In the wake of the largest stimulus spending in history, prices for store-of-value (SOV) assets have increased dramatically. These assets include precious metals like Gold, as well as the top-dog cryptos Bitcoin and Ethereum.

Gold on the Cusp of a Meteoric Breakout

Trading activity for the yellow metal has driven prices to near all-time highs (ATHs) over the past few days. These highs have historically followed government spending, as investors move funds into assets that hedge against inflation.

For example, the inflation-adjusted ATH for gold happened in January 1980, when the price reached $2,250. This came after enormous government spending from the Carter administration.

The second ATH (first in non-adjusted inflation terms) occurred in the summer of 2011 when prices approached $1,950. The price action was largely driven by the Economic Stimulus Act of 2008.

Gold is approaching a record high. On an intra-period basis, the highest was on Sept. 6, 2011, of 1,921.17. On a close basis, it's at a record, of more than 1,900. (Deleted my earlier imprecise tweet.) Either way, gold is on a tear, with many expecting it to continue. pic.twitter.com/4gZ37RBa6P

— Lisa Abramowicz (@lisaabramowicz1) July 24, 2020

After closing this Friday’s session above $1,900 a troy ounce, Gold remains just shy of that magical 2011 topping figure at $1,921. However, if the trend holds true, the stimulus that has recently been injected into the economy should continue to drive prices further north.

Coordinated Breakout

While precious metals have increased pretty dramatically in recent days, digital assets have also followed suit. Prices for both Bitcoin and Ethereum broke out as well.

After several weeks of uncharacteristic price stability around $9,200, Bitcoin quickly jumped to over $9,600. Ethereum also experienced a surge, rising from $236 to $275 in a little over three days. While neither asset is near its ATH, both saw coordinated breakouts with Gold.

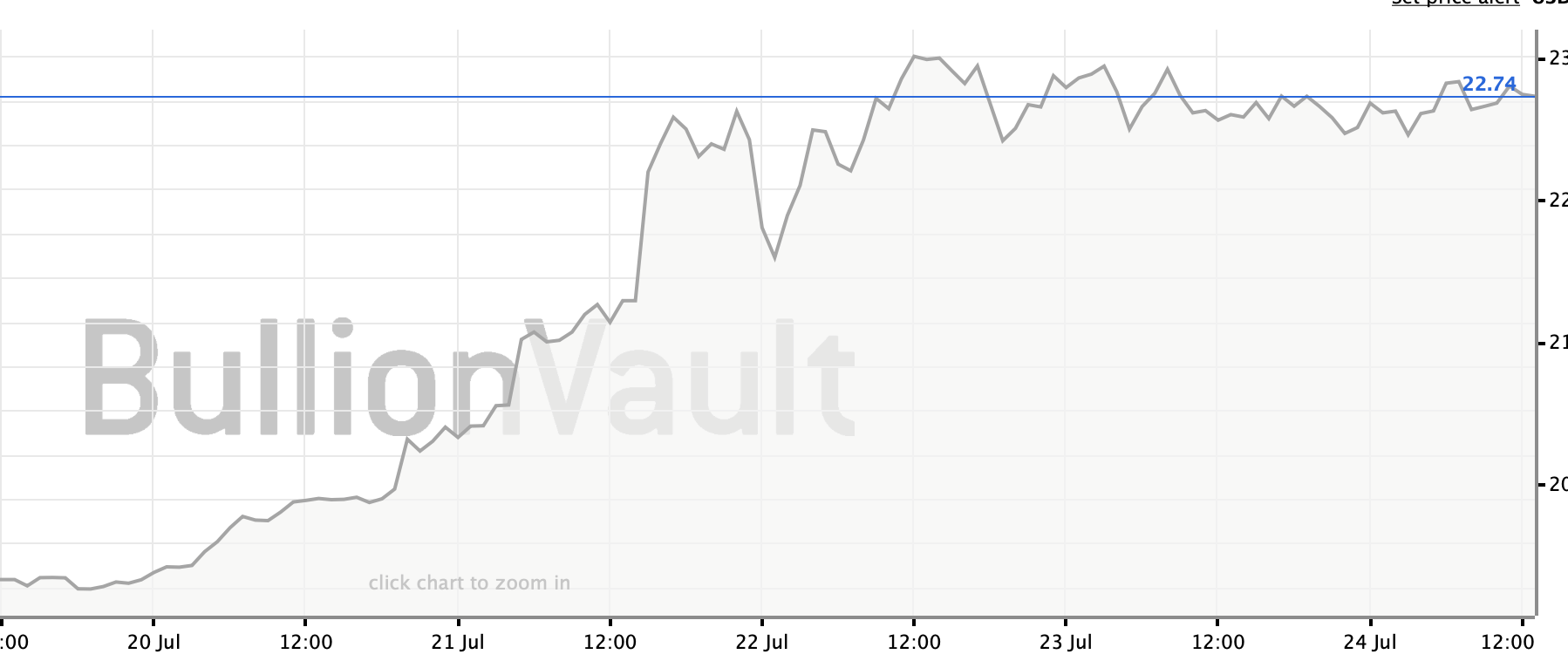

Silver also jumped substantially, although it too remained under previous ATHs. The precious metal rose from $19 to well over $22 in the same period.

The coordinated breakout among these asset groups could well be an indicator of the wider market. As investors seek to move out of inflation-sensitive assets like fiat currency, funds will inevitably flow into SOV assets.

Crypto as SOV?

The recent narrative among the cryptocurrency faithful has been that Bitcoin is not a SOV asset. Most famously, Bitcoin bull, Tyler Winklevoss, retreated on his position in this regard.

However, there is no end in sight for the influx of central bank stimulus. Investors are growing in their understanding of Bitcoin, and its role may very well change.

Additionally, the recent OCC ruling could have a substantial effect on the overall sentiment toward Bitcoin. With institutional banks now moving toward crypto custody, many may well see growth in the potential of Bitcoin to function as digital gold.