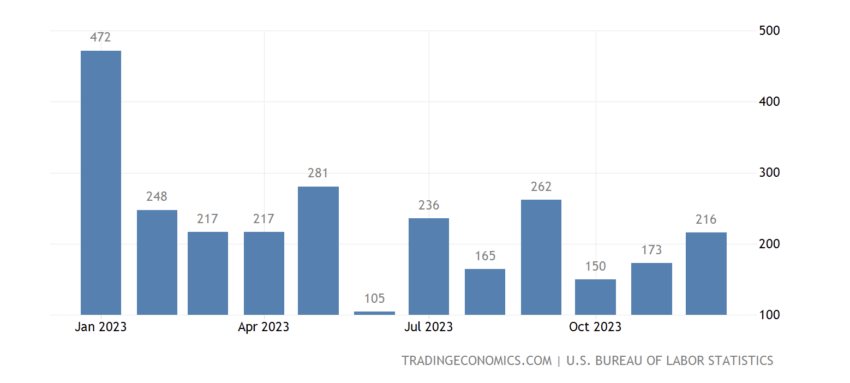

The US Bureau of Labor Statistics reported Friday that employers added 216,000 jobs in December, causing a muted response in crypto markets ahead of an anticipated Bitcoin exchange-traded fund (ETF) approval. The unemployment rate remained at 3.7%, while average hourly earnings rose 0.4% monthly.

Labor force participants clocked 34.3 weekly hours, compared to 34.4 in November. Average hourly earnings rose 4.1% yearly, while the labor force participation rate dropped slightly from 62.8% to 62.5%.

Nonfarm Payrolls Rise Before Bitcoin ETF Deadline

The number of new jobs beat the 170,000 estimate expected by economists. Last month, the US economy added 196,000 new jobs.

Read more: Crypto vs. Stocks: Where To Invest Your Money in 2023

The number of new jobs cuts the chances that the Fed will soon drop interest rates. While inflation edges toward the Fed’s 2% goal, cutting rates before optimal job conditions are reached could cause higher wage growth.

Higher wage growth drives inflation because people spend more when they earn more. Private jobs data released yesterday show that employers hired more in December.

Bill Dudley, a former president of the New York Fed, said last month that markets got too excited after the Fed chair Powell’s last speech. He added today that the Fed will wait to cut rates, but the bar for a future rate hike is high.

“It is clear the Fed is going to be waiting awhile before it starts cutting rates because the labor market is still quite strong and the wage growth is still quite strong,” Former Fed Governor Randall Kroszner stated.

Bitcoin Waits for ETF After Nonfarm Payrolls

Crypto markets were muted after the recent jobs report, while Treasury yields spiked, with the two-year yields up nine basis points to 4.88%. The S&P 500 and Nasdaq 100 futures indices fell 0.4% on the day.

The bearish response of the stock market was expected as traders are paring back on bets on stocks, which rallied in the lead-up to the jobs announcement. Crypto traders, on the other hand, expect Bitcoin ETF approvals to have the most near-term impact on Bitcoin’s price.

Read more: How To Prepare for a Bitcoin ETF: A Step-by-Step Approach

Yesterday, Fox Business reported that the US Securities and Exchange Commission (SEC) could start issuing approvals for Bitcoin ETFs this Friday. Approvals are expected to feed institutional demand for Bitcoin wrapped in a regulated product. Investment titans BlackRock, ARK Invest, and eleven others await the SEC’s verdict on their applications to launch a spot Bitcoin ETF.

Do you have something to say about nonfarm payrolls or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.